PM511 – Elevating Investment Projects: Transforming Costs into Fixed Assets in Dynamics 365 Finance

Table of Contents

ToggleIntroduction

Investment projects play a crucial role in long-term asset development, enabling organizations to track costs and capitalize expenses efficiently. In Dynamics 365 Finance, Investment Projects provide a structured framework to capture and manage costs associated with asset creation, such as building infrastructure, purchasing equipment, or upgrading facilities. Unlike revenue-generating projects, investment projects focus on capitalizing eligible costs into fixed assets while expensing non-capitalizable costs directly to the profit and loss (P&L) account.

Investment projects follow a structured financial posting process, ensuring that costs are correctly tracked and transferred to the Fixed Asset module upon project completion. Below are the key financial transactions and corresponding journal entries at each stage of the investment project lifecycle:

Journal Entries for Investment Projects in Dynamics 365 Finance

| Project Stage | Transaction | Debit Account | Credit Account | Purpose |

|---|---|---|---|---|

| 1. Journal Posting | Recording project costs (labor, materials, subcontractors) | Investment in Progress (WIP) Account | Accounts Payable / Expense Account | Captures incurred costs under WIP |

| 2. Invoice Proposal Posting | Customer invoicing (if applicable for cost recovery) | Accounts Receivable (Customer) | Deferred Revenue Account (Liability) | Bills external funding sources (if any) |

| 3. Capitalization Posting | Transferring capitalizable costs to fixed assets | Fixed Asset Account | Investment in Progress (WIP) Account | Converts WIP to capitalized asset value |

| 4. Non-Capitalizable Cost Posting | Expensing non-capitalizable costs | Expense Account (P&L) | Investment in Progress (WIP) Account | Moves non-asset costs to P&L |

| 5. Asset Depreciation Posting | Recording periodic depreciation of capitalized assets | Depreciation Expense Account | Accumulated Depreciation Account | Recognizes asset depreciation over time |

By leveraging Dynamics 365 Finance, organizations can ensure accurate cost tracking, seamless asset capitalization, and compliance with financial reporting standards. This structured approach enables businesses to efficiently manage large-scale infrastructure projects, facility upgrades, and capital investments, ensuring that costs are correctly allocated and financial statements accurately reflect asset value.

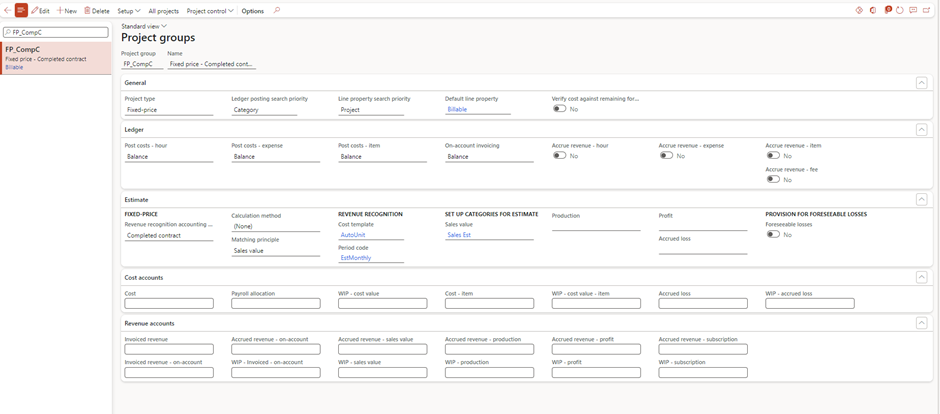

No nominal accounts are used within the Project group; instead, nominal accounts are defined in the Ledger Posting setup.

PROJECT GROUP

Scenario to Focus

A car part distribution company is constructing a new warehouse to expand storage capacity and improve supply chain efficiency. This Investment Project in Dynamics 365 Finance will track all costs, including land acquisition, construction labor, material procurement, and equipment installation. Throughout the project, expenses will be categorized as capitalizable or non-capitalizable, ensuring accurate financial reporting. Work in Progress (WIP) accounting will capture incurred costs until the warehouse is completed and ready for use, at which point capitalizable costs will be transferred to the Fixed Asset module, while non-capitalizable costs will be expensed to the profit and loss (P&L) account. With no customer billing involved, the focus remains on precise cost tracking, capitalization, and compliance with financial policies.

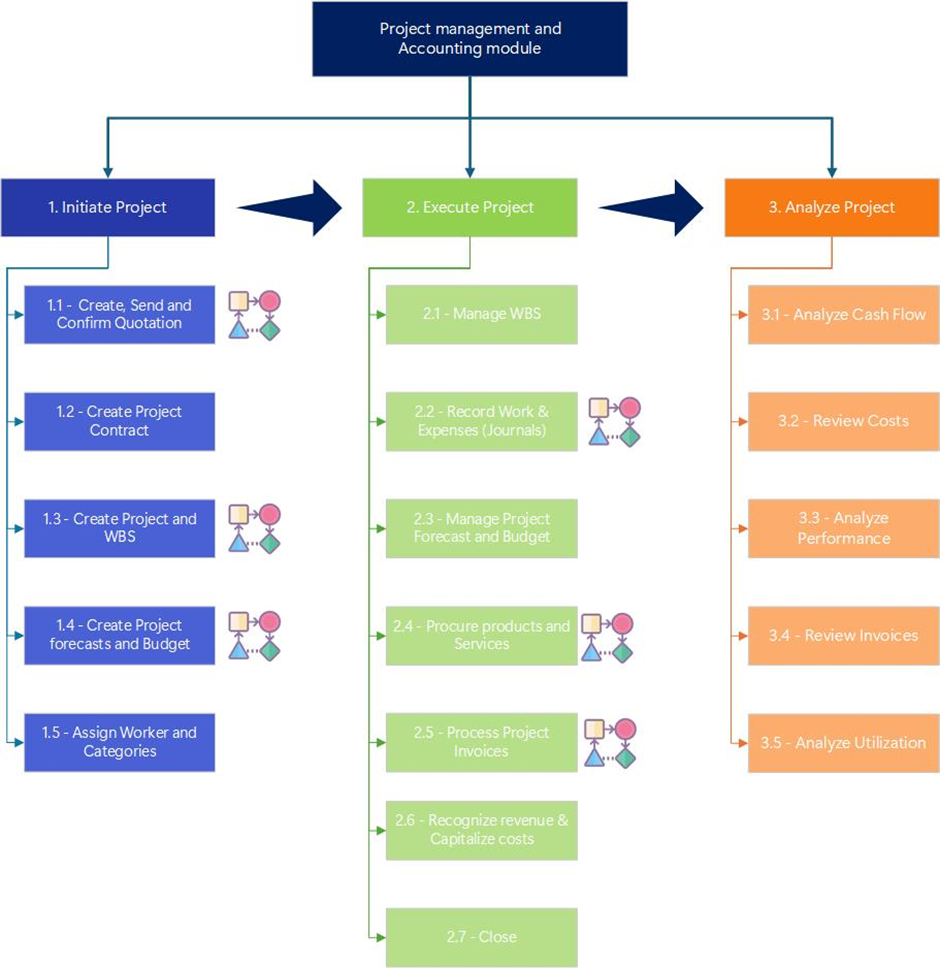

Project lifecycle

Initiate Project

Create, Send and Confirm Quotation

- Not Required

Create Project Contract

- Not Required

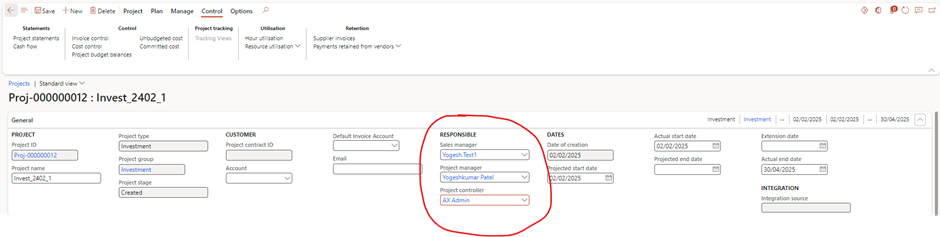

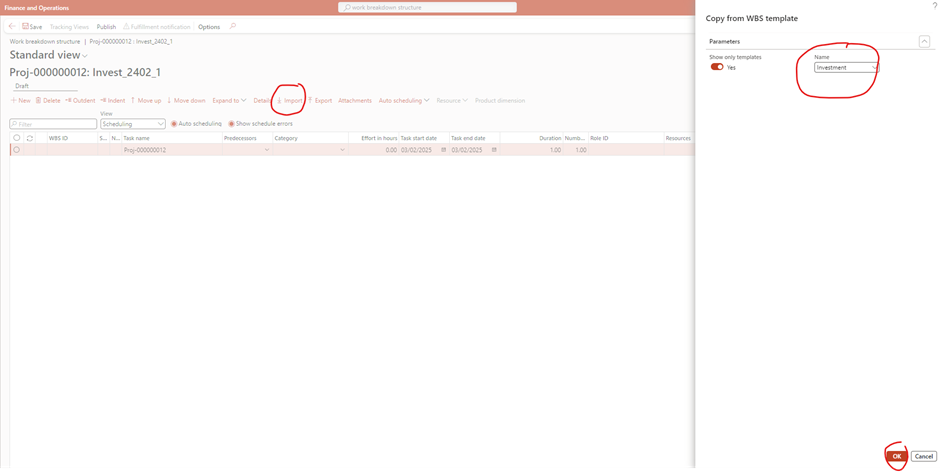

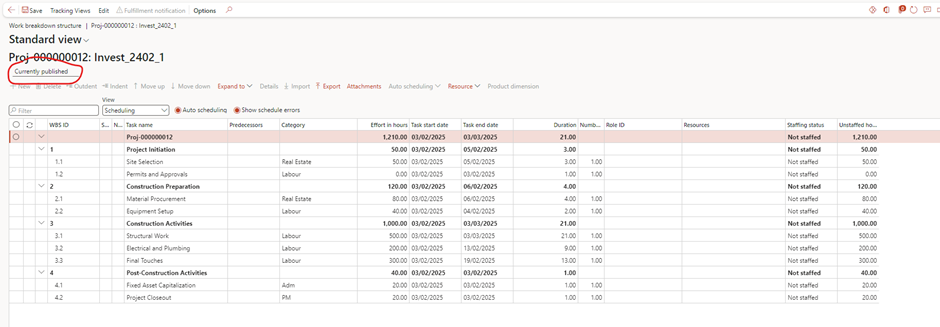

Create Project and WBS

- Create Project and Create or Import WBS template

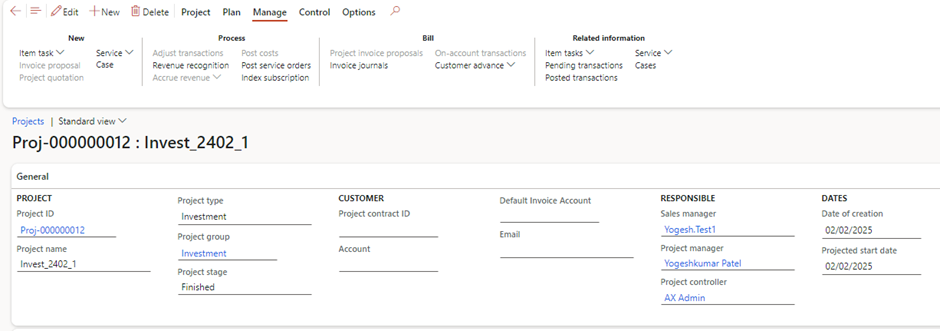

PROJECT:

- Assign Project Responsible (Optional)

WBS:

- Import WBS from Template or Add WBS lines manually.

- Publish WBS (Modify WBS if required)

Create Project Forecasts and Budget

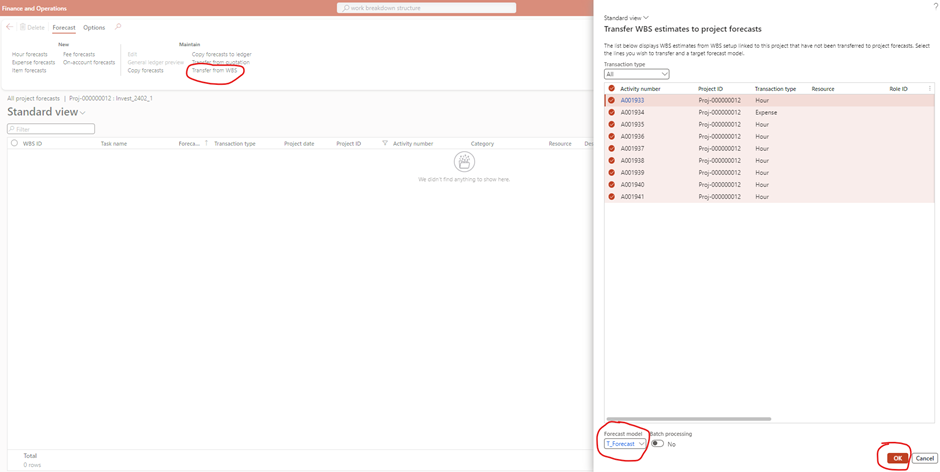

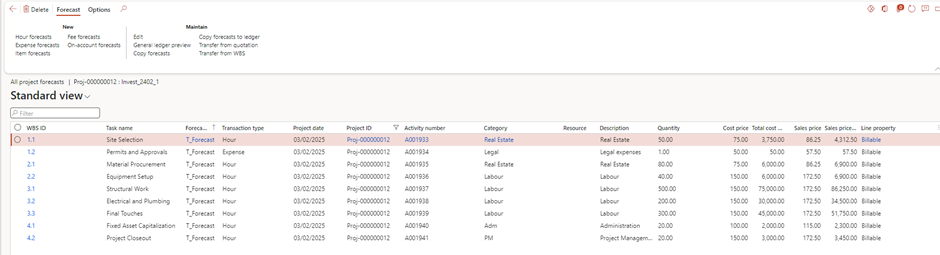

Setup Forecast

- Navigate to Project > Action tab: Plan > Forecast > All forecast > Maintain: Transfer from WBS

- Generated Forecast

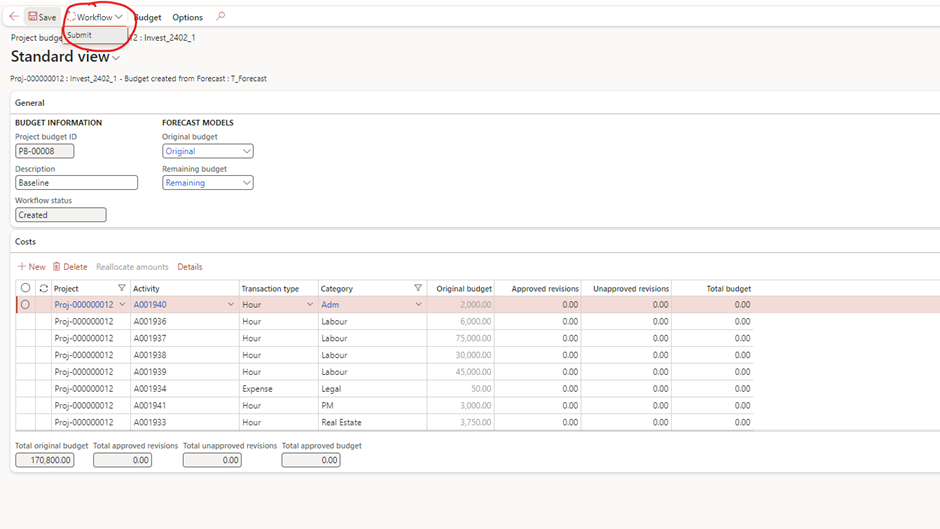

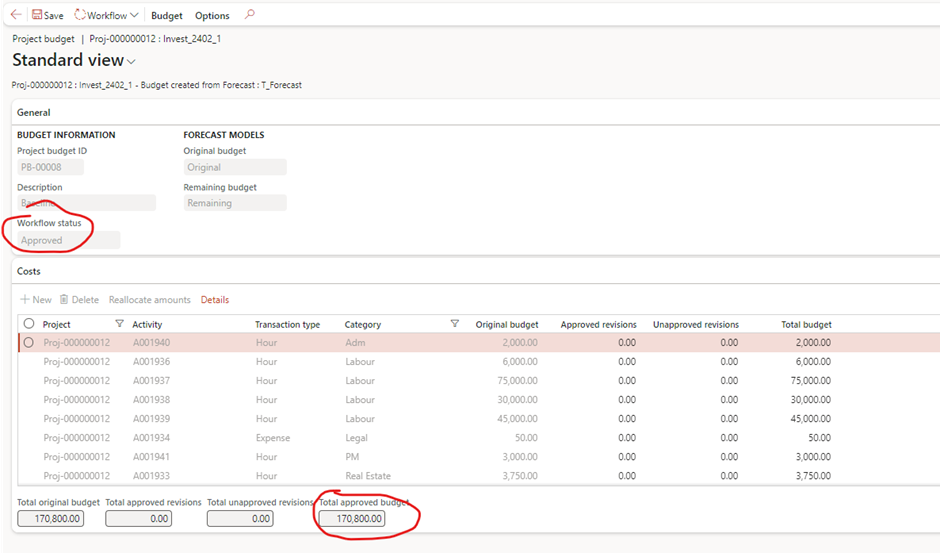

Setup Budget

- Turn on Budget control manually or default from Project management and accounting Parameters

- Plan > Budget > Project Budget

- Action Pane Import > Import to Project Budget > Source Type: WBS Estimate > Select Forecast model > OK

- WBS budget Submit to workflow

- Budget status changed to ‘Approved’ after workflow approval

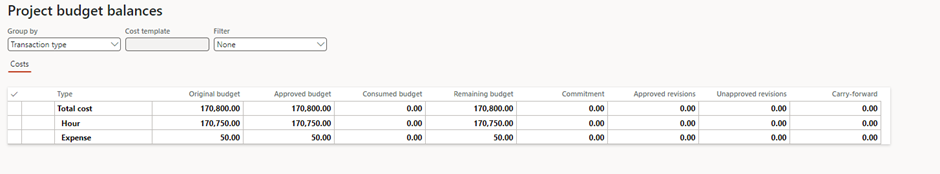

- Budget Balanced are added: Action Tab: Budget > Related Information > Project Budget Balances

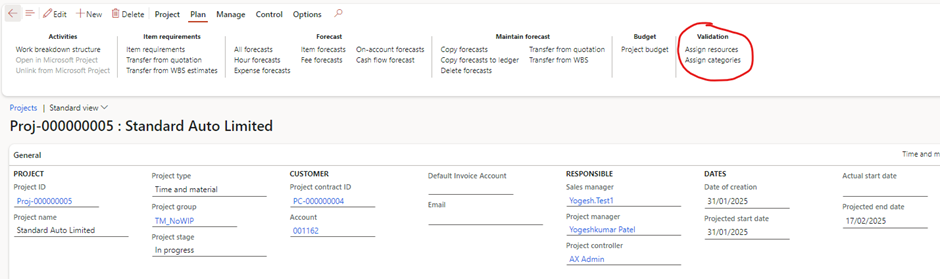

Assign Worker and Category

Note: I am skipping this step. The following content is from a previous article. Since investment projects require collaboration among individuals with diverse skills, booking resource availability ensures that the project remains on track.

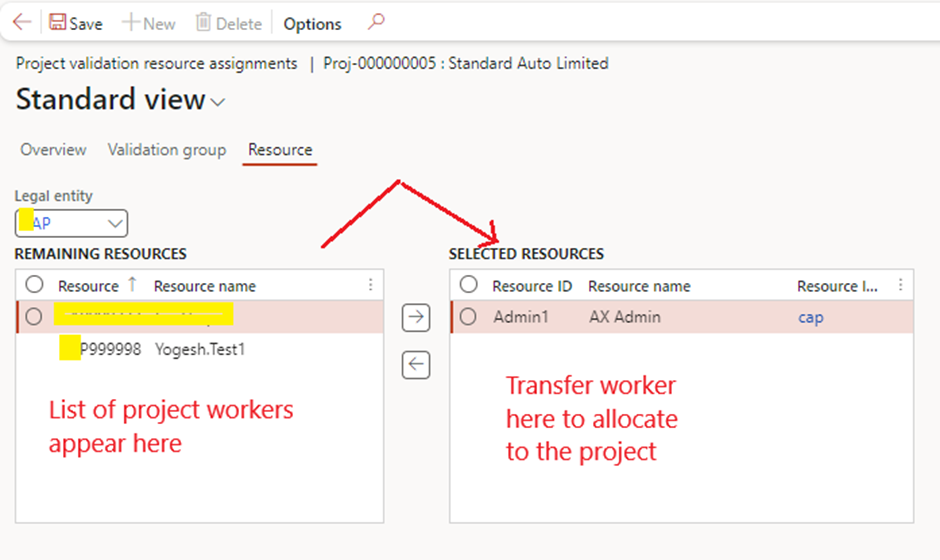

Assign Resources

- Assign Resources allows you to allocate specific resources (such as employees or equipment) to a project. By assigning resources, you ensure that the necessary personnel and tools are available to complete the project tasks. This step is crucial for resource planning and management, ensuring that the right resources are assigned to the right tasks at the right time

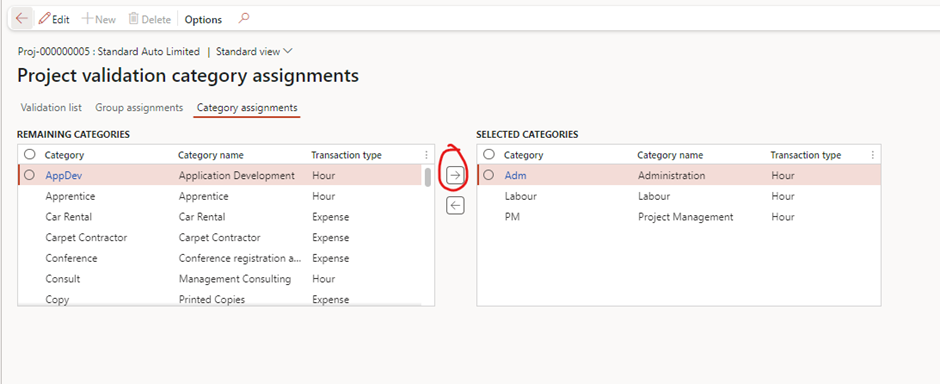

Assign Categories

- Assign Categories is used to assign project categories to various transactions within the project. Project categories help in classifying and managing different types of project costs and revenues, such as labor, materials, and expenses. Proper categorization is essential for accurate project accounting and reporting

Execute Project

Manage WBS

- Manage WBS (Work Breakdown Structure) stage under the Execution stage of the project lifecycle refers to the process of overseeing and updating the detailed breakdown of the project’s tasks and activities during the execution phase.

It involves:

1. TASK MANAGEMENT

- Ensuring that all tasks outlined in the WBS are being executed as planned. This includes tracking progress, updating task statuses, and making adjustments as necessary

- Go to Project > Action tab: Plan > Activities: Work Breakdown structure

2. RESOURCE ALLOCATION (Optional)

- Managing the assignment of resources to various tasks within the WBS. This ensures that the right resources are available and utilized efficiently

- I am skipping this part. Follow Previous article

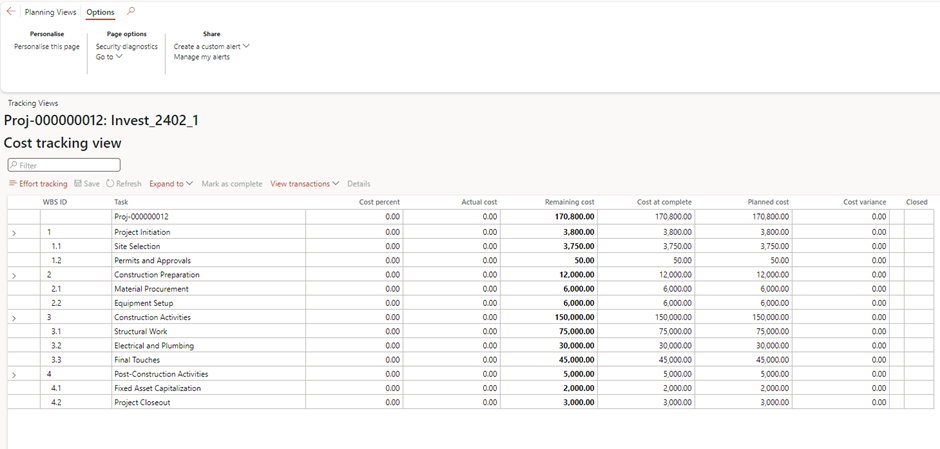

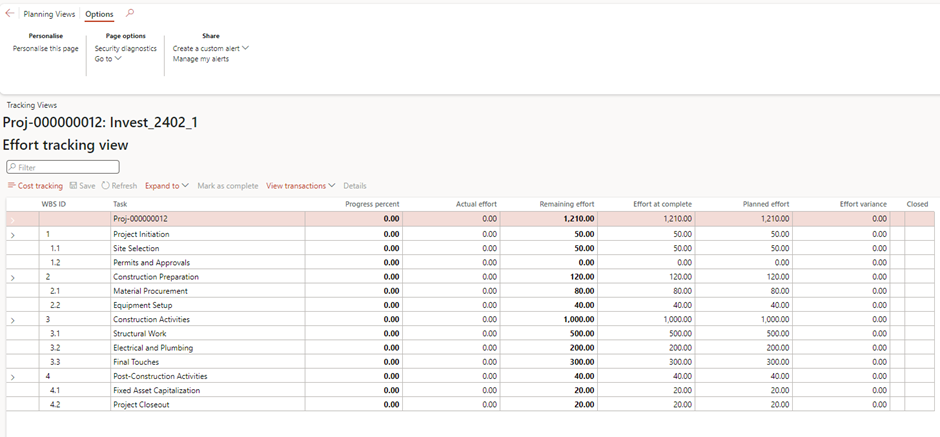

3. MONITORING AND CONTROL

- Continuously monitoring the progress of tasks against the project plan. This involves identifying any deviations from the plan and implementing corrective actions to keep the project on track

- Cost and Time Tracking: Keeping track of the time and costs associated with each task in the WBS. This helps in maintaining budget control and ensuring that the project stays within its financial constraints.

- Go to Project > Action tab: Plan > Activities: Work Breakdown structure > Action pane: Tracking View

EFFORT TRACKING

COST TRACKING

4. COMMUNICATION AND REPORTING

- Regularly communicating the status of the WBS to stakeholders and providing updates on the project’s progress. This helps in maintaining transparency and ensuring that everyone is informed about the project’s status

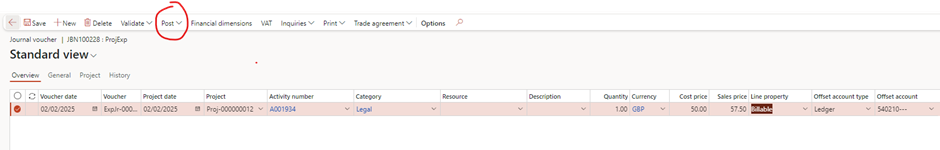

Record Work

- Set Project stage to In Progress

ADMIN RECORD HOURS

- Action Tab: Journals > Hours

- Click +New to create hour Journal Header and Go to Lines

- Add appropriate line details > Post

- Action Tab: Journals > Expense

- Click +New to create Expense Journal Header and Go to Lines

- Add appropriate line details > Post

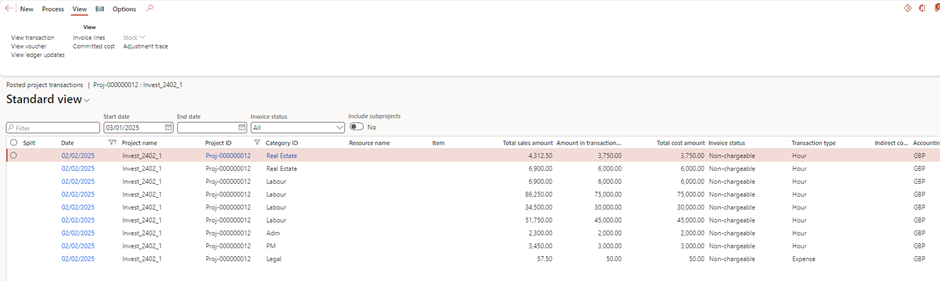

- Posted transactions are available on posted transaction screen (Project > Action tab: Manage > Related information: Posted transactions)

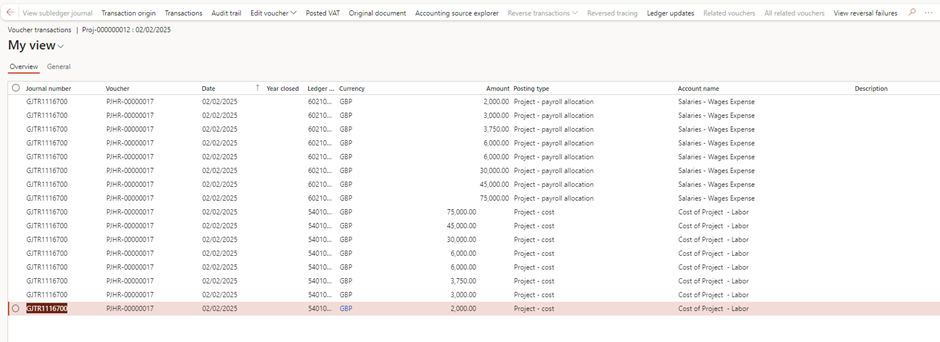

- Verify Voucher transactions

Manage Project Budget and Forecast

Manage Budget

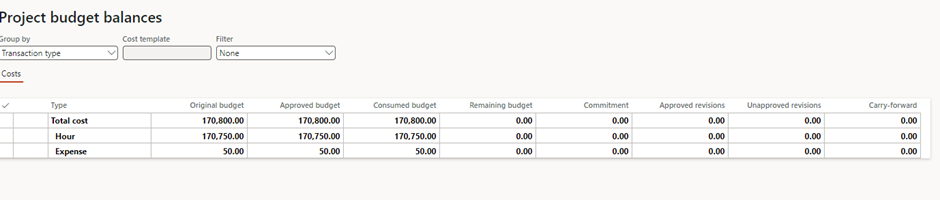

- Track Budget balance – Go to Project > Action Tab: Plan > Budget: Project Budget > Action Tab: Budget > Related Information: Project budget balance

COST

- New Revision: This button allows you to create a new budget revision. When you need to update or adjust the project budget due to changes in project scope, costs, or other factors, you can use this button to initiate a new revision process. Check Previous Article

- Revisions: This button provides access to a list of all previous budget revisions. It allows you to review the history of changes made to the project budget, ensuring transparency and traceability of budget adjustments. Check Previous Article

Manage Forecast

- Manage Forecast stage is essential for updating and overseeing financial projections as the project progresses. This involves adjusting forecasts based on actual performance, monitoring costs and revenues, ensuring efficient resource allocation, conducting variance analysis to identify and address discrepancies, and communicating updated financial information to stakeholders. By managing forecasts effectively, project managers can maintain financial control and ensure the project remains on track. Check Previous Article.

Procure Product and Services

- This step is not required for this project type.

Process Project Invoices

- This step is not required for this project type.

Recognize Revenue & Capitalize costs

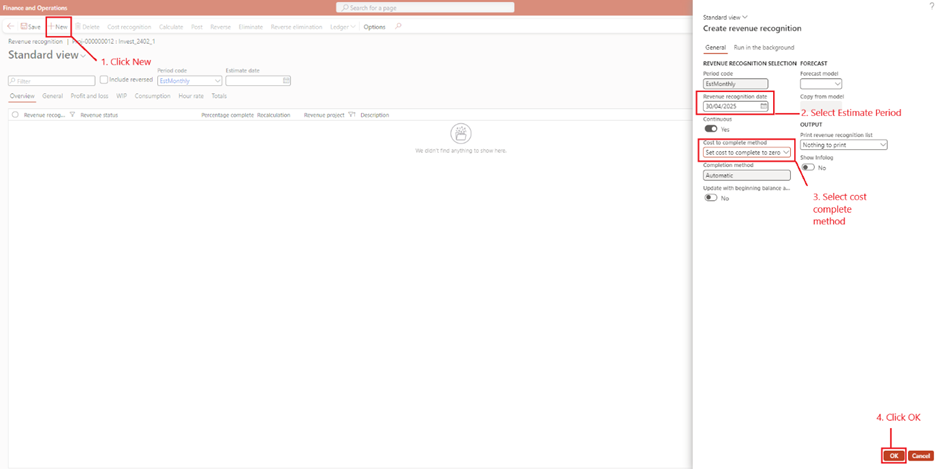

Revenue Recognition:

- Recording the revenue earned from the project based on the work completed. This ensures that the financial statements accurately reflect the project’s progress and earned income

- Go to Project > Action Tab: Process > Revenue Recognition

- Click +New

- Set Estimate Period

- Select Cost to Complete Method to ‘Set Cost to Complete to Zero’ as it indicates that project is fully realized

- Click OK

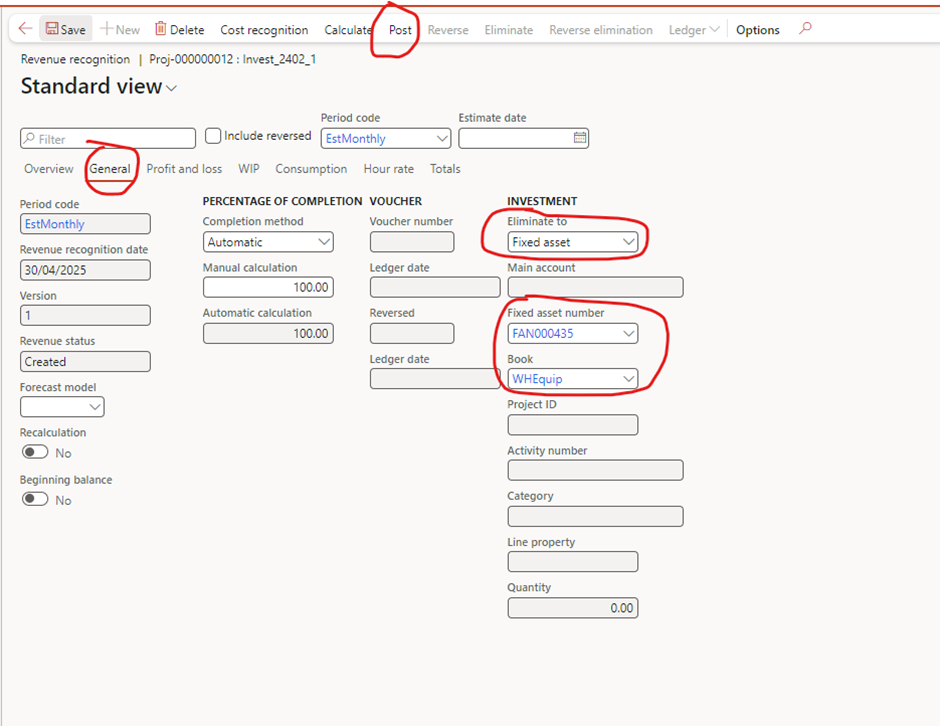

- Switch to General Tab > Set Eliminate To Fixed Assets > Select Fixed Assets (Not – this is a new Fixed asset and currently set to Not yet Acquired status)

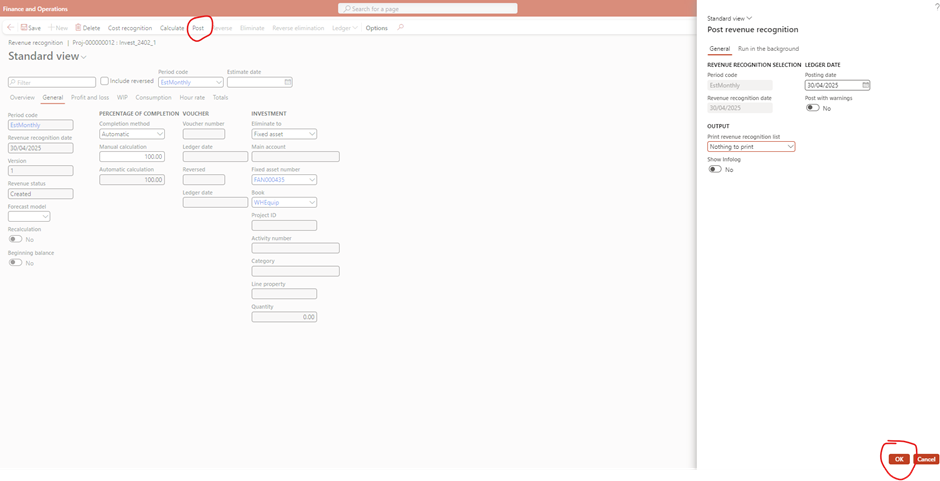

- Click Post

- Post Revenue Recognition > OK

Note – The cost is not transferred to Fixed Assets until the estimation is eliminated.

Capitalization of Costs:

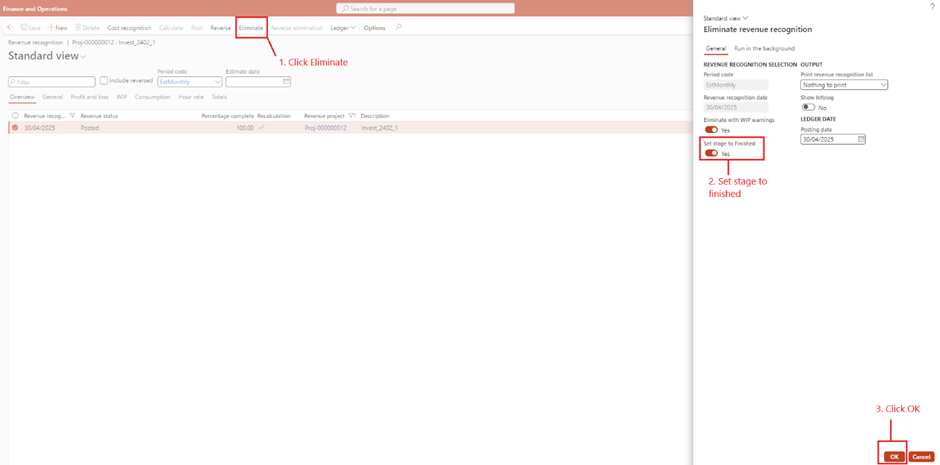

- Click Eliminate

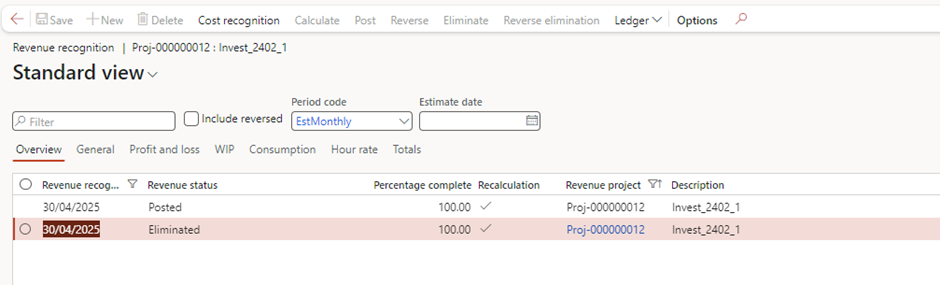

- Elimination is posted

- Cost has been capitalized in Fixed assets too

Close

The Close step of the project execution stage serves several important purposes:

1. Finalization of Transactions: It ensures that all transactions related to the project, such as time entries, expenses, and invoices, are recorded and finalized

PROJECT HAS BEEN MARKED AS CLOSED AS A PART OF ELIMINATION POSTING.

2. Read-Only Status: Once the project is closed, it is set to a read-only status, preventing any further modifications or additions. This helps maintain the integrity of the project data

3. Financial Reconciliation: The close step allows for the reconciliation of all financial aspects of the project, ensuring that all costs and revenues are accurately accounted for

4. Reporting and Analysis: Closing the project enables the generation of final reports and

Analyze Project

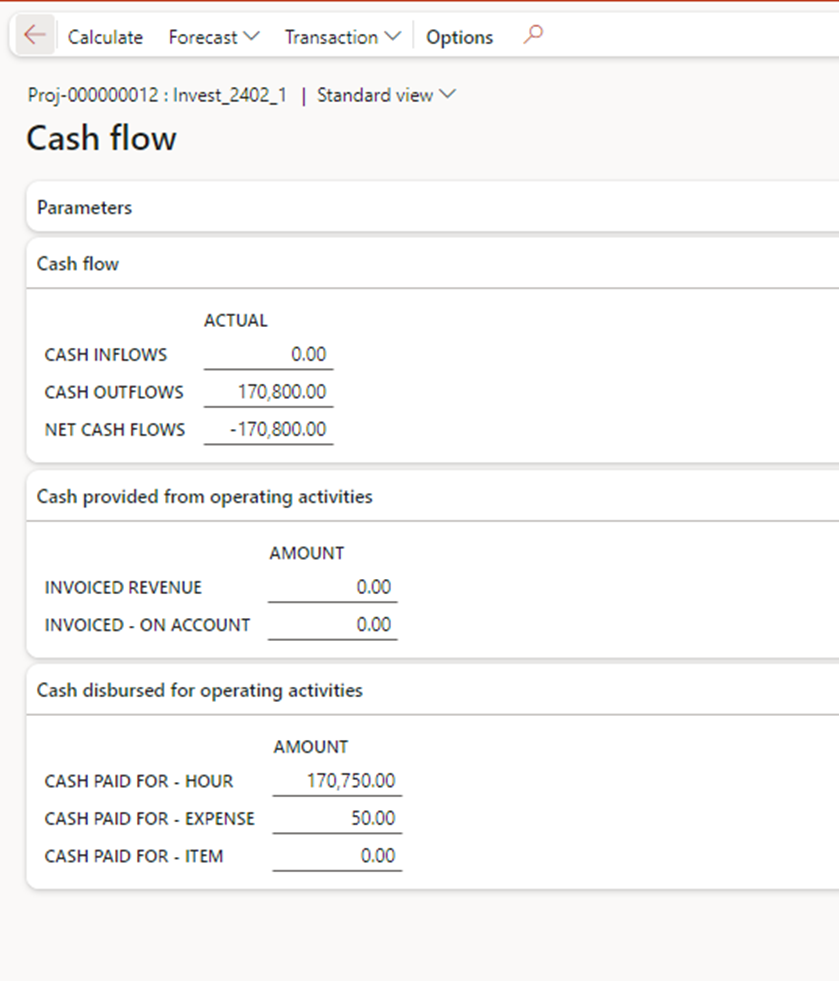

Analyze Cash Flow

- This stage involves examining the cash inflows and outflows associated with the project. It helps in understanding the project’s financial health, ensuring there is enough liquidity to cover expenses, and identifying any potential cash flow issues.

- Project > Action Pane: Control > Statement > Cash Flow

Check Previous article to know purpose of each field on this report.

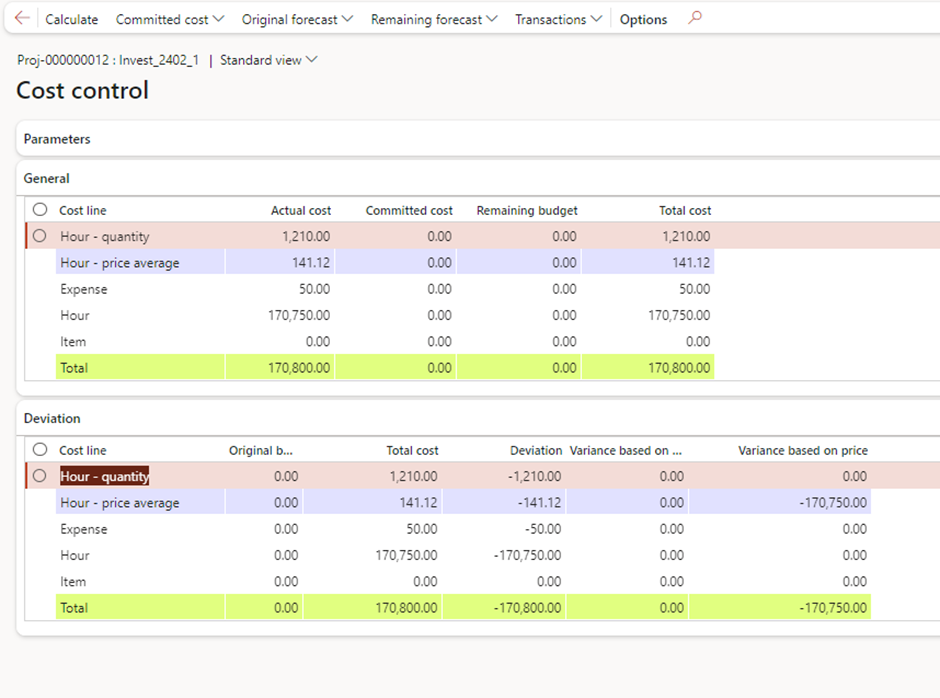

Review Costs

- This stage focuses on evaluating all costs incurred during the project. It ensures that the project stays within budget and helps identify any areas where costs can be optimized or reduced

- Project > Action Pane: Control > Control > Cost Control

Check Previous article to know purpose of each field on this report.

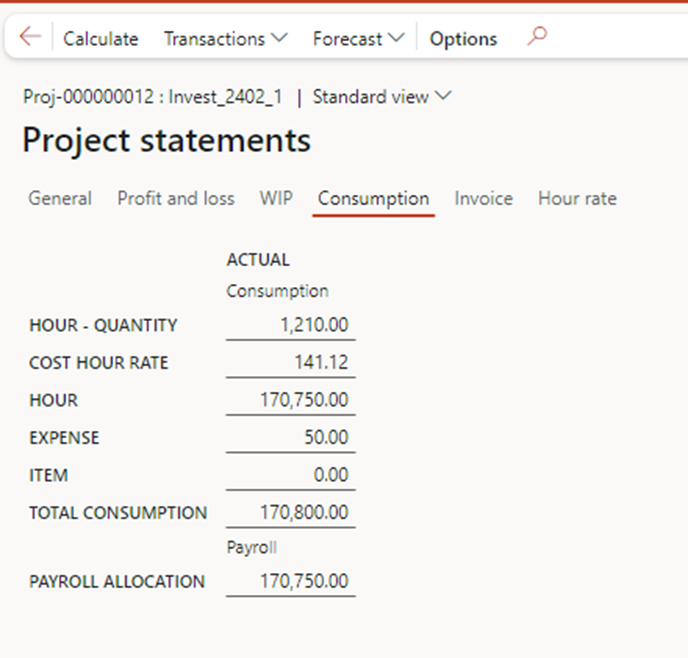

Analyze Performance

- This stage involves measuring various project metrics to determine if the project is meeting its objectives. It includes tracking key performance indicators (KPIs) such as schedule adherence, budget compliance, and overall project progress

- Project > Action Pane: Control > Statement > Project Statement

Check Previous article to know purpose of each field on this report.

Review Invoices

- This stage ensures that all invoices related to the project are accurate and have been processed correctly. It helps in verifying that all billable work has been invoiced and that there are no discrepancies

- Not applicable for INTERNAL project type.

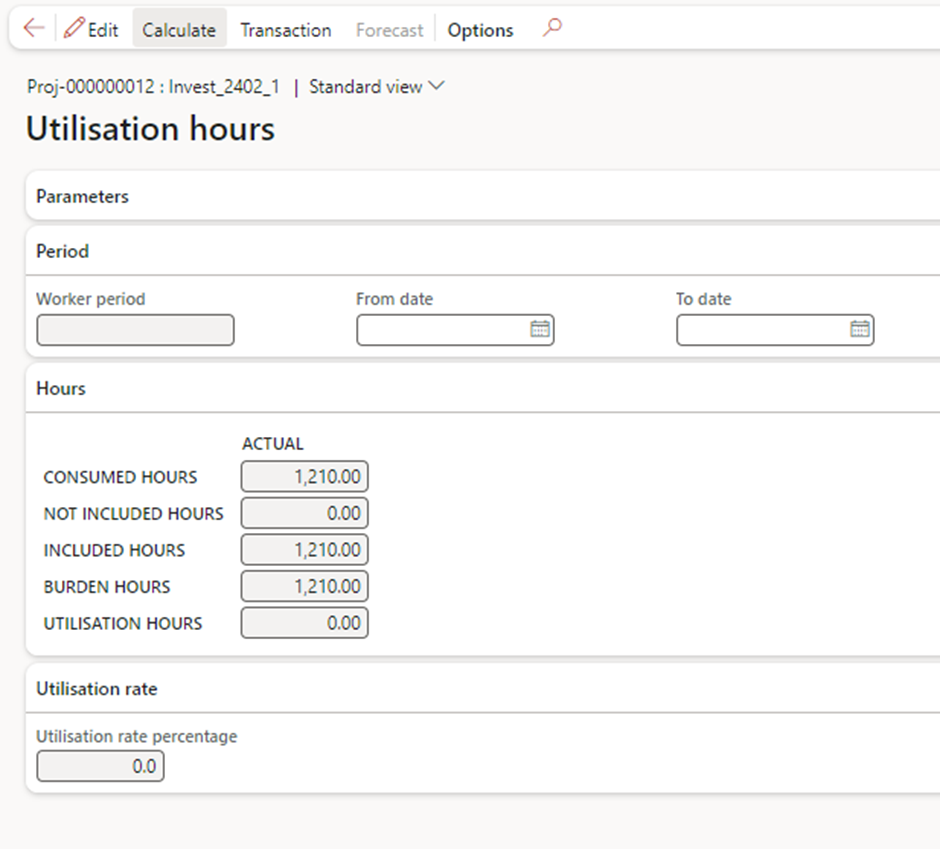

Analyze Utilization

- This stage examines how effectively project resources, such as personnel and equipment, have been utilized. It helps in identifying any underutilization or overutilization of resources, ensuring optimal productivity and efficiency

HOUR UTILIZATION

- This button provides a detailed view of how many hours each resource has worked compared to their available hours. It helps in tracking the actual hours logged by team members against their allocated hours, allowing project managers to monitor workload distribution and identify any over- or under-utilization of resources

- Project > Action Pane: Control > Utilization >Hour Utilization

RESOURCE UTILIZATION

- Resource Reservations: It allows you to view and manage the reservations of resources for various tasks and projects. It helps ensure that resources are allocated efficiently and are available when needed

- Resource Reservation Analysis – Resource: This analysis focuses on individual resources, providing insights into how each resource is being utilized. It helps in identifying any underutilization or overutilization of specific resources, allowing for better resource management

- Resource Reservation Analysis – Project: This analysis provides a project-level view of resource utilization. It helps in understanding how resources are allocated across different projects, ensuring that resources are used effectively to meet project goals

- Resource Reservation Analysis – Role: This analysis focuses on the utilization of resources based on their roles. It helps in assessing whether specific roles are being effectively utilized and can assist in planning future resource needs based on role requirements

Conclusion

Effectively managing Investment Projects in Dynamics 365 Finance allows organizations to track, control, and capitalize costs associated with long-term asset development. By utilizing the system’s structured WIP tracking, automated asset capitalization, and financial reconciliation, businesses can ensure cost transparency and compliance with accounting standards.

The Investment Project framework ensures that capitalizable costs are accurately transferred to the Fixed Asset module, while non-capitalizable expenses are appropriately recorded in the profit and loss account (P&L). With automated journal postings, financial teams can streamline the transition from project costs to capitalized assets, reducing manual effort and minimizing errors.

By adopting best practices such as clear project coding, regular cost reconciliation, and detailed Work Breakdown Structures (WBS), organizations can optimize their capital investment strategy and maximize asset value. With Dynamics 365 Finance, businesses gain complete financial control over their investment projects, ensuring profitability, scalability, and long-term operational efficiency.

Expand Your Knowledge: See More Project Management Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment