GS520 – Tax Calculation Service Basics in Globalization Studio

Tax compliance across multiple regions is one of the biggest challenges in ERP systems—especially for…

GS519 – Managing Errors, Logs, and Submission History in Globalization Studio

Even with the best-designed formats and pipelines, issues can still occur. Maybe the government rejects…

GS518 – Integrating External APIs with Logic Apps and Electronic Reporting

In a world of connected systems and compliance-driven automation, businesses often need to call external…

GS517 – Configuring UK MTD VAT Submission in D365FSCM – End-to-End Sandbox Setup and Validation Guide

Making Tax Digital (MTD) is a UK government initiative requiring VAT-registered businesses to keep digital…

GS516 – Connecting to Government Portals and Web Services in Globalization Studio

Many countries now mandate businesses to submit tax, invoice, or audit data electronically to government…

GS515 – Digital Signatures and Key Vault Integration in Globalization Studio

Digital signatures are a key part of global compliance. Whether you’re submitting invoice XMLs to…

GS514 – Managing Document Routing and Output Locations in Globalization Studio

After designing a document layout using Business Document Management (BDM) or Electronic Reporting (ER), the…

GS513 – Business Document Management (BDM) in Globalization Studio

One of the most common requests from finance, sales, and operations teams is: “Can we…

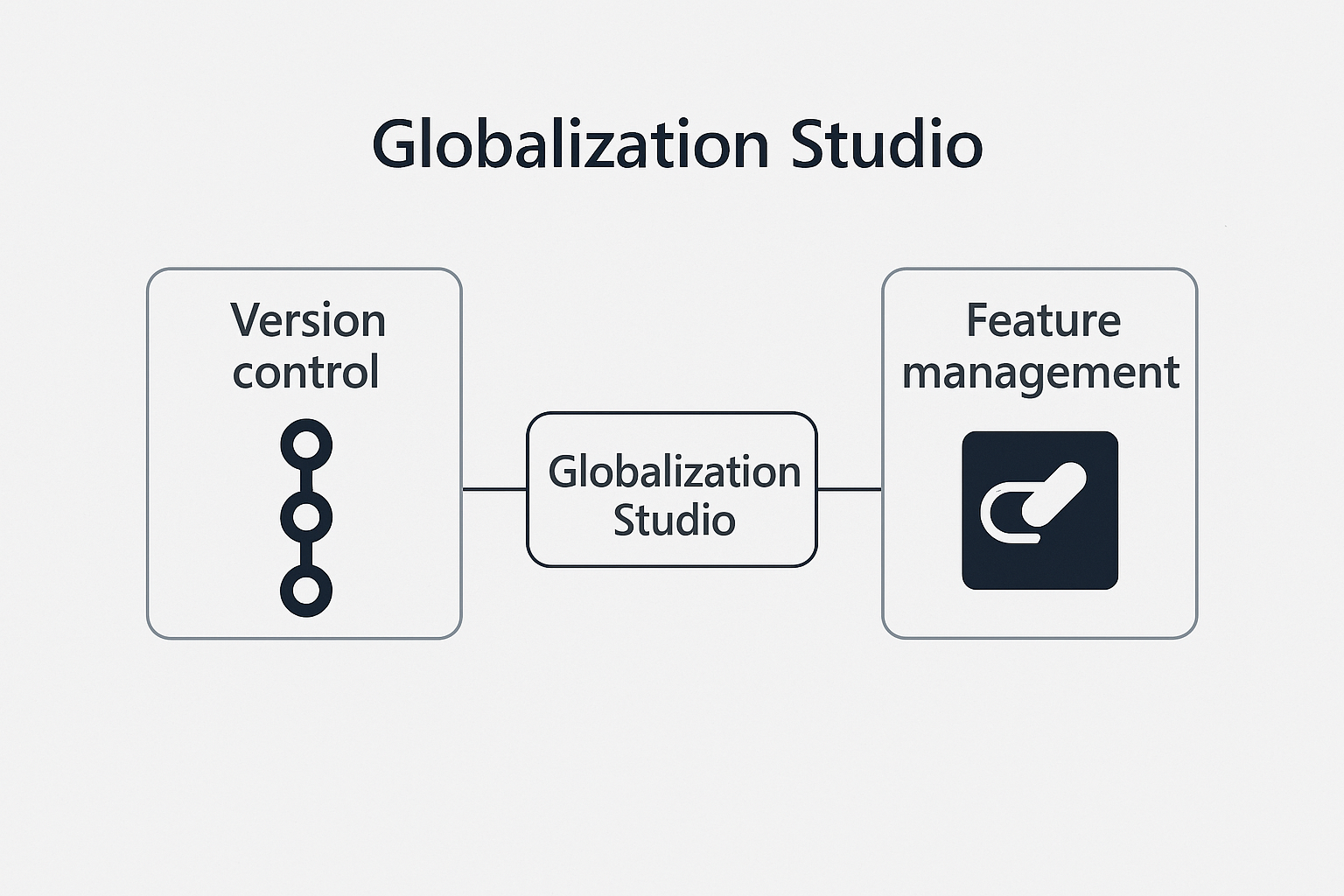

GS512 – Version Control and Feature Management in Globalization Studio

Once you start building and deploying compliance features, like tax reports, invoice formats, or e-invoicing…