GS516 – Connecting to Government Portals and Web Services in Globalization Studio

Many countries now mandate businesses to submit tax, invoice, or audit data electronically to government platforms. Microsoft simplifies these obligations by offering prebuilt integrations through Globalization Studio and Electronic Reporting (ER).

In this article, you’ll learn:

- Which countries are supported out-of-the-box

- How Microsoft handles submissions like Brazil’s NF-e and Italy’s FatturaPA

- How Spain’s SII VAT reporting is implemented using ER + message processing

- What tools are used: messaging, pipeline, web service settings, and web apps

This builds on GS506 – Pipelines and GS515 – Digital Signatures.

Table of Contents

Toggle🌍 Countries with OOB Government Portal Integration

Microsoft provides native connectors and ER formats for multiple regions. These features require no custom development and are maintained by Microsoft.

✅ Available Out-of-the-box:

| Country | Supported Submission | Technology Used |

| Brazil | NF-e (Nota Fiscal Eletrônica) | (Preview) ER format + custom pipeline |

| Italy | FatturaPA | ER + Signature + Government connector |

| Spain | SII VAT Reporting | ER + Message Processing (non-EI pipeline) |

| Saudi Arabia | ZATCA JSON API + QR Code | ER + Signature + Web service connector |

| Egypt | ETA JSON reporting | ER + Signature + JSON submission |

| UK | MTD VAT Return | ER + Electronic Messaging + Web service |

| France | Chorus Pro | ER + Government portal integration |

🇧🇷 Brazil – NF-e Submission (Preview)

Microsoft offers a preview feature for Brazilian NF-e submission:

- Generates NF-e XML via ER

- Includes government-required tags like CFOP, NCM, and CST

- Out of box pipeline

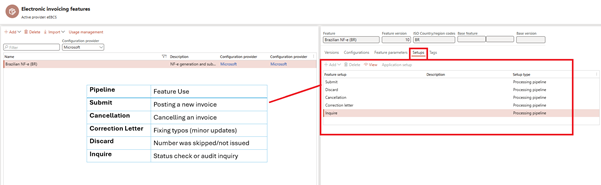

- Pipeline includes actions like:

- Generate NF-e

- Call SEFAZ service (Preview)

- Store XML and PDF

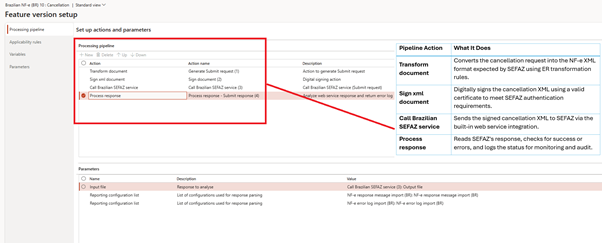

- Each pipeline feature has list of predefined collection of actions i.e. Cancellation step has following pipeline processing actions

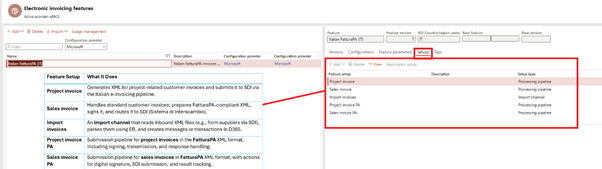

🇮🇹 Italy – FatturaPA Integration

Italy’s B2G and B2B e-invoicing uses the FatturaPA XML standard via SDI (Sistema di Interscambio).

Microsoft provides:

- Prebuilt ER format for FatturaPA

- Built-in Submit pipeline step: Call Italian SDI Service

- Auto-signing using Azure Key Vault or certificate

- Message status: Submitted, Accepted, Error

📌 No need for custom development , simply configure applicability and pipeline steps.

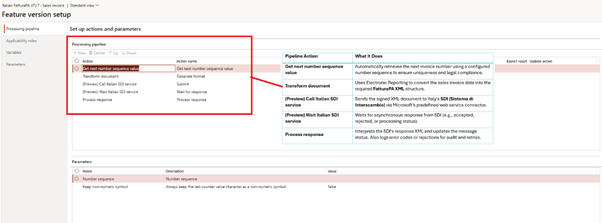

- Here is the processing pipeline of Sales invoice feature step.

🇪🇸 Spain – SII VAT Submission (ER + Message Processing)

Unlike Brazil or Italy, Spain’s SII VAT submission is not handled via the Electronic Invoicing Add-in.

Instead, it’s configured through:

- Electronic Reporting (ER) for SII XML generation

- Electronic Message Processing for tracking & control

- Processing Pipelines for sequencing actions

- Web Service Settings for government API endpoints

- Web Applications for authentication and integration

🪜 Step-by-Step: Submitting SII to AEAT in Spain

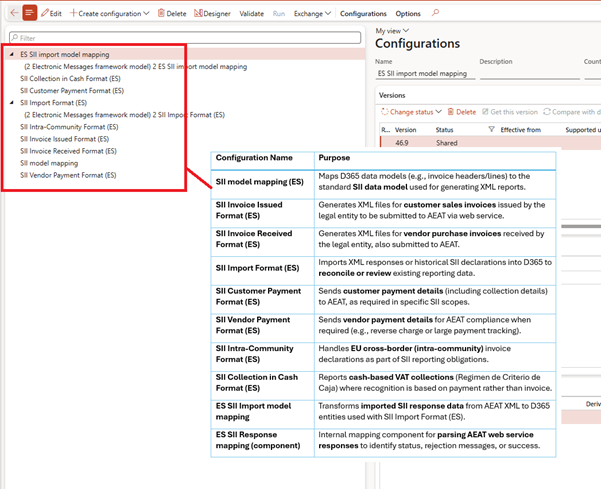

✅ Step 1: ER Format for SII

- Microsoft provides the SII ER format (Sales Invoice, Purchase Invoice, Payments, etc.)

- Generates XML for each transaction

- Applies filtering via model mapping and query range

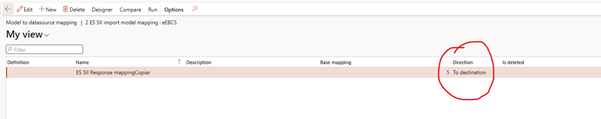

✅ Step 2: Electronic Message Configuration

- Navigate to Electronic Messaging Setup

- Create a message type for SII (e.g., Outgoing invoices)

- Link to:

- Model mapping

- Format

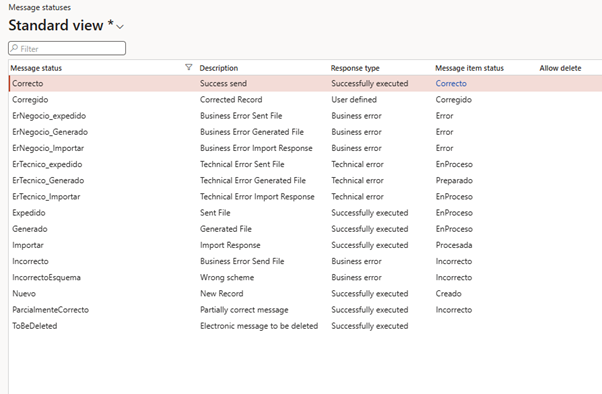

✅ Step 3: Electronic Message Statuses

- Shows health of each submission i.e. Success, Partial accepted, technical error

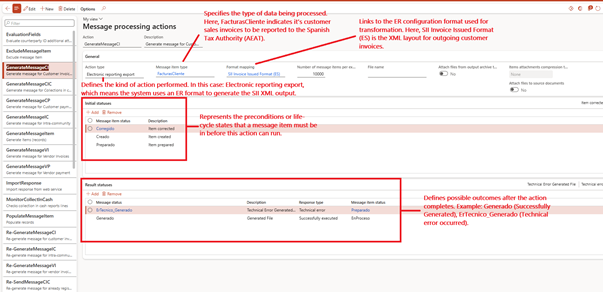

✅ Step 4: Electronic Message Processing Actions

- Defines what the system should do with a message (e.g. transform it, send it to a web service, import a response, or update a record). Think of it as a step in a process like printing, emailing, or exporting a file.

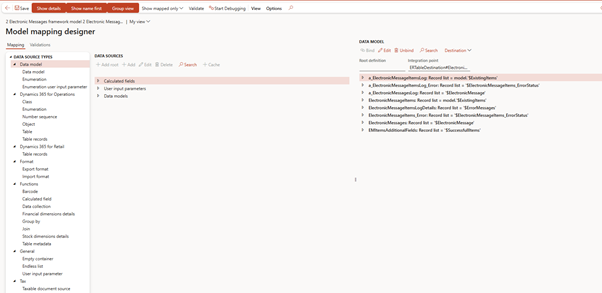

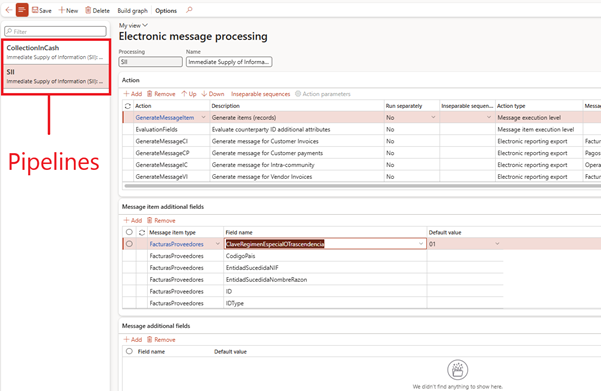

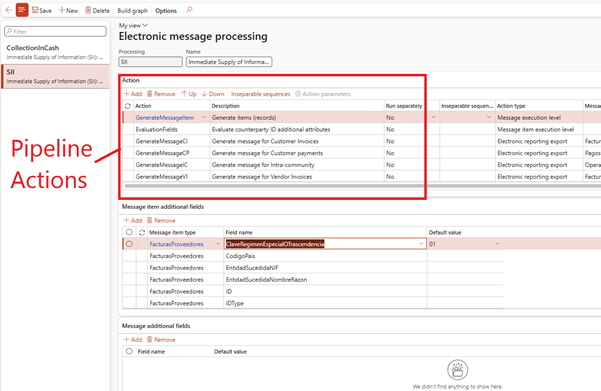

✅ Step 5: Electronic Message Processing (Pipeline)

- Electronic Message Processing is the engine that runs the sequence of actions defined in a message processing framework. Think of it like a recipe that tells D365 what steps to follow, fetch records, generate a file, sign it, submit it, import the response, and update statuses.

✅ Step 6: Electronic Message Processing (Pipeline) Actions

This controls the order of operations:

| Step | Purpose |

| Generate file | Run ER to produce SII XML |

| Sign (optional) | Sign XML if required |

| Web service call | Send file to AEAT endpoint |

| Status check | Wait and fetch AEAT response |

🧠 This is not part of the Electronic Invoicing add-in. It runs inside the standard Electronic Messaging engine.

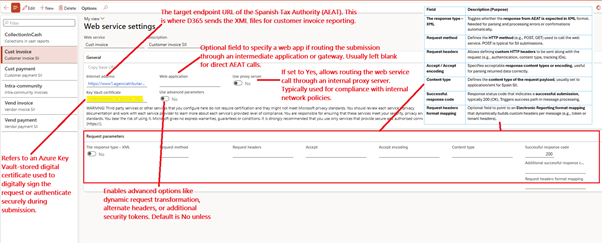

✅ Step 7: Configure Web Service (Secure connection to Webservices)

- This screen is used to configure external API endpoints like government portals or custom logic apps where D365 will send or receive electronic documents, such as invoices or tax files. It’s a technical bridge between D365 and the outside world.

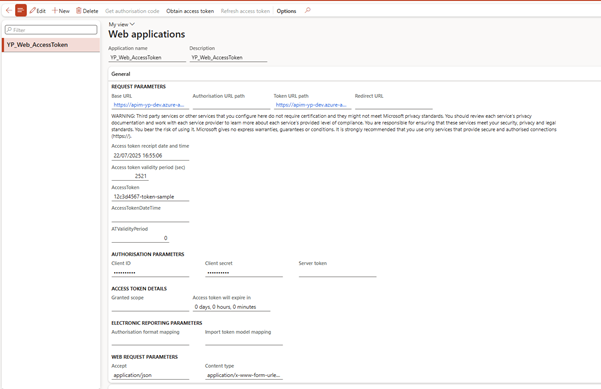

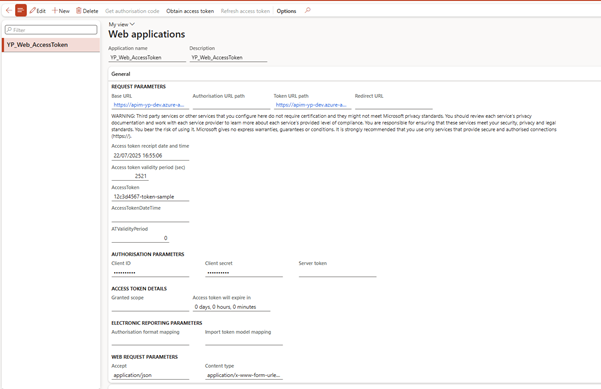

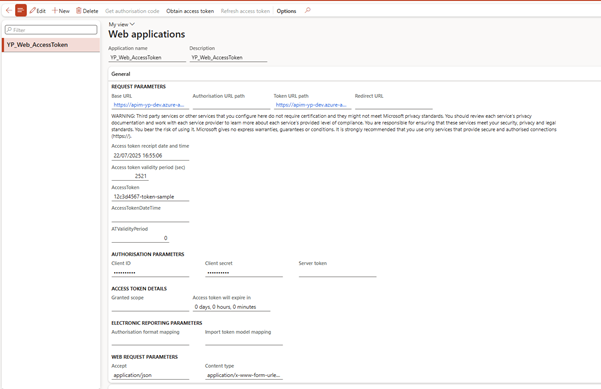

✅ Step 8: Web Application (Auth2.0)

Note – this is a sample web application created for other purpose. It is not for Spain SII AEAT submission

- A Web Application is where you define the OAuth 2.0 authentication settings for connecting securely to external APIs (e.g. Logic Apps, government systems).

- Imagine this as your login and token generator for accessing protected web services. You don’t call the API here. This setup just helps authenticate the call.

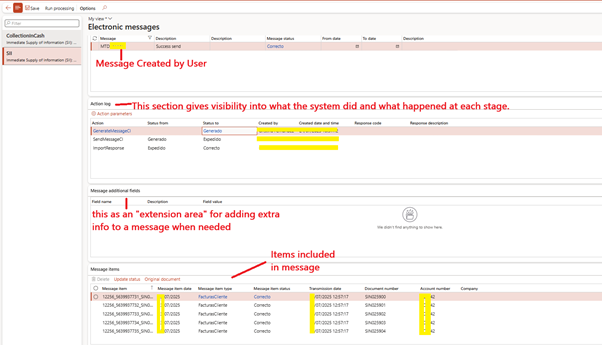

✅ Step 9: Electronic Message (Container)

- An Electronic Message is the container or envelope that holds all the data and actions related to a regulatory communication or document submission. It

- Gets created when you’re about to send documents (like customer invoices) to a government or external API.

- Tracks what has been sent, what failed, and what was returned.

- Connects ER templates, message processing actions, and submission statuses.

- Request sent to AEAT Government site

- Response received from AEAT Government site

🧠 Tips for Country-Specific Submissions

| Tip | Why It Helps |

| Always start with Microsoft’s templates | Saves weeks of custom work |

| Use UAT/test environments for submission | Avoid accidental production posting |

| Configure Web App + Certificate early | Required for OAuth or mutual TLS |

| Monitor messages regularly | Rejections can be fixed early |

🧭 Related Articles

- GS506 – Pipelines Overview

- GS507 – Electronic Invoicing

- GS510 – Reusing Microsoft Features

- GS515 – Digital Signatures & Key Vault

- GS517 – Error Handling and Submission Logs

📘 Coming Up Next

In GS517 – Configuring UK MTD VAT Submission in D365FSCM, we’ll walk through a complete, real-world setup of Making Tax Digital (MTD) for VAT in the UK—connected to the HMRC sandbox environment.

You’ll learn:

- How to configure application parameters

- Set up the electronic messaging framework

- Connect and authenticate with the UK government gateway

- Validate your submission end-to-end using test credentials

📖 Continue reading: GS517 – UK MTD VAT Submission Setup →

🔍 View Full Article in PDF

GS516I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment