BG503 – Top-Down Budgeting in Dynamics 365 Finance: Real-World Scenarios from Planning to Control (Part-2: Budget Planning)

Table of Contents

ToggleIntroduction

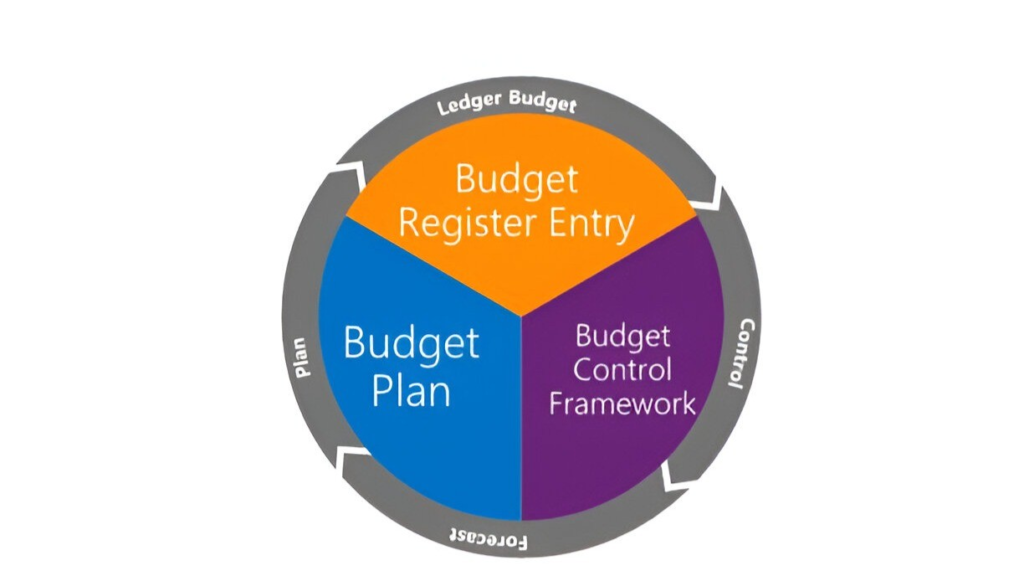

Budget planning is the cornerstone of effective financial management, bridging the gap between strategy and execution. In this second part of our series on top-down budgeting in Dynamics 365 Finance, we delve into the Budget Planning phase—where collaboration, configuration, and workflows come together to create a clear and actionable financial roadmap.

Building on the foundation set in Basic Budgeting Setup, this article explores how organizations can structure and manage budget planning processes tailored to their unique needs. From defining workflows and hierarchies to enabling departmental collaboration, this phase ensures alignment between financial goals and operational requirements.

Let’s dive into the Budget Planning process and see how Dynamics 365 Finance simplifies and streamlines collaborative budgeting

Scenario Overview

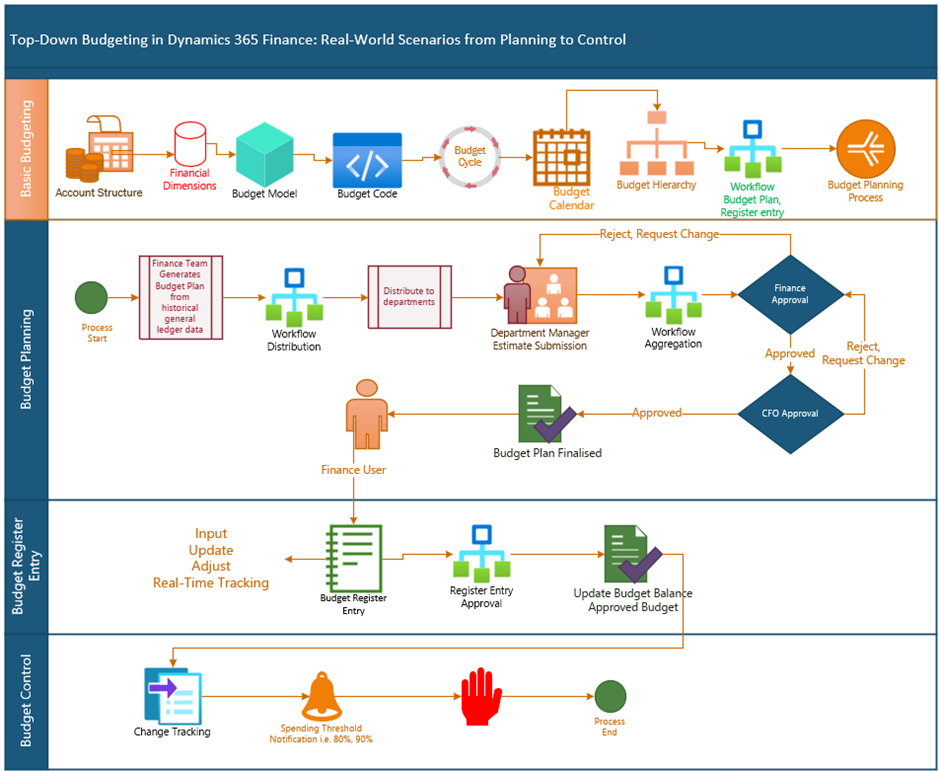

- The Finance team generates an initial budget for Marketing, IT, and Product Development departments from historical General ledger expense transactions.

- The Finance team distributes budget to each department.

- Department managers review their allocated budgets, make necessary revisions, and approve the plans.

- The revised budgets are sent back to the Finance team for consolidation and submission to the CFO.

- After the CFO’s approval, the Finance team creates budget register entries to update the organization’s financial system and activate the budget for tracking and control.

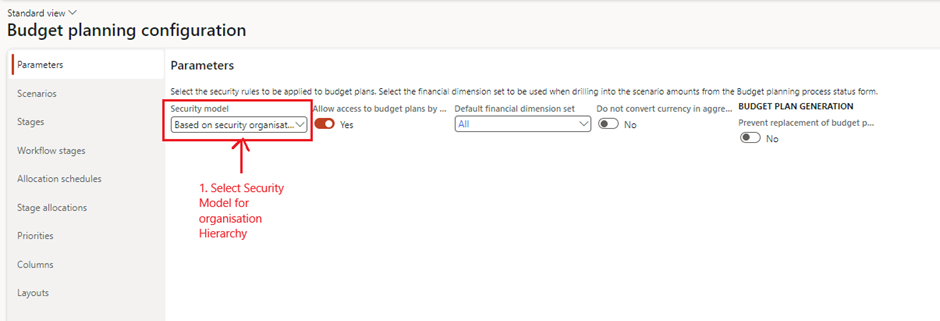

Budget Planning Configuration

- Parameters: Rules that define how budgeting works in your system, like setting guidelines for approvals and limits.

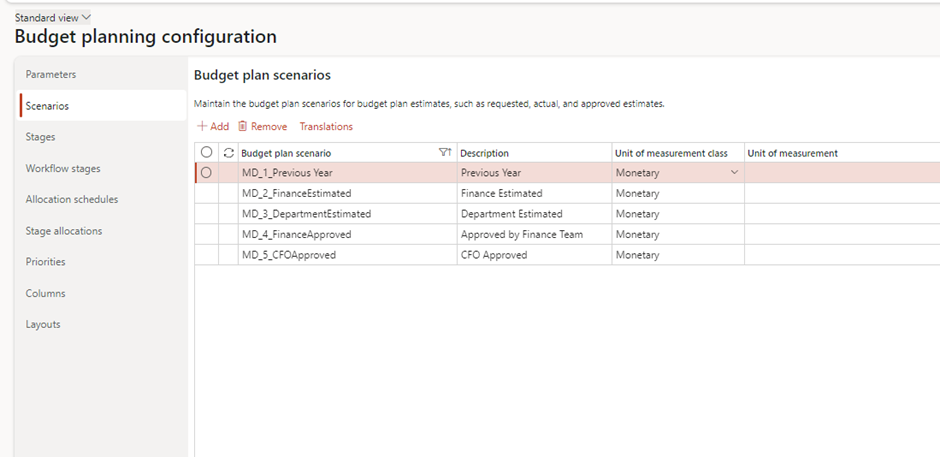

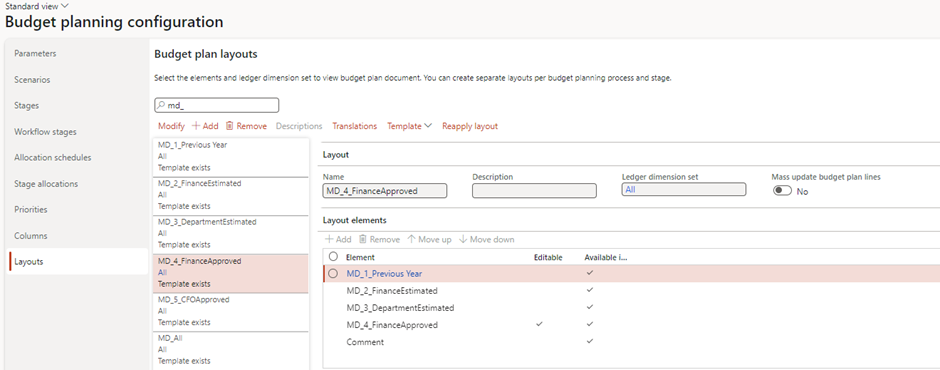

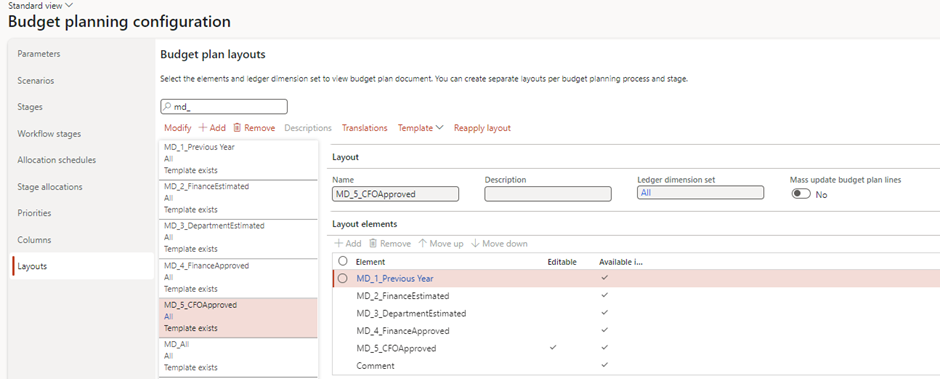

2. Scenarios: Different versions or possibilities of a budget plan

- Previous Year – Scenario which will hold historically general ledger budget data

- Finance Estimated – Scenario which will hold Finance estimated (any adjustment made by Finance on historical budget data before distributing to departments)

- Department Estimated – Scenario which will hold Department submitted budget data to Finance team.

- Finance Approved – Scenario which will hold Finance Team approved and submitted to CFO budget data

- CFO Approved – Scenario which will hold CFO approval budget data

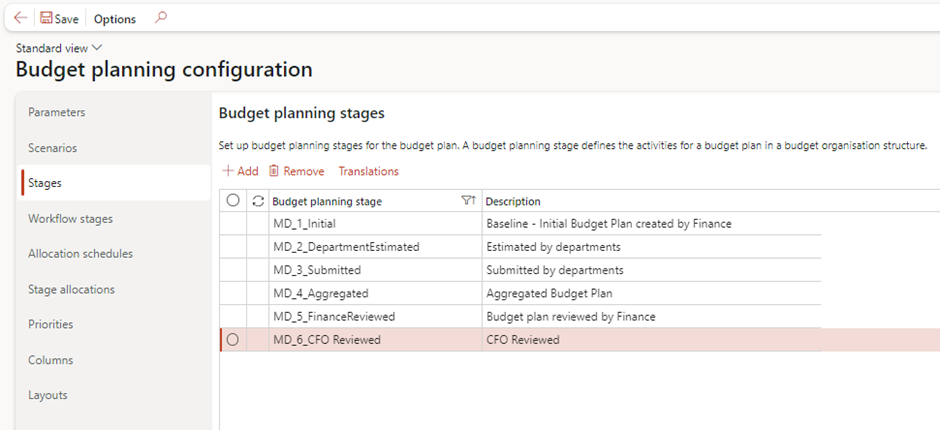

3. Stages: Steps in the budget planning process, from initial drafts to final approvals

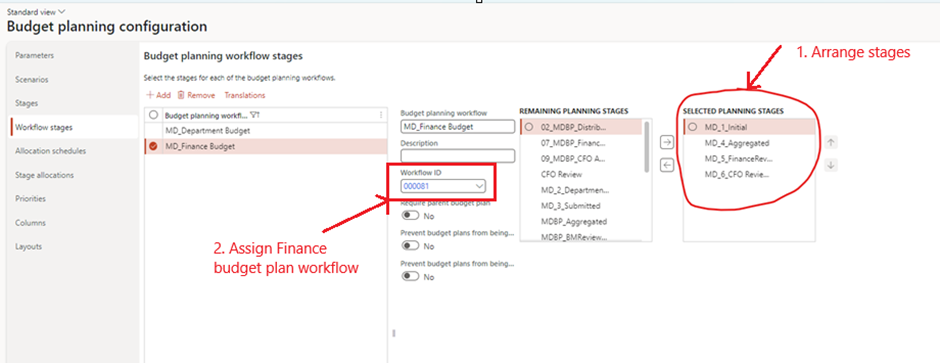

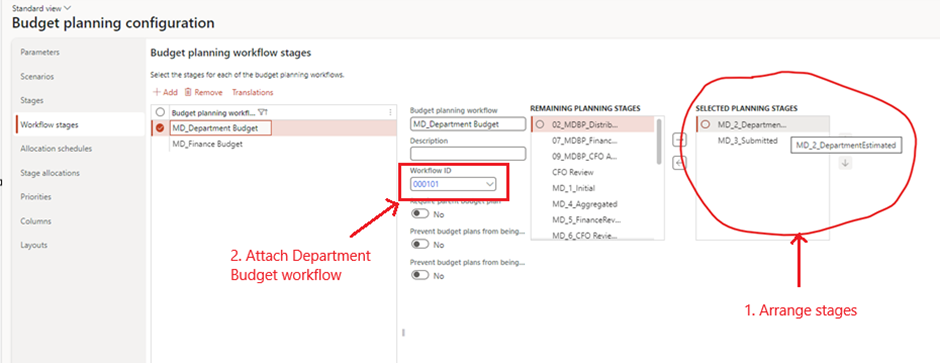

4. Workflow Stages: Automated checkpoints where the budget moves through approvals and reviews.

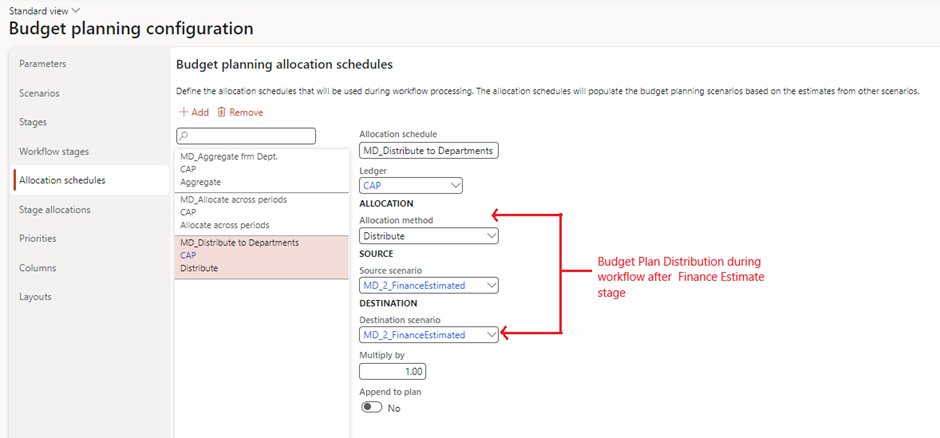

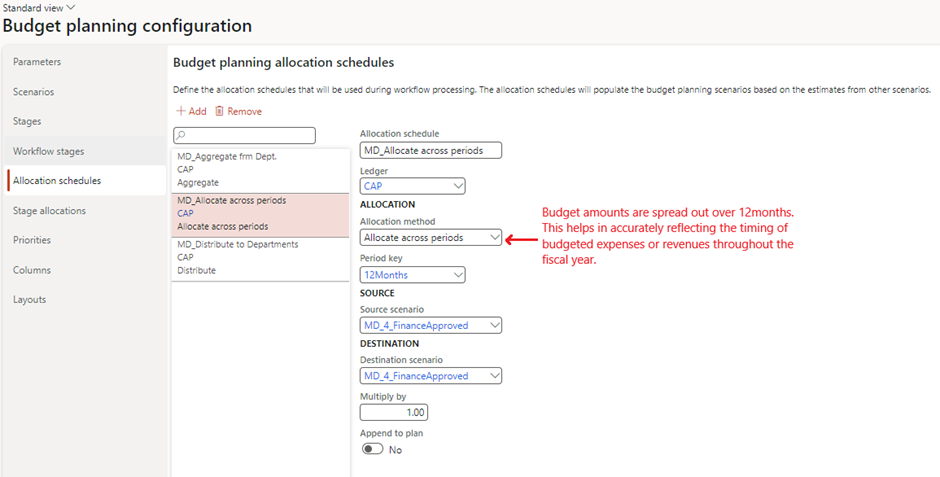

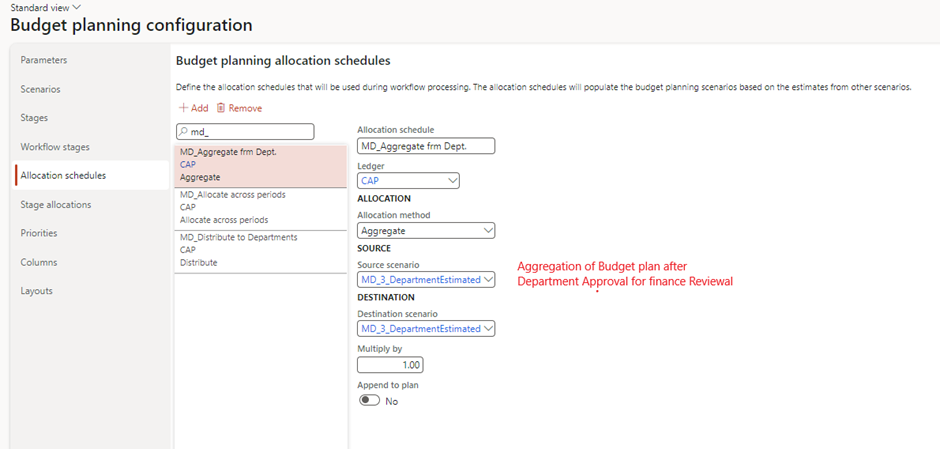

5. Allocations Schedules: A timeline for distributing budgeted amounts across accounts or time periods.

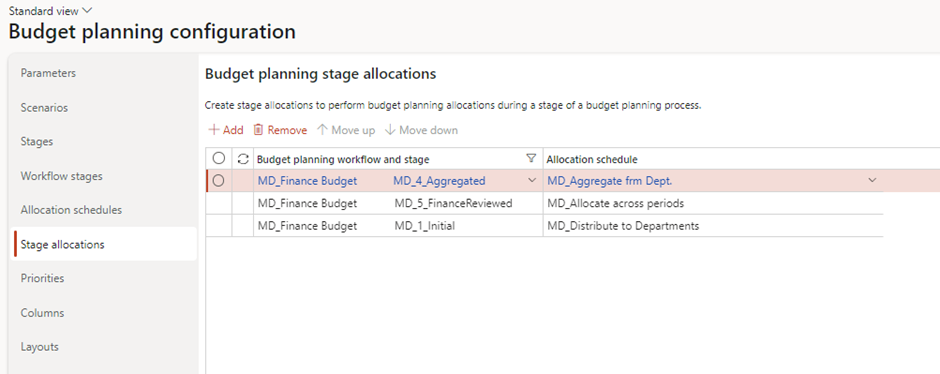

6. Stage Allocations: Specific rules or amounts assigned at different stages of the budgeting process.

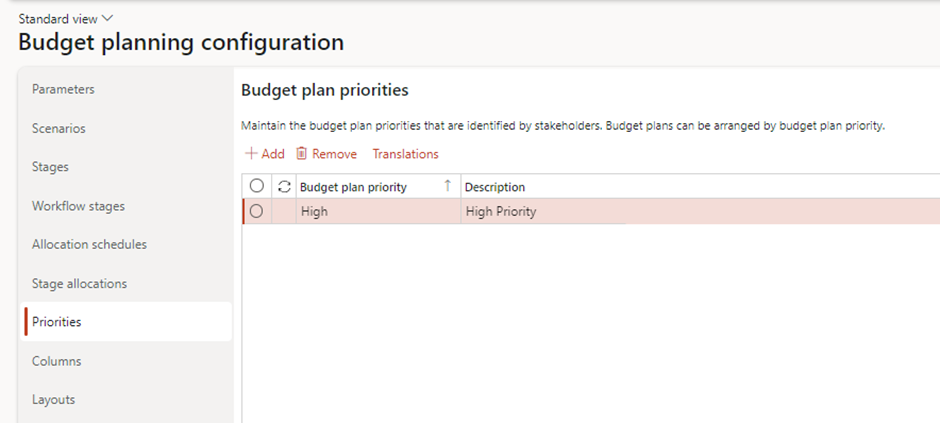

7. Priorities: The importance ranking of budget items to ensure critical needs are funded first

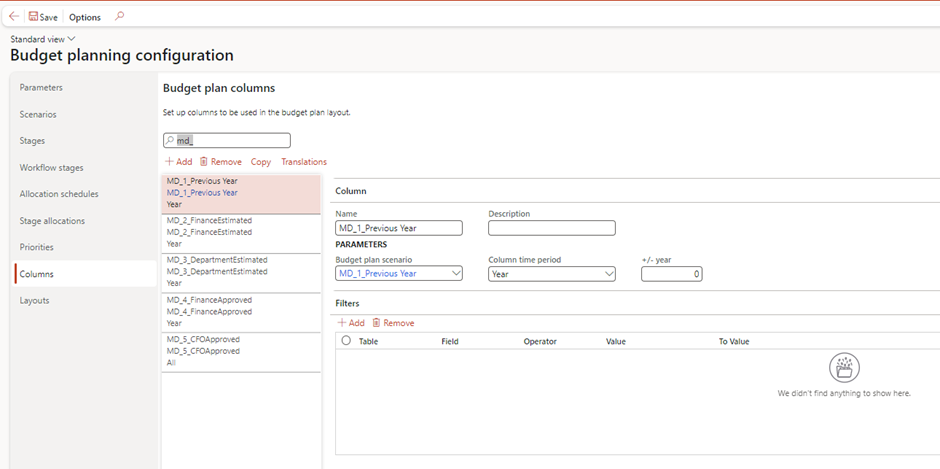

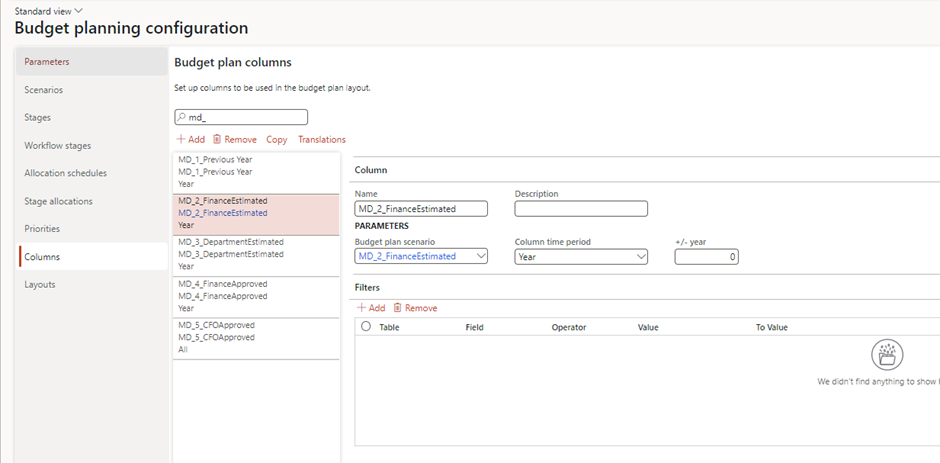

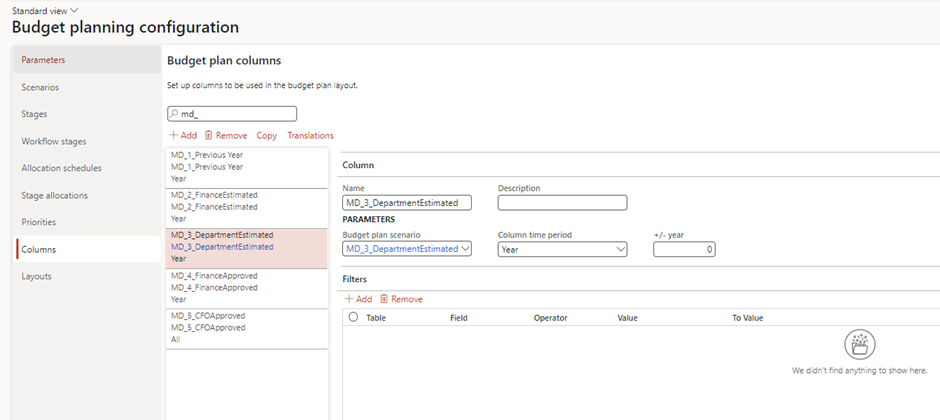

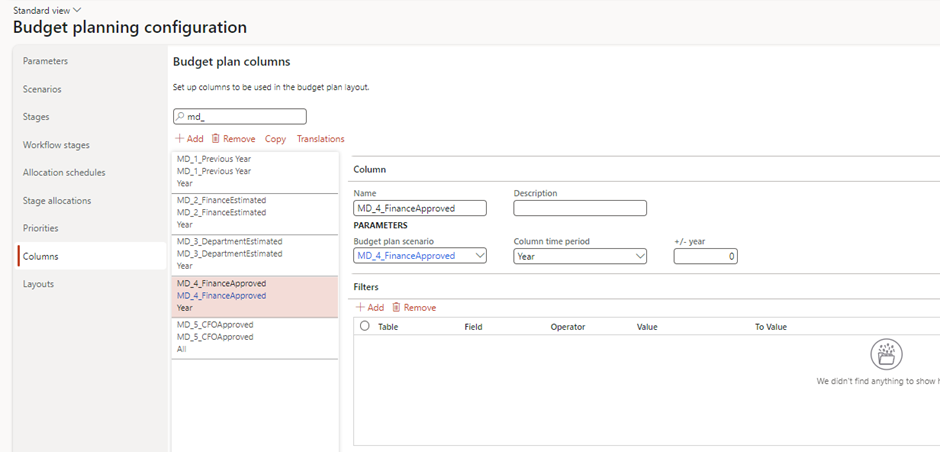

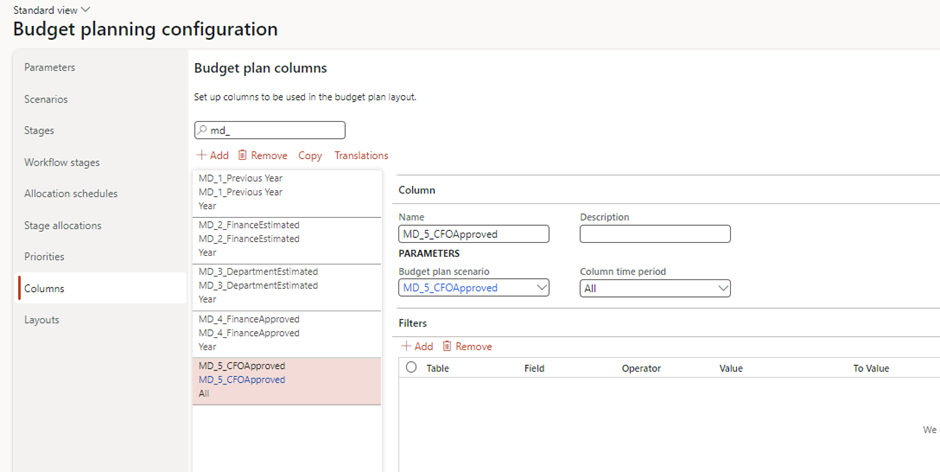

9. Columns: Data fields shown in a budget plan.

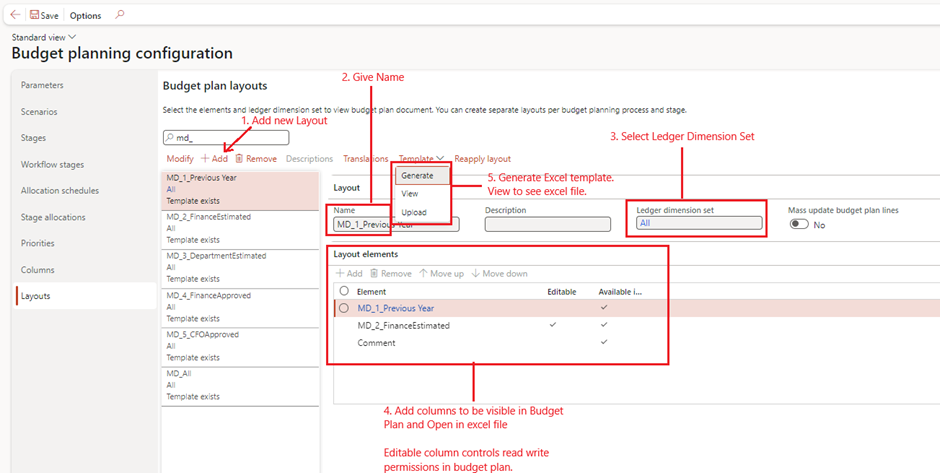

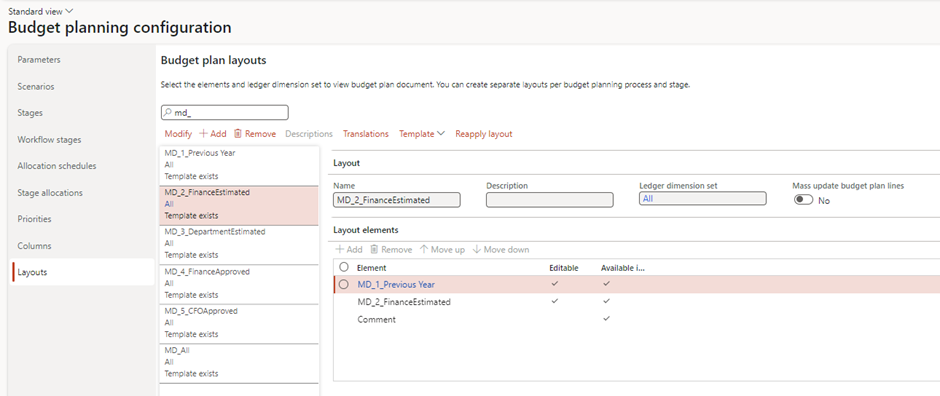

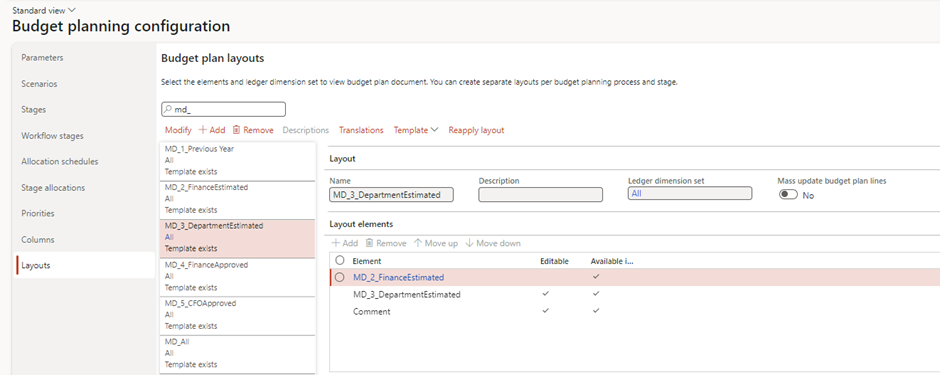

10. Layouts: The visual arrangement of budget information to make it easier to read and analyse.

Scenario Testing

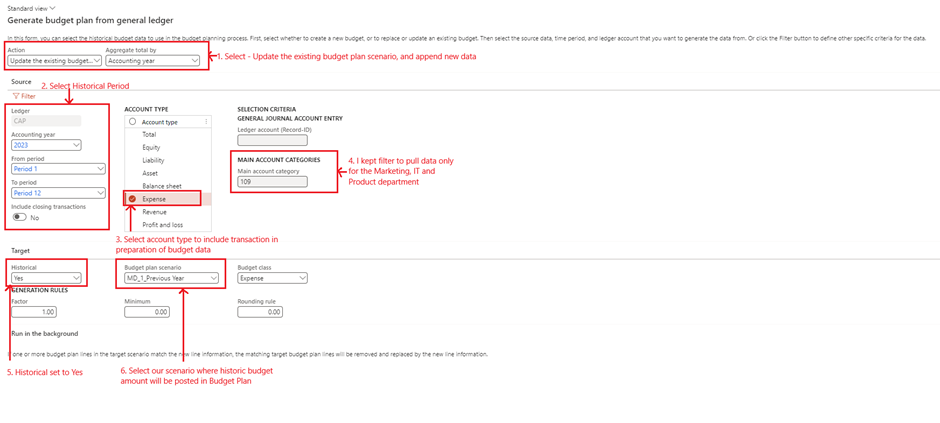

Step 1: Generate Initial Budget from Historical General Ledger Transactions

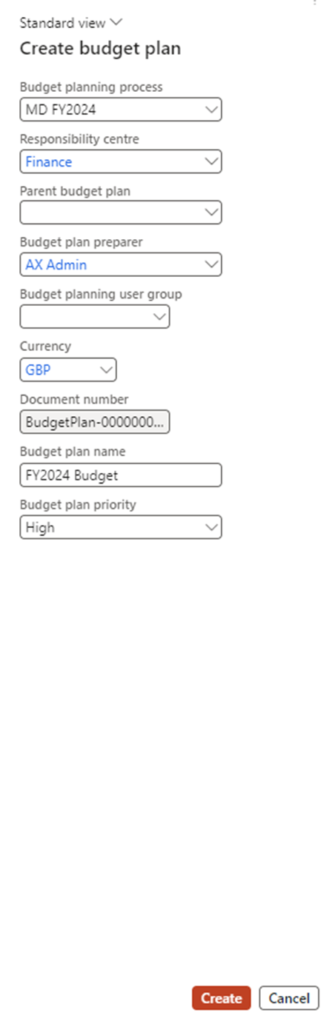

- Navigate to Budget Planning: Go to Budgeting > Budget Planning > Budget Plans.

- Create a New Budget Plan:

- Pull Historical Data:

- Use the Generate Budget Plan function.

- Specify criteria.

- Validate the generated budget amounts.

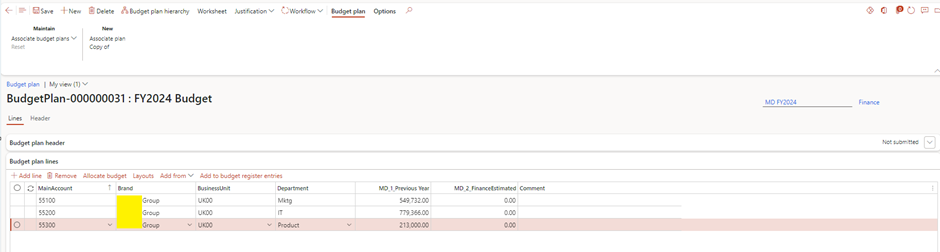

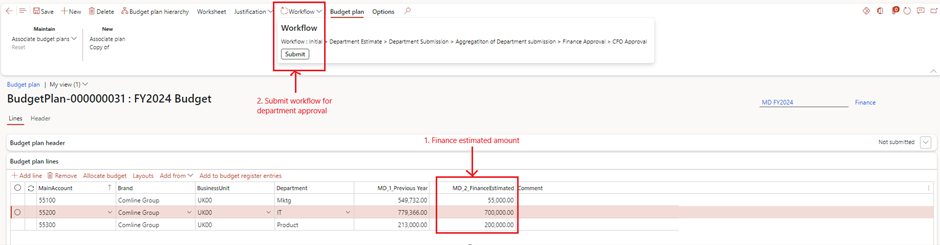

Step 2: Distribute Budget to Departments

- Finance Revise historical budget and submit to workflow

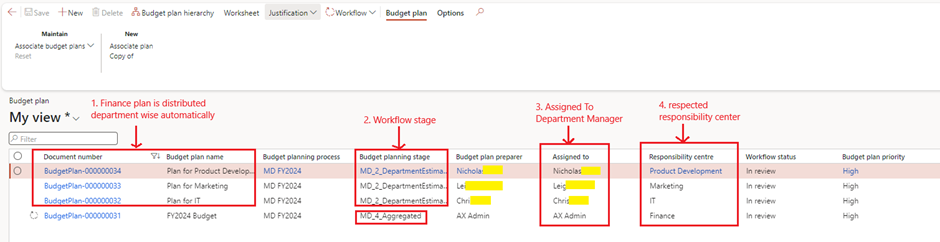

- Distribute the Budget:

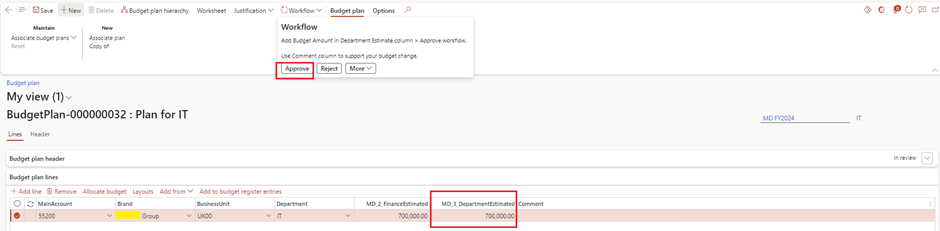

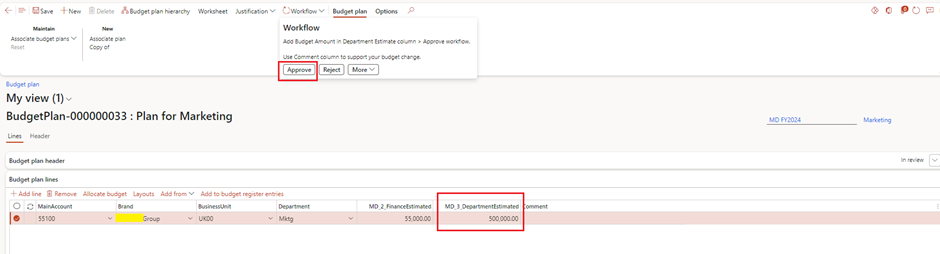

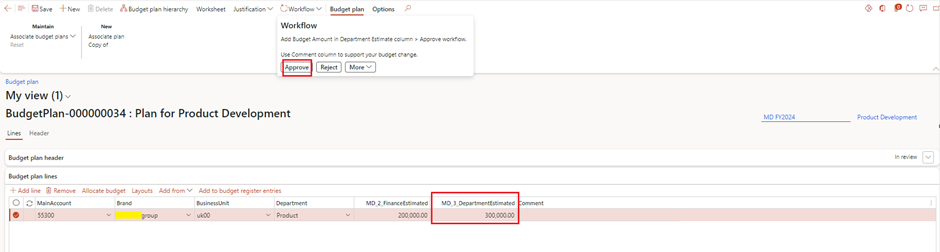

Step 3: Department Managers Review and Revise Allocated Budgets

- Review Budget Allocations:

- Department managers access their respective budget plans.

- Make Revisions if required

- Approve Budget Plan:

- Department managers approve and submit their revised budgets through the workflow.

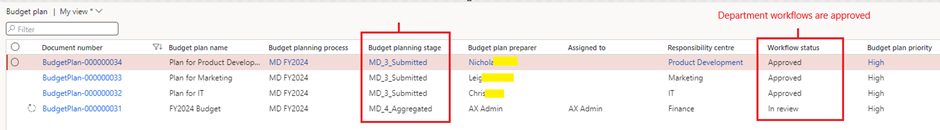

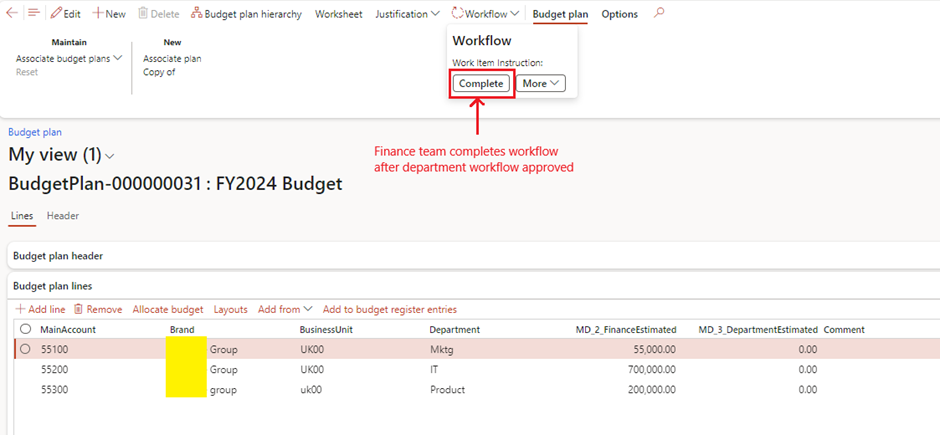

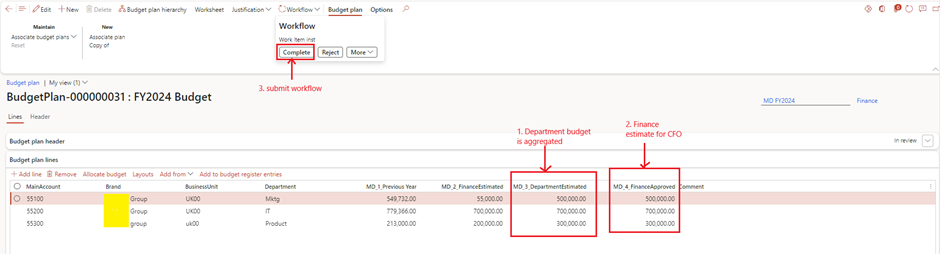

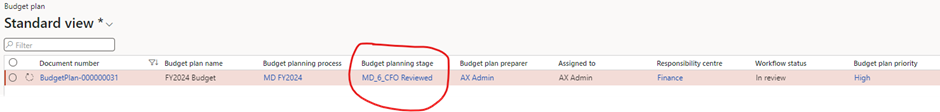

Step 4: Consolidate and Submit Budgets to the CFO

- Consolidate Revisions:

- Complete workflow to aggregate department budget

- Submit for CFO Approval:

- Use the workflow to send the consolidated budget plan to the CFO.

Step 5: CFO Approval and Activation

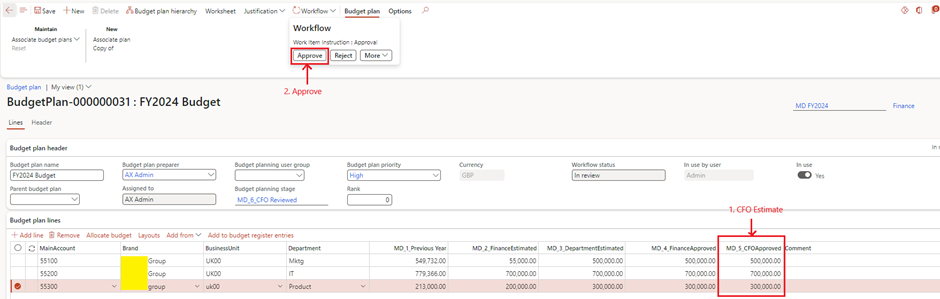

- Review by CFO:

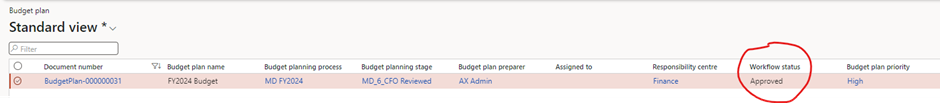

- Approved by CFO:

- Budget Plan approved

Conclusion

In conclusion, the budget planning process in Dynamics 365 Finance provides a structured and collaborative framework for aligning financial resources with organizational objectives. From the Finance team’s initial budget creation to departmental reviews, revisions, and the CFO’s final approval, the process emphasizes transparency, accountability, and strategic decision-making. This cohesive workflow not only fosters cross-departmental collaboration but also ensures the organization stays on track with its financial goals.

With the budget plan approved, the next critical step is ensuring compliance with these budgets through robust controls. In the upcoming article, we’ll delve into Budget Control, detailing how to enforce spending limits and maintain financial discipline before implementing the budget using register entries. Stay tuned!

Expand Your Knowledge: See More Budgeting Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment