BG501 – Introduction to Budgeting in Dynamics 365

Table of Contents

ToggleIntroduction

Budgeting is a cornerstone of effective financial management. In today’s fast-paced business environment, organizations need robust tools to plan, monitor, and control their financial resources. Dynamics 365 Finance provides a comprehensive budgeting solution that simplifies financial planning and helps ensure businesses stay aligned with their financial goals.

This article introduces the budgeting capabilities in Dynamics 365 Finance, how they work, and the practical benefits they offer across different industries, including manufacturing, distribution, and retail.

What is Budgeting in Dynamics 365 Finance?

Budgeting in Dynamics 365 Finance is a structured framework for planning and monitoring an organization’s financial performance. It enables businesses to create detailed budget plans, enforce budgetary control, and gain insights into financial outcomes—all within a unified platform.

Whether you need to establish a high-level annual budget or manage detailed cost center budgets, Dynamics 365 Finance provides the tools to make budgeting efficient and transparent.

How Budgeting Works in Dynamics 365 Finance

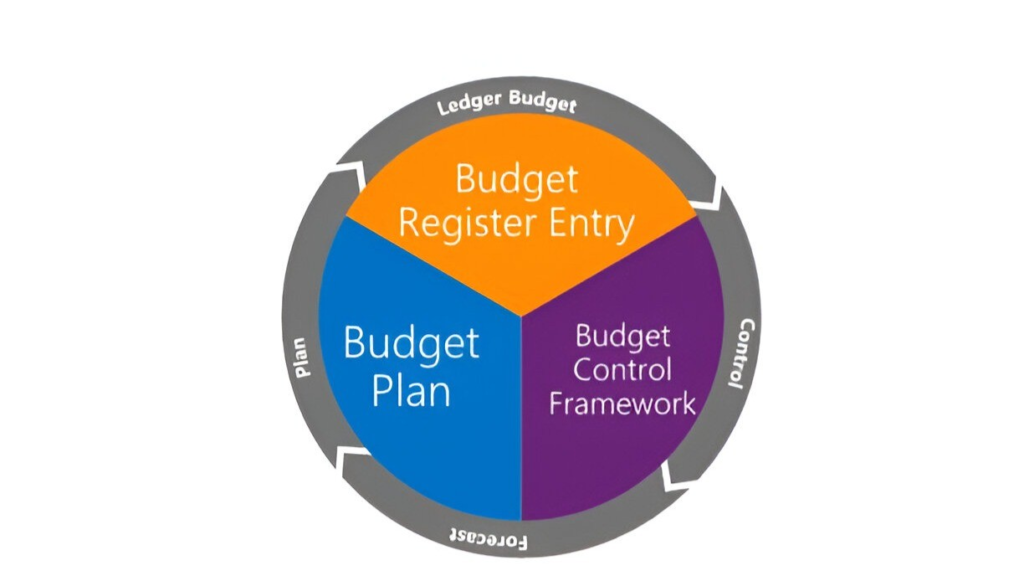

Budgeting in Dynamics 365 Finance provides a robust framework to create, manage, and monitor financial plans, ensuring organizations operate within their financial limits while meeting strategic goals. Let’s explore the four core areas of budgeting in Dynamics 365 Finance—Budget Planning, Budget Register Entries, Budget Control, and Reporting & Analysis—highlighting their comprehensive functionalities and practical applications.

Budget Planning

Budget planning is the foundation of financial management, enabling organizations to create detailed, collaborative budgets. Dynamics 365 Finance offers advanced tools to streamline this process, including leveraging historical data, general ledger (GL) data, and custom scenarios to predict and allocate budgets.

Key Functionalities

- Historical Data Integration: Create budgets based on previous years’ performance or data trends.

- General Ledger Data Usage: Populate budget plans directly from GL account balances or transactions.

- Templates and Scenarios: Define multiple scenarios (e.g., best-case, worst-case) to model different financial outcomes.

- Allocation Automation: Distribute budgets across departments, dimensions, or time periods using predefined rules or percentages.

- Workflow-Driven Approvals: Facilitate collaboration and approval across departments and hierarchy levels.

Real-Life Use Cases

- Annual Budgeting: A manufacturing company uses historical production costs and revenue data to plan for the upcoming fiscal year.

- Scenario Planning: A retail chain creates multiple budget plans based on different market conditions, helping them prepare for economic uncertainties.

- Project-Specific Budgeting: An IT company plans budgets for large client projects, incorporating estimated labor and resource costs.

Budget Register Entries

Budget register entries are the operational representation of approved budgets. They allow organizations to input, adjust, and update budgets in the system, enabling real-time tracking and control.

Key Functionalities

- Budget Creation and Adjustments: Record initial budgets and make periodic adjustments (e.g., reallocations or amendments).

- Pre-Approval Integration: Convert finalized budget plans into register entries.

- Multi-Currency Support: Handle budgets across different currencies, converting them to a base currency for consolidated tracking.

- Audit Trail: Maintain a detailed history of all budget changes for accountability and compliance.

Real-Life Use Cases

- Mid-Year Adjustments: A marketing team increases their budget mid-year to accommodate a new campaign.

- Grant Funding: A non-profit uses register entries to allocate funds across specific programs like education and healthcare.

- Regional Budgets: A multinational company records budgets for regional offices in various currencies, aggregating them into a single consolidated budget.

Budget Control

Budget control ensures that spending aligns with approved budgets by monitoring transactions such as purchase orders, invoices, and journal entries. This feature enforces financial discipline and prevents overspending.

Key Functionalities

- Spending Validation: Block or warn users when transactions exceed budgeted amounts.

- Threshold Settings: Define thresholds (e.g., 80% or 90%) to trigger alerts as spending approaches limits.

- Dimension-Specific Control: Apply budget control at the account, department, project, or other dimension levels.

- Real-Time Monitoring: Continuously track expenditures and available funds to ensure compliance.

Real-Life Use Cases

- Expense Tracking: A government agency ensures that departmental spending remains within the approved limits for public transparency.

- Project Oversight: An engineering firm monitors project costs to prevent overruns and ensure profitability.

- Automated Alerts: A retail company receives notifications when marketing expenditures exceed 90% of the approved budget, allowing them to adjust in real-time.

Reporting and Analysis

Introduction

Reporting and analysis empower organizations to evaluate budget performance, analyze variances, and make data-driven decisions. Dynamics 365 Finance provides tools for real-time insights and historical comparisons.

Key Functionalities

- Variance Analysis: Compare actuals to budgets to identify discrepancies.

- Power BI Integration: Use dashboards and visualizations to track budget trends and outcomes.

- Detailed Reports: Generate reports by dimensions, periods, or departments for in-depth analysis.

- Predictive Insights: Leverage historical data and trends to forecast future budgets.

Real-Life Use Cases

- Variance Tracking: A retail chain identifies cost-saving opportunities by analyzing variances in marketing and operational budgets.

- Performance Dashboards: A CFO uses Power BI to present a financial overview to the board, showing how budgets align with business objectives.

- Historical Comparison: A manufacturing company evaluates spending patterns over multiple years to refine future budgets.

Key Benefits of Budgeting in Dynamics 365 Finance

Centralized Financial Management

Dynamics 365 Finance integrates budgeting with other financial processes, such as accounts payable, procurement, and project accounting, ensuring a single source of truth.

Real-Time Oversight

With budget control and live data, businesses can monitor expenses in real-time and prevent cost overruns before they occur.

Scalability and Flexibility

From small organizations to multinational corporations, Dynamics 365 Finance accommodates varying levels of budget complexity, including multi-currency and multi-entity requirements.

Improved Collaboration

Workflow automation fosters collaboration between teams, ensuring that budget approvals are timely and transparent.

Use Cases Across Industries

Manufacturing Company

A manufacturing company planning for the next fiscal year needs to budget for raw materials, equipment maintenance, and labor costs. Using Dynamics 365 Finance:

- The finance team creates budget register entries for fixed and variable costs.

- Budget planning tools allow the team to simulate scenarios based on fluctuating raw material prices.

- Budget control prevents overspending on production expenses by setting thresholds for procurement.

Distribution Company

A distribution company that manages multiple warehouses requires a budget to optimize logistics and inventory. With Dynamics 365 Finance:

- Budget register entries allocate funds for transportation, storage, and staffing.

- Real-time monitoring helps the company track transportation costs and adjust for seasonal peaks.

- Reports provide insights into cost-per-delivery metrics, improving efficiency.

Retail Company

A retail company preparing for the holiday season needs a budget that aligns with sales forecasts and marketing campaigns. Dynamics 365 Finance allows the company to:

- Set up budget plans for inventory replenishment, advertising, and seasonal staffing.

- Use budget control to ensure marketing expenses don’t exceed allocations.

- Analyze sales performance against budget to optimize planning for the next season.

Conclusion

Budgeting in Dynamics 365 Finance offers a powerful and flexible approach to financial planning, enabling organizations to make informed decisions, prevent overspending, and quickly adapt to changing business conditions. In this article, we explored key periodic tasks such as generating budget plans, maintaining budget control, and creating budget proposals. These tasks help streamline financial operations and ensure that organizations stay within budget while maintaining control over their financial resources.

In the next article, I will be walking you through a real-life business scenario of top-down budgeting in Dynamics 365 Finance. I will provide a detailed explanation of how to manage basic budgeting, budget planning, budget control, and budget register entries. This practical example will help illustrate how these features work together to support efficient financial planning and alignment with organizational goals. Stay tuned to learn how to implement these steps in your own business!

Expand Your Knowledge: See More Budgeting Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment