BG504 – Top-Down Budgeting in Dynamics 365 Finance: Real-World Scenarios from Planning to Control (Part-3: Budget Control)

Table of Contents

ToggleIntroduction

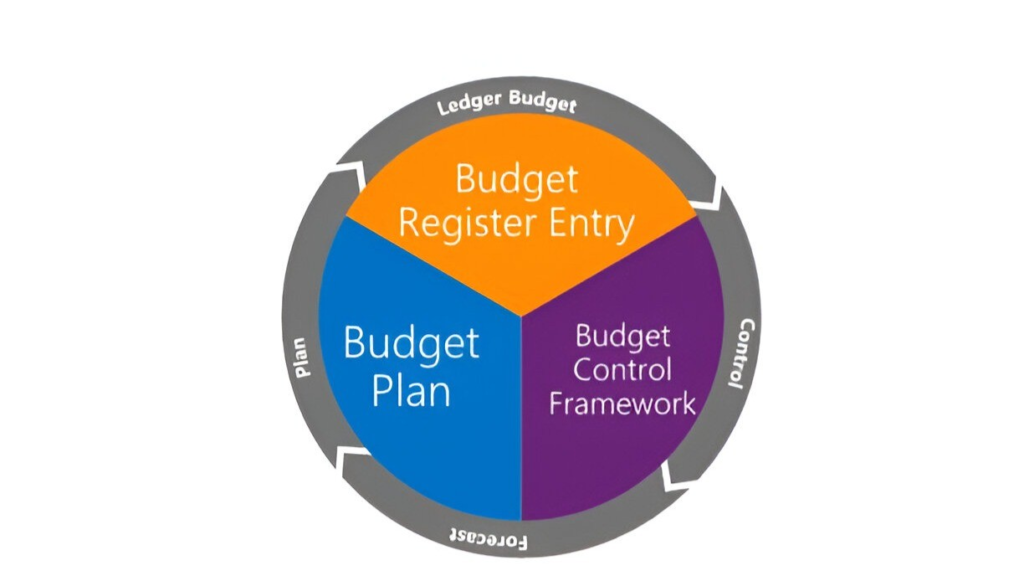

Welcome to Part 3 of our series, “Top-Down Budgeting in Dynamics 365 Finance: Real-World Scenarios from Planning to Control,” where we continue exploring the critical stages of budgeting in Dynamics 365 Finance. In the previous article, we covered Budget Planning, detailing how Finance teams collaborate with departments and leadership to create and finalize budget plans.

Now, we turn our attention to Budget Control, a pivotal step in ensuring financial discipline and compliance with approved budgets. Budget Control enables organizations to define spending rules, set thresholds, and monitor transactions in real time, preventing overspending and supporting fiscal stability.

In this article, we’ll delve into the configuration and implementation of Budget Control, demonstrating its integration with other financial processes. Through practical examples and step-by-step instructions, we’ll show how Budget Control safeguards financial resources and aligns spending with strategic objectives, paving the way for seamless budget execution in subsequent stages.

Scenario Overview

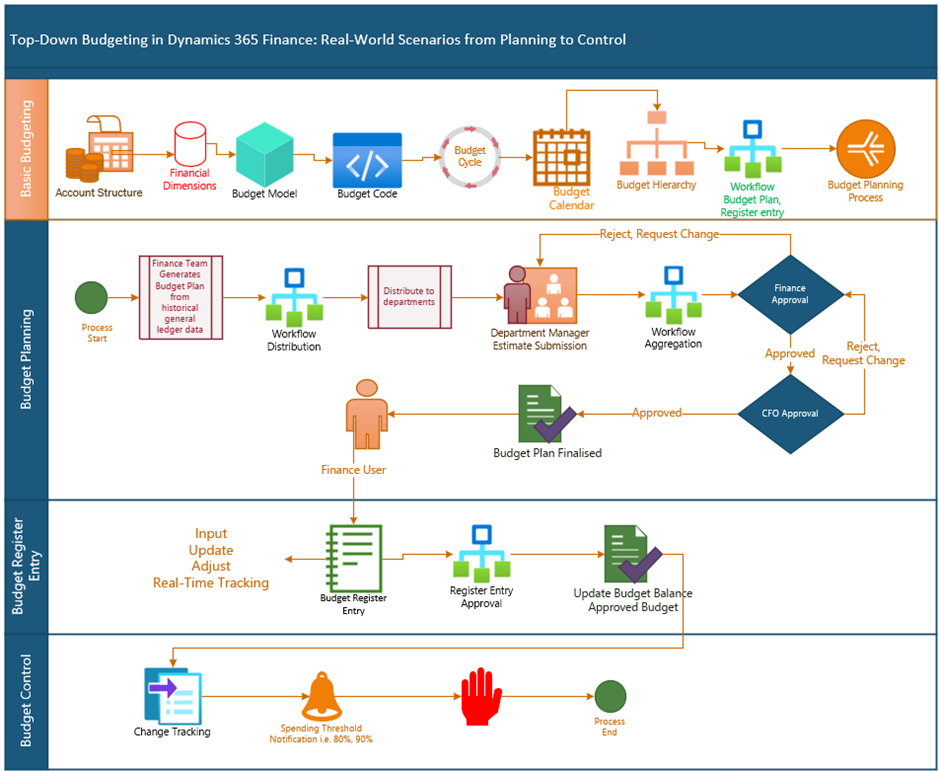

- The Finance team generates an initial budget for Marketing, IT, and Product Development departments from historical General ledger expense transactions.

- The Finance team distributes budget to each department.

- Department managers review their allocated budgets, make necessary revisions, and approve the plans.

- The revised budgets are sent back to the Finance team for consolidation and submission to the CFO.

- After the CFO’s approval, the Finance team creates budget register entries to update the organization’s financial system and activate the budget for tracking and control.

Scenario Testing:

Step-by-Step Instructions to Configure and Test Budget Control in Dynamics 365 Finance

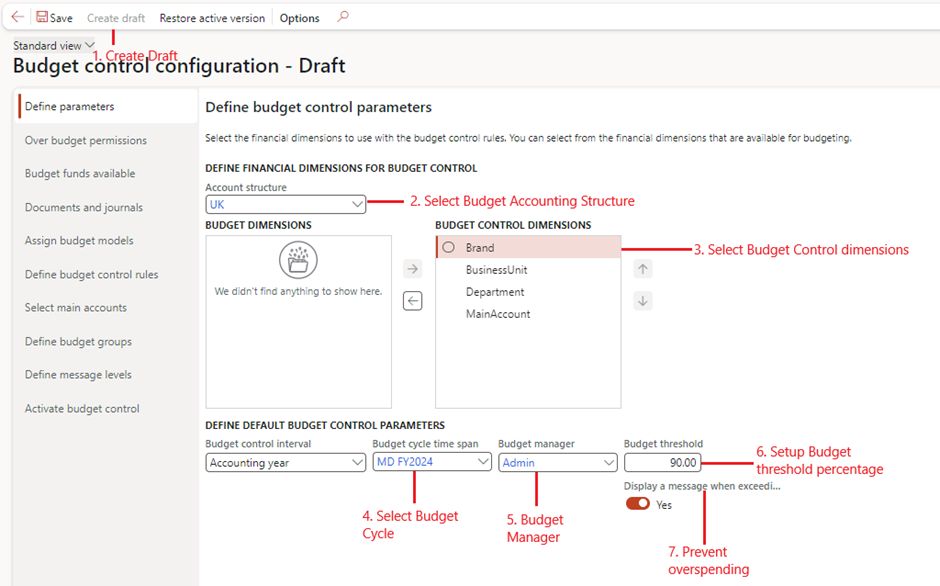

Step 1: Create Draft and Define Parameter

- Go to Budgeting > Setup > Budget Control Configuration > Define Parameters

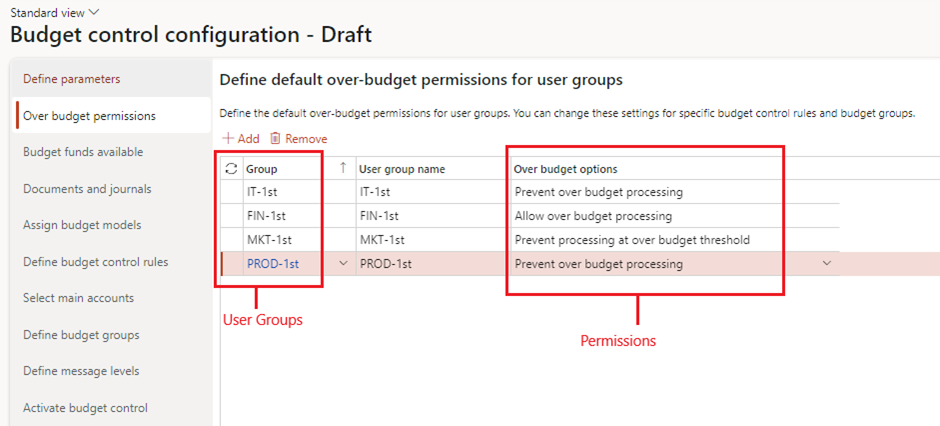

Step 2: Configure Over Budget Permission

- Specify conditions under which exceeding the budget is allowed and who has authority to approve such exceptions.

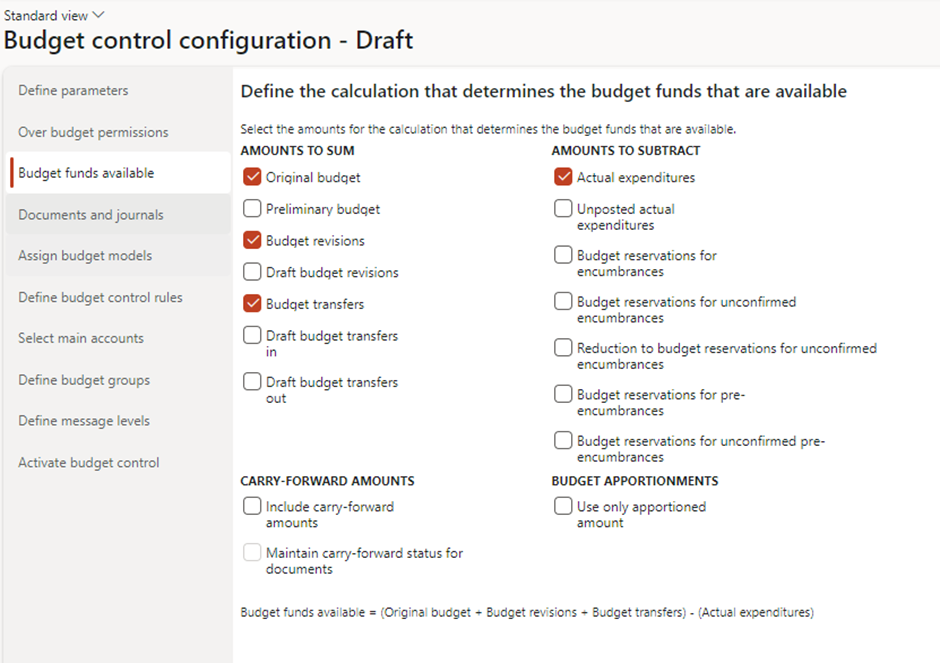

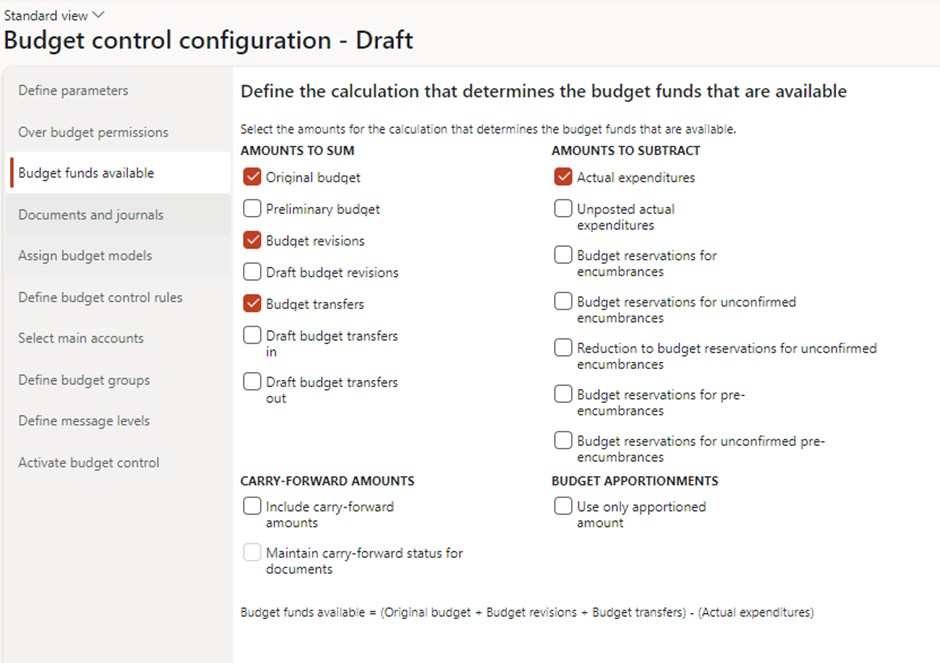

Step 3: Select Budget Funds Available

- Determine how the system calculates available budget balances to ensure accurate spending limits.

Step 4: Configure Documents and Journals

- budget control to specific financial transactions, such as purchase orders and general journals, to enforce compliance at every step.

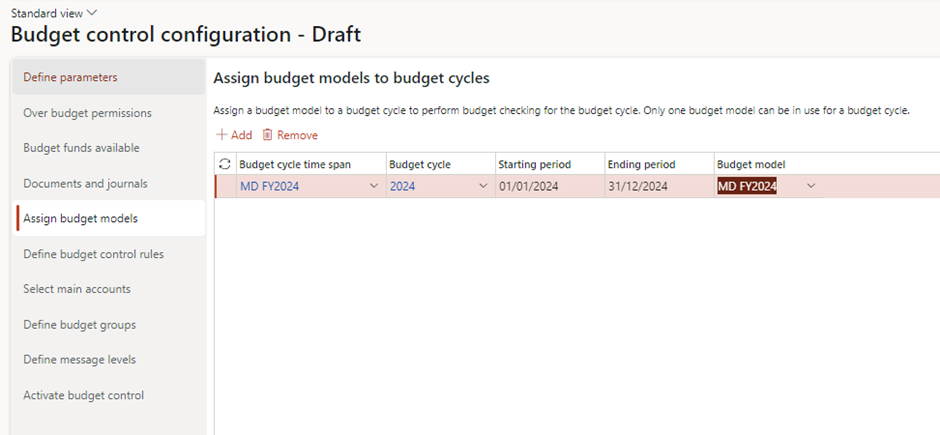

Step 5: Assign Budget Model to Budget Cycle

- Associate the correct budget model with the control configuration to monitor spending against approved budgets.

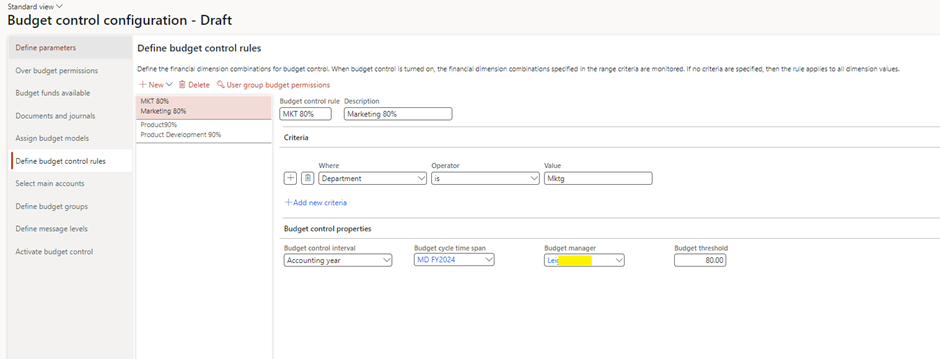

Step 6: Define Budget Control Rules

- Set criteria and conditions to enforce budget limits based on financial dimensions, accounts, or other parameters.

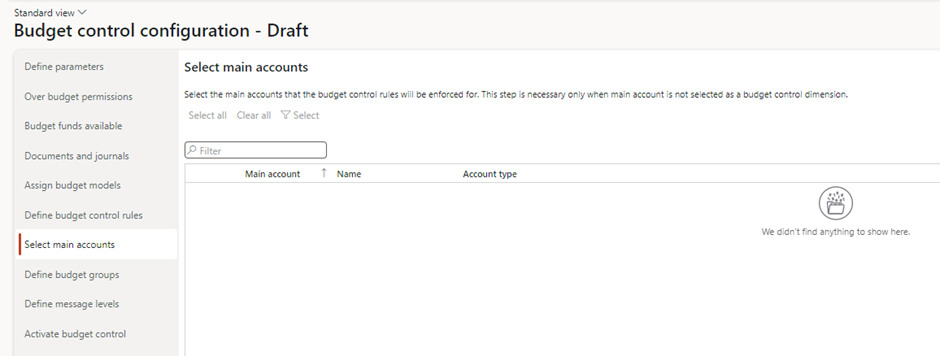

Step 7: Select Main accounts

- Specify which general ledger accounts are subject to budget control for focused financial tracking. Note – This step is necessary only when main account is not selected as a budget control dimension.

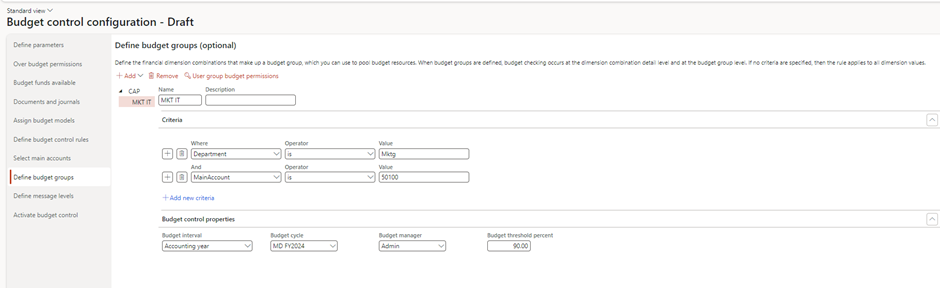

Step 8: Define Budget Groups

- Group related accounts or dimensions to streamline budget monitoring and control.

Step 9: Define Message Level

- Configure system alerts or actions (warnings or errors) to guide users when budget limits are exceeded. Users of the user group will continue receiving error messages based on their over-budget permissions, but they will not receive warning messages.

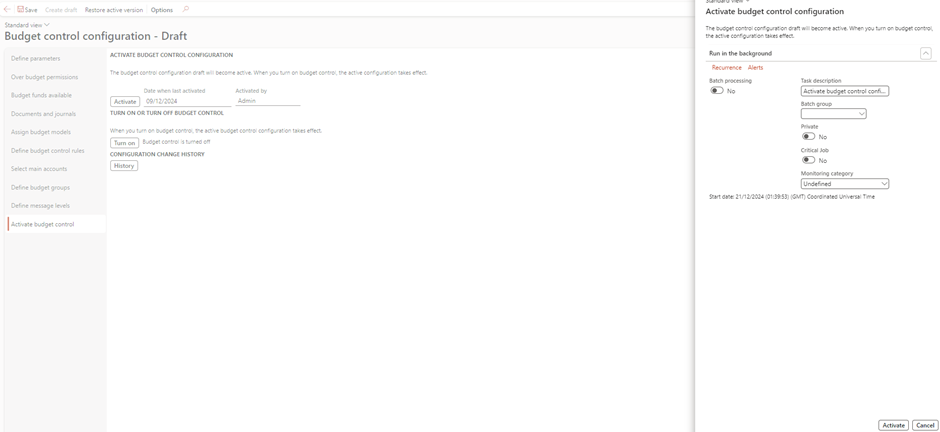

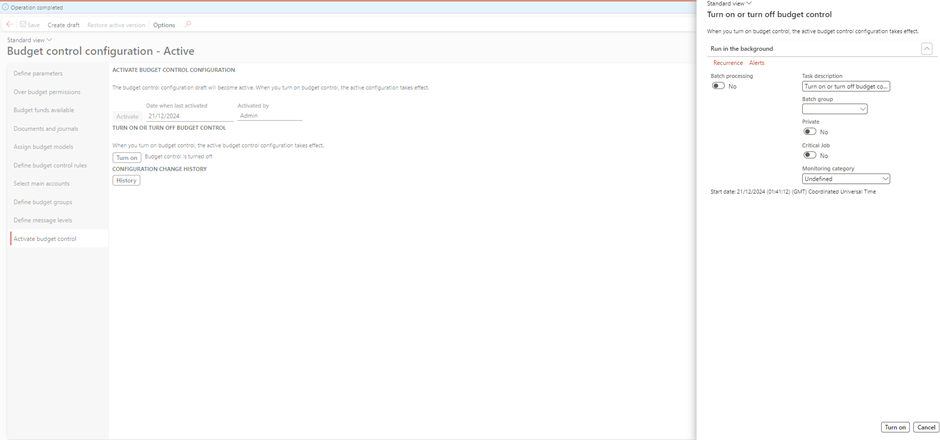

Step 10: Activate Budget Control & Turn On

- Enable budget control to enforce rules and track spending in real time across the organization.

Activate

Turn On

Testing Budget Control

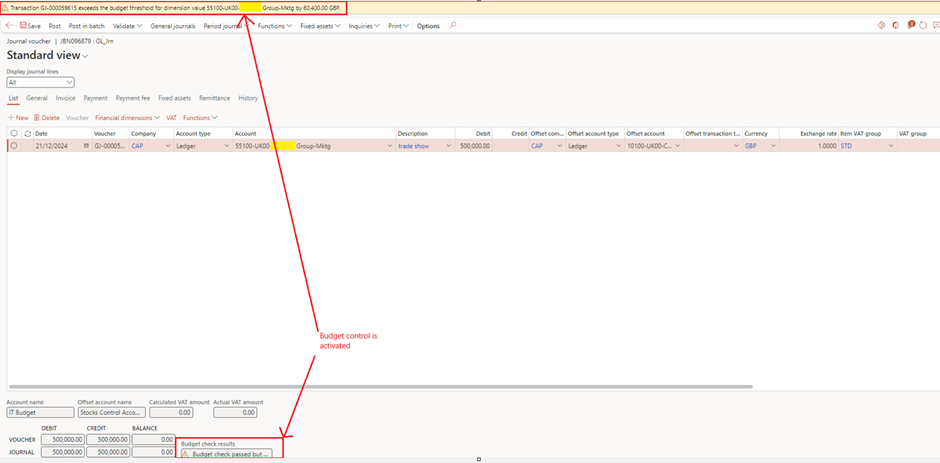

Step 1: Test with a General Journal

- Create a General Journal Entry and validate

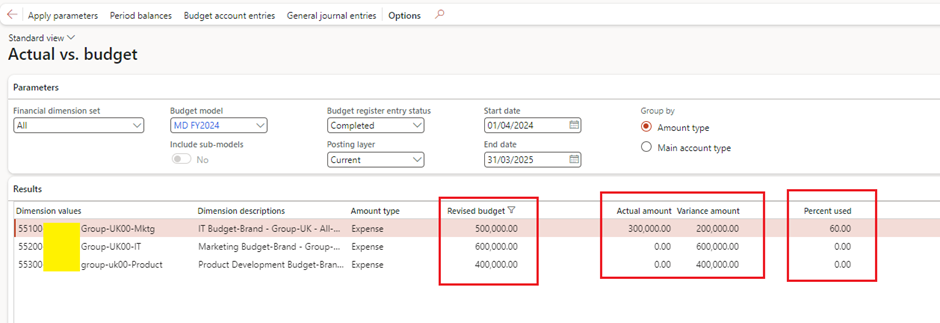

Step 2: Review Budget Control Report

- Actual Vs Budget tracking

Conclusion

In conclusion, Budget Control in Dynamics 365 Finance is a powerful tool that ensures financial discipline and alignment with approved budgets. By defining clear spending rules, thresholds, and real-time monitoring mechanisms, organizations can effectively prevent overspending and maintain fiscal accountability. Activating Budget Control not only enforces compliance but also empowers Finance teams to manage resources strategically and transparently.

With Budget Control configured and operational, your organization is well-positioned to move forward with implementing the approved budgets. In the next article, we’ll focus on Budget Register Entries, exploring how to convert finalized budget plans into actionable entries within Dynamics 365 Finance. This step will enable seamless budget execution and tracking, further strengthening financial management processes. Stay tuned!

Expand Your Knowledge: See More Budgeting Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment