RM502 – Understanding Rebate Management Posting Profiles in Dynamics 365 Supply Chain Management (SCM): Payment Types Simplified

Table of Contents

ToggleIntroduction

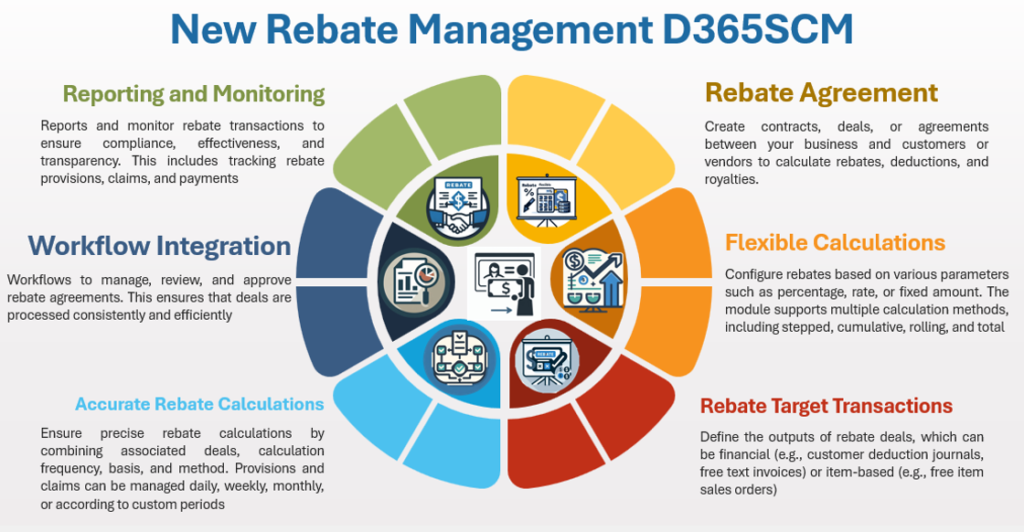

Rebate Management in Dynamics 365 Supply Chain Management (SCM) is a robust tool to help organizations manage and process rebates efficiently. One key aspect of setting up rebates is configuring posting profiles for payment types, which determine how the rebate transactions are recorded in the system and processed financially.

In this article, we’ll explore the different payment types available in rebate management and provide simple examples for each to clarify how they work in real-world scenarios.

Rebate Processing Types

| Rebate Processing Type | Overview | Use Case | Example |

| None | No financial transactions are created; rebates are tracked for informational purposes only. | Track rebate eligibility without processing payments. | A distributor monitors a £1,000 rebate for steering parts but does not process an actual payment. |

| Pay Using Purchase Ledger | The rebate is recorded as a purchase transaction and paid to the customer or supplier via the purchase ledger. | Issue rebate payments directly to customers. | A customer buys 1,200 brake pads at £50 each and earns a £3,000 rebate. A purchase invoice is generated, and payment is made to the customer. |

| Customer Deductions | The rebate is deducted from the customer’s outstanding invoices instead of a separate payment. | Offset rebates against future customer invoices. | A customer buys 500 filters and earns a £1,000 rebate, which is deducted from their next £5,000 invoice, reducing the payable amount to £4,000. |

| Tax Invoice Customer Deductions | Similar to Customer Deductions but processed through a tax invoice for compliance with tax regulations. | Operate in regions where rebates require formal tax invoicing. | A customer earns a £5,000 rebate, a tax invoice is issued, and the rebate is deducted from their next invoice. |

| Trade Spending | Rebates are classified as marketing or promotional expenses and recorded in the general ledger under trade spending. | Encourage dealers or partners to promote specific products. | A £10 rebate per unit is offered for brake discs, a dealer sells 2,000 units, and the £20,000 rebate is recorded as a marketing expense. |

| Reporting | Rebates are logged for analysis but do not create financial transactions or affect payments. | Assess rebate program effectiveness without affecting accounting records. | A 2% rebate on £100,000 worth of steering parts is logged for reporting purposes, but no payment or deduction is made. |

Comparison of Payment Types

| Payment Type | Use Case | Transaction Type | Example |

|---|---|---|---|

| None | Tracking-only rebates with no financial transactions. | No transactions recorded. | Track potential rebates on steering parts for reporting. |

| Pay Using Purchase Ledger | Pay rebates directly to customers as separate transactions. | Purchase invoice/payment. | Pay a £3,000 rebate for brake pad purchases. |

| Customer Deductions | Adjust rebates against the customer’s outstanding invoices. | Accounts receivable adjustment. | Deduct a £1,000 rebate for filters from the next invoice. |

| Tax Invoice Customer Deductions | Ensure tax compliance by processing rebates with formal tax invoices. | Accounts receivable + Tax. | Issue a tax invoice for a £5,000 suspension parts rebate. |

| Trade Spending | Record rebates as promotional or marketing expenses. | Marketing expense. | Allocate £20,000 rebates for brake disc promotions under trade spending. |

| Reporting | Track rebates for reporting purposes without financial impact. | Reporting-only. | Monitor a £2,000 rebate on steering parts for performance analysis. |

Conclusion

Configuring the appropriate payment type for rebates in Dynamics 365 Supply Chain Management (SCM) ensures accurate financial reporting, compliance, and alignment with business strategies. Whether you’re paying rebates directly, deducting them from invoices, or tracking them for analysis, the Rebate Management module gives you the flexibility to manage diverse business scenarios.

Understanding the nuances of each payment type helps you design rebate programs that support your organization’s goals while maintaining financial clarity and compliance.

Expand Your Knowledge: See More Rebate Management Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment