RM506 – Driving Sales with Transaction-Based Rebates: Tax Invoice Deductions for Steering and Suspension Products in D365 SCM

Table of Contents

ToggleIntroduction

In a competitive market like car part distribution, incentivizing customers while maintaining financial transparency is key. Dynamics 365 Supply Chain Management (D365 SCM) introduces Transaction-Based Rebates with the Tax Invoice Customer Deduction payment type to manage rebates effectively. For a car parts distributor dealing in high-demand products like steering and suspension arms, this approach enables real-time rebate tracking and accurate financial reconciliation.

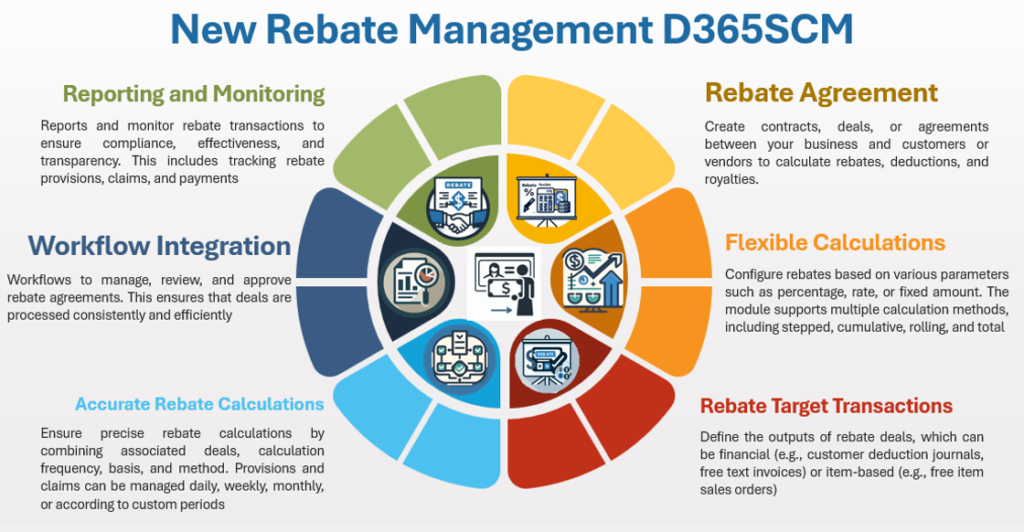

What Is Transaction-Based Rebates?

Transaction-Based Rebates calculate rebate amounts for each sales transaction based on predefined criteria, such as product group, quantity, or value. The Tax Invoice Customer Deduction payment type ensures that rebate amounts are deducted from customer invoices while maintaining clear visibility for tax and accounting purposes.

Scenario: Encouraging Bulk Purchases of Steering and Suspension Arms

Business Context:

Your company distributes steering and suspension arms to auto repair shops. To incentivize bulk purchases, you offer a 5% rebate on all purchases over £50,000 within a quarter. The rebate is applied as a deduction on the customer’s tax invoice (Free Text) for the following period.

Steps to configure Tax Invoice Customer Deduction rebate deal

Prerequisite:

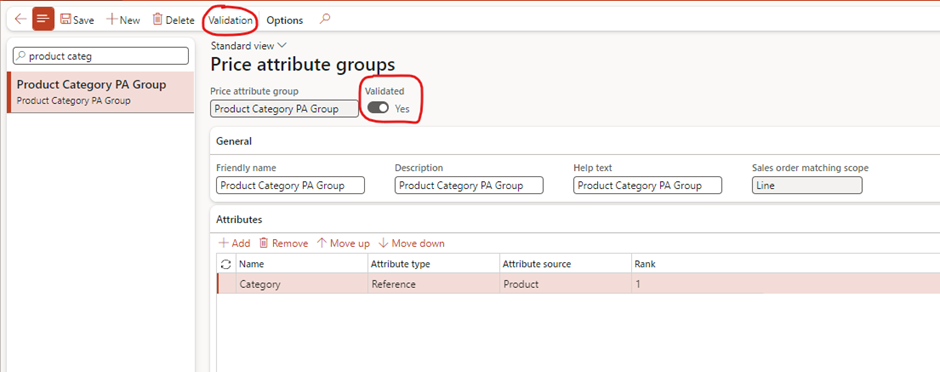

- Price attribute group

- Navigate to Pricing Management > Setup > Price attribute groups > Create New > ‘Only Category attribute is required’

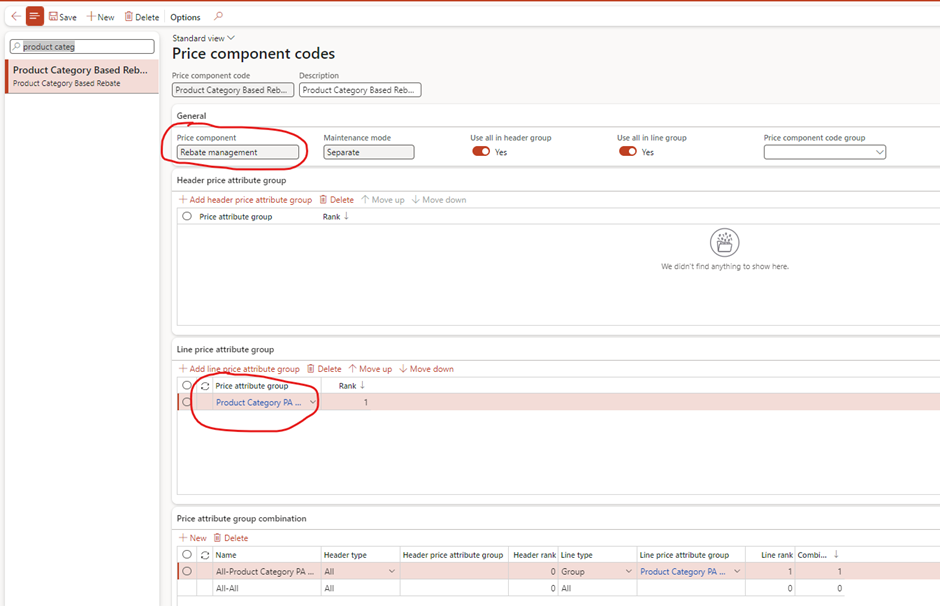

2. Create Price Component code

- Navigate to Pricing Management > Setup > Price component codes > Assign price attribute group created above

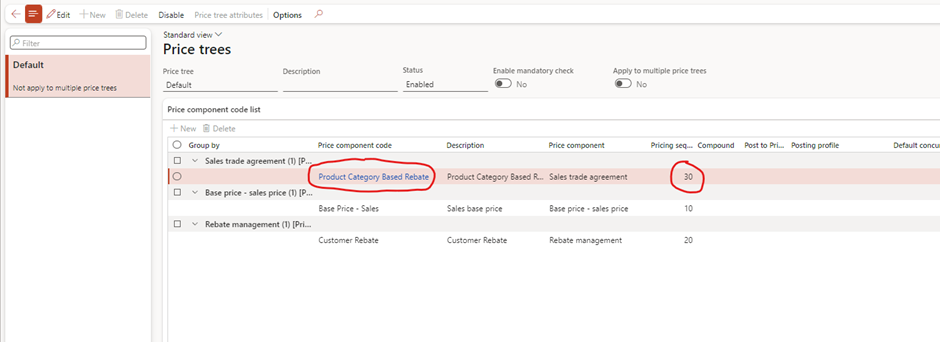

3. Setup Price Trees

- Navigate to Pricing Management > Setup > Price component codes > Price Trees > Setup pricing tree structure

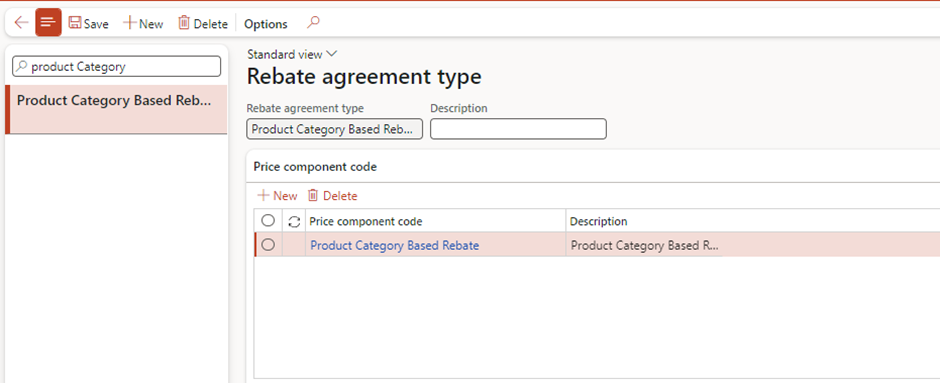

4. Create Rebate Agreement Type

- Navigate to Rebate Management > Setup > Rebate Agreement type > Assign ‘Customer Rebate’ price component code created above

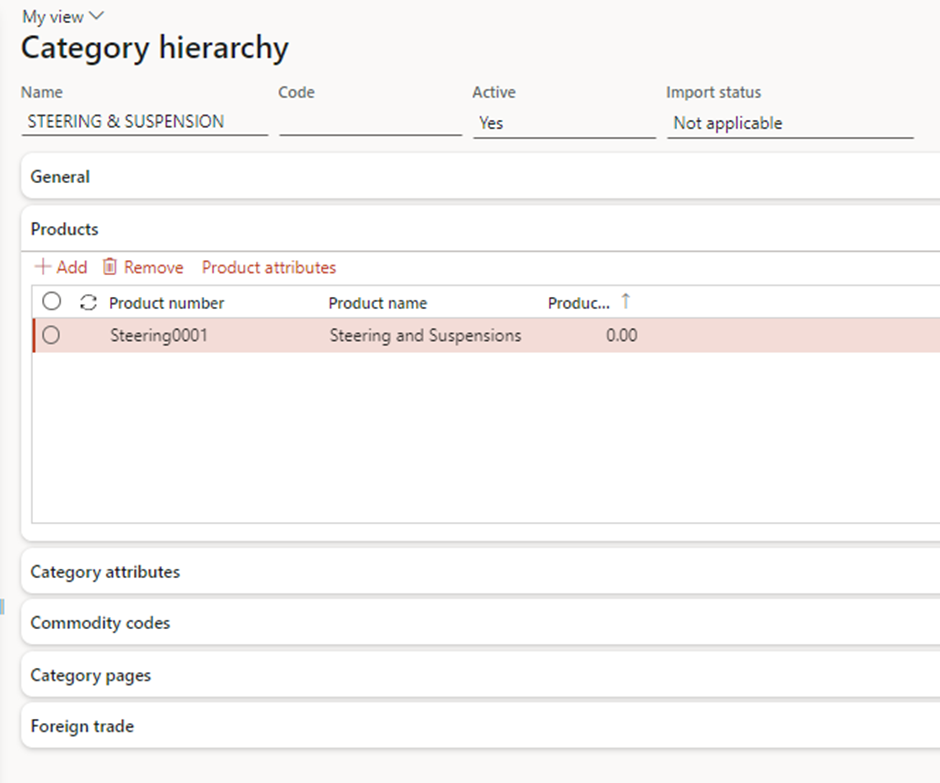

5. Assign Category to Released Products

- Navigate to Product Information Management > Setup > Category and attributes > Category Hierarchies > Choose your default hierarchy > Add Products (Or this can be imported using data management)

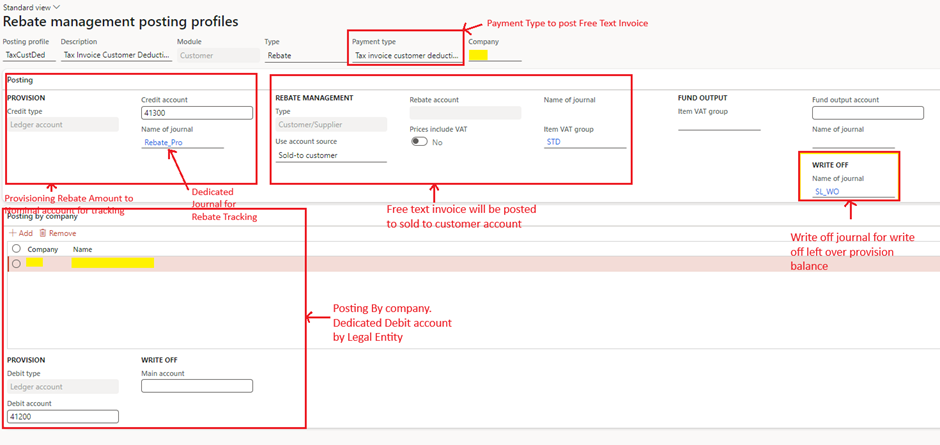

Step 1: Set Up Posting Profile for Customer Deduction

- Navigate to Rebate Management > Setup > Rebate Management Posting Profiles.

- Create a new posting profile with:

- Link this posting profile to the rebate deal.

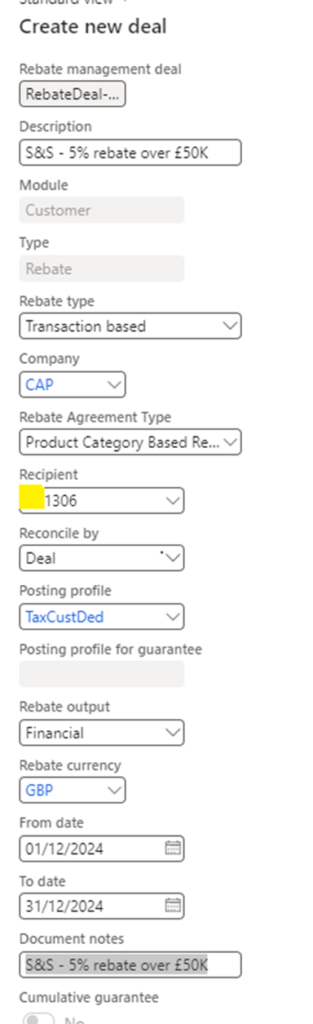

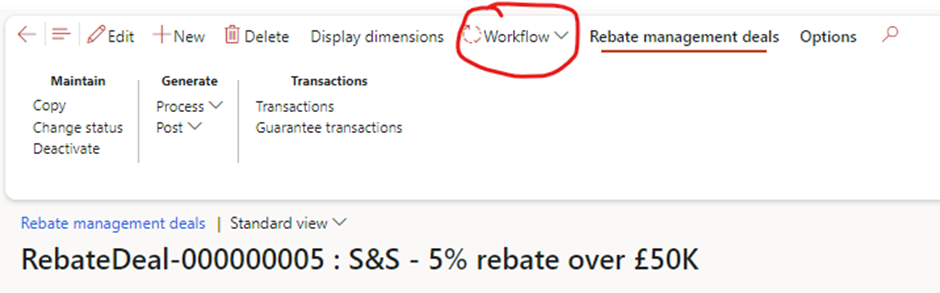

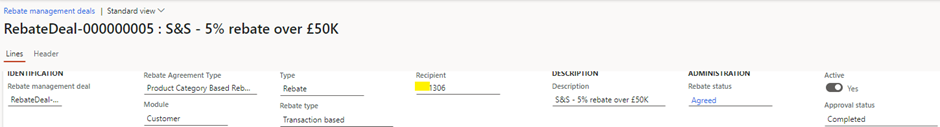

Step 2: Create and activate Rebate Deal

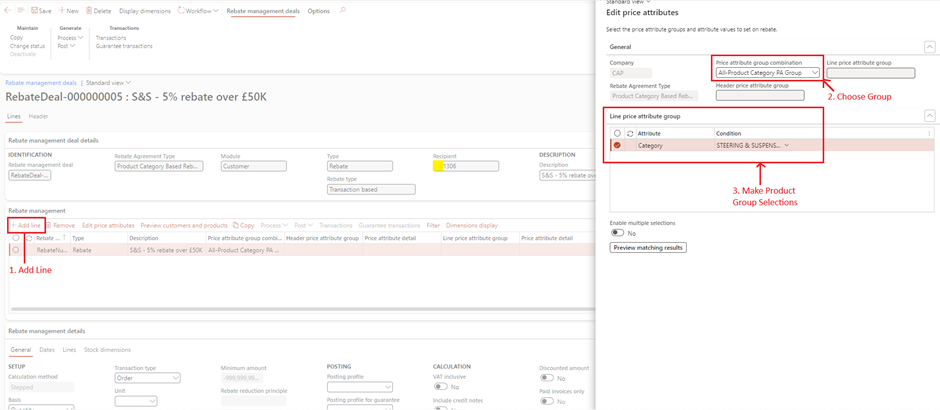

- Go to Rebate Management > Rebate Deals > Customer Rebate deals > +New

- Add line details for Product group selection

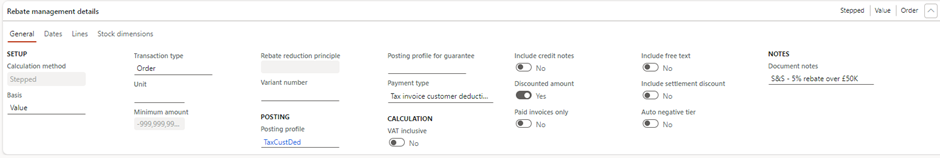

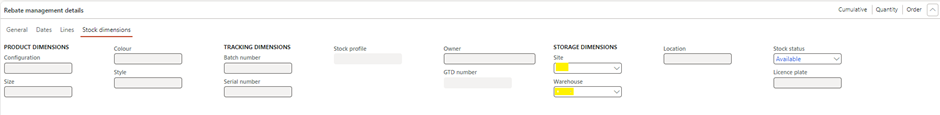

- Setup Rebate management details

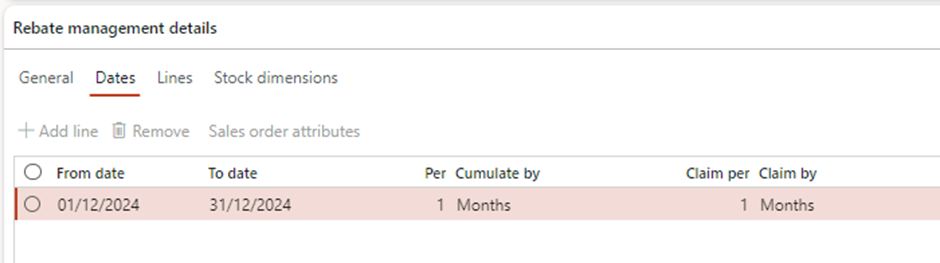

- Rebate to be claimed once a month

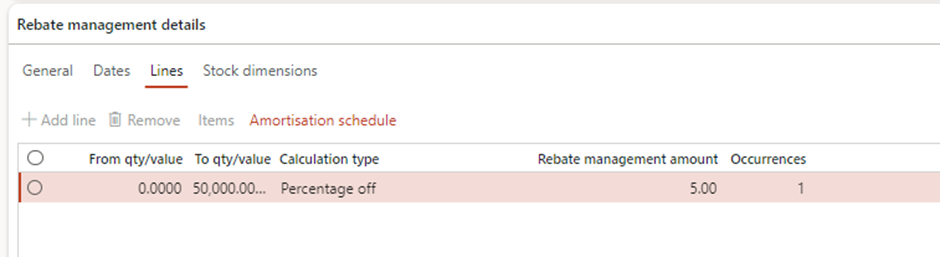

- Rebate is eligible for order quantity above 500 in a month

- Rebate is specific to Site and Warehouse

- Submit it to workflow (Must!)

- Workflow sets agreement deal to active and change status to Agreed

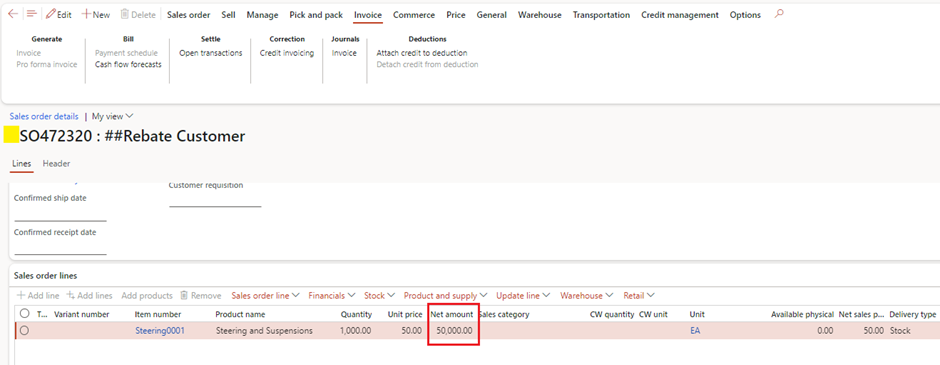

Step 3: Process Sales Order Transactions

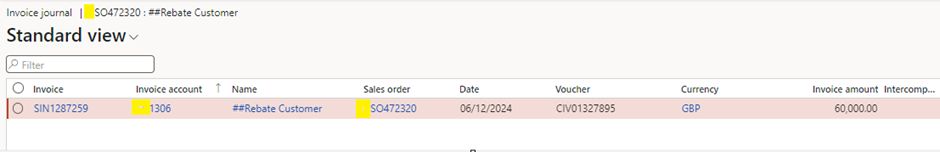

- Record the sales order for Net amount of >=£50,000

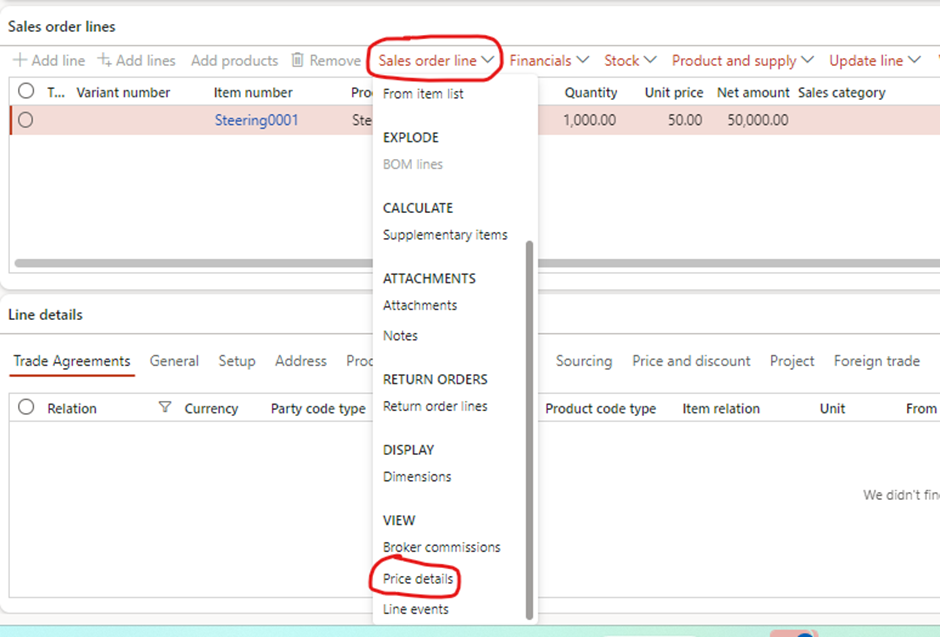

- Track Rebate from with Sales order: Sales order lines > Price details

- Post the invoice.

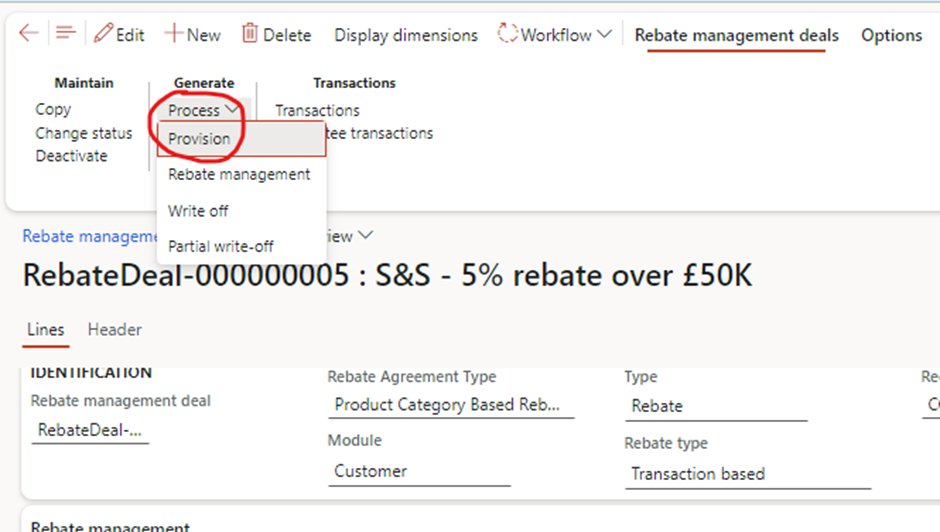

Step 4: Process Provision (this step is optional)

- Process Provision: This involves calculating and creating accruals for the expected rebate amounts based on qualifying transactions. These accruals are not yet posted to the general ledger but are set aside as provisions.

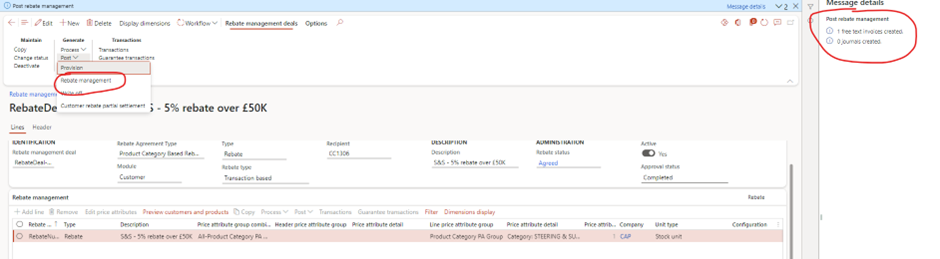

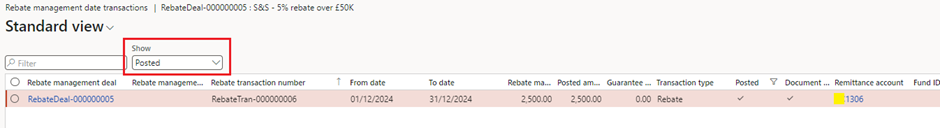

Step 5: Post Provision and Rebate Transactions

- Rebate Post: This final step posts the calculated rebate transactions to the general ledger. It records the financial impact of the rebates, completing the rebate management cycle.

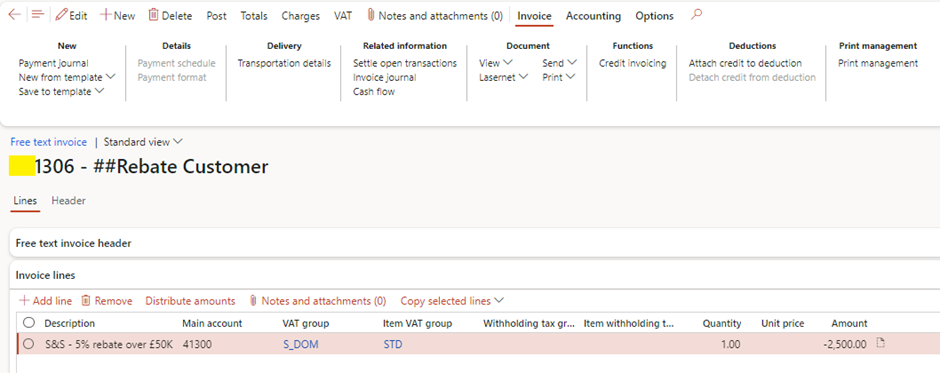

- It created free text credit note (Make sure, credit note require separate posting)

- Verify posted transactions:

Example in Action

Scenario Execution:

- A customer purchases steering and suspension arms worth £50,000 in first month.

- The system calculates a 5% rebate:

- Rebate Amount: £50,000 × 5% = £2,500.

- In Next Month, the rebate is applied as a deduction on the customer’s tax invoice:

- Invoice Amount: £10,000.

- Less Rebate: £2,500.

- Net Payable: £7,500.

Benefits of Transaction-Based Rebates with Tax Invoice Deductions

- Real-Time Incentives

Customers benefit immediately from rebates, encouraging bulk purchases of high-value product groups like steering and suspension arms. - Financial Transparency

Tax invoice deductions ensure compliance with accounting standards while maintaining visibility for both the distributor and the customer. - Scalability

The transaction-based approach allows for tailored rebate criteria, such as thresholds for specific product groups or purchase volumes.

Conclusion

By leveraging Transaction-Based Rebates with Tax Invoice Customer Deductions in D365 SCM, car part distributors can offer dynamic, real-time incentives for customers while ensuring accurate financial reconciliation. For product groups like steering and suspension arms, this approach not only boosts customer loyalty but also drives sustained revenue growth.

Expand Your Knowledge: See More Rebate Management Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment