OCR 503 – Streamlining Accounts Payable: The Role of Background Batch Jobs in Automated Invoice Capture

Table of Contents

ToggleIntroduction

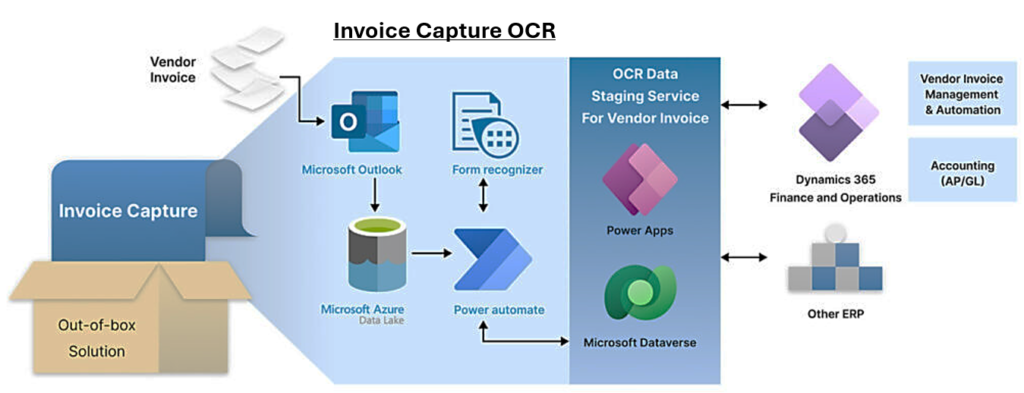

In today’s fast-paced business environment, organizations are increasingly reliant on efficient accounts payable processes to maintain financial health and operational agility. One critical aspect of this efficiency is the automation of invoice capture workflows. Background batch jobs play a pivotal role in enhancing these processes, ensuring accuracy, timeliness, and compliance. This article explores the key components of automated invoice workflows, including the matching of vendor invoices with product receipts, the submission of invoices to workflows, and the validation of invoice matching.

Key Components of Automated Invoice Capture

| Process | Overview | Purpose | Run |

|---|---|---|---|

| Automated Invoice Workflow Process | Systematic handling of vendor invoices from receipt to payment, using predefined workflows. | Streamlines the approval process, reduces manual intervention, and ensures timely payments. | Every Minute |

| Match Vendor Invoice Lines with Product Receipts | Compares details on vendor invoices with corresponding product receipts recorded in the system. | Ensures accuracy, preventing discrepancies and reducing errors and potential disputes. | Every Hour |

| Submit Vendor Invoices to Workflow | Automatically submits validated invoices to the appropriate approval workflow based on criteria. | Facilitates timely review and approval, minimizing delays in payments. | Every Hour |

| Validate Invoice Matching | Checks that invoice details align with matched receipts and applicable purchase orders. | Ensures only valid invoices are processed for payment, reducing the risk of overpayments or fraud. | Every Minute |

Conclusion

The integration of background batch jobs into the automated invoice capture process offers organizations a robust solution for enhancing their accounts payable operations. By streamlining invoice workflows, accurately matching vendor invoices with product receipts, and ensuring effective validation, these automated processes contribute to improved efficiency, accuracy, and accountability. As businesses continue to navigate the complexities of financial management, leveraging such technologies will be crucial for optimizing accounts payable and maintaining a competitive edge in the market.

By embracing automation, organizations can focus more on strategic initiatives while ensuring that their financial processes are efficient and reliable.

Expand Your Knowledge: See More Invoice Catpure Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment