BG502 – Top-Down Budgeting in Dynamics 365 Finance: Real-World Scenarios from Planning to Control (Part-1: Basic Budgeting)

Table of Contents

ToggleIntroduction

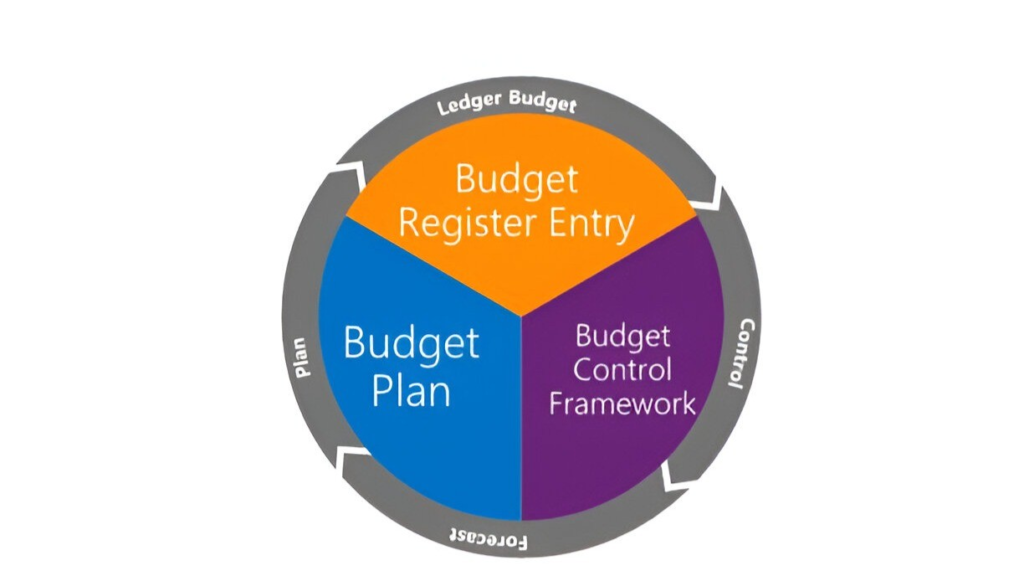

Effective budgeting is the backbone of an organization’s financial health, ensuring that resources are allocated strategically and monitored effectively. To make the budgeting process easier to understand, we’ve broken down a comprehensive use case into five distinct articles, each focusing on a specific stage of the budgeting journey. These articles collectively illustrate how the Finance team collaborates with Marketing, IT, and Product Development to streamline budget planning, approval, and activation. By covering each phase in detail, this series ensures clarity and provides actionable insights for implementing budgeting processes in Dynamics 365 Finance.

This first article focuses on Basic Budgeting Setup, laying the foundation for subsequent articles that cover:

- Budget Planning Setup – Structuring and managing collaborative budget workflows.

- Budget Control Setup – Ensuring spending aligns with approved budgets through rules and permissions.

- Register Entry Setup – Implementing approved budgets in the system for operational use.

- Report Tracking and Analysis – Monitoring performance and deriving actionable insights.

By addressing each stage individually, this series provides a clear, step-by-step guide to mastering top-down budgeting in Dynamics 365 Finance.

Scenario Overview

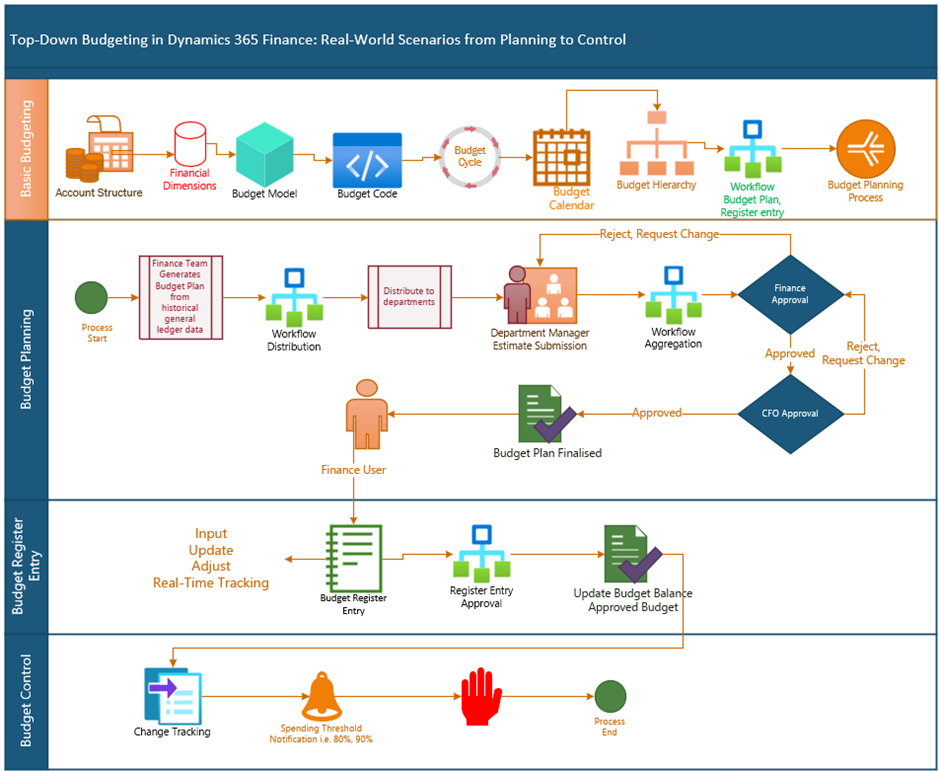

- The Finance team generates an initial budget for Marketing, IT, and Product Development departments from historical General ledger expense transactions.

- The Finance team distributes budget to each department.

- Department managers review their allocated budgets, make necessary revisions, and approve the plans.

- The revised budgets are sent back to the Finance team for consolidation and submission to the CFO.

- After the CFO’s approval, the Finance team creates budget register entries to update the organization’s financial system and activate the budget for tracking and control.

Basic Budgeting Setup

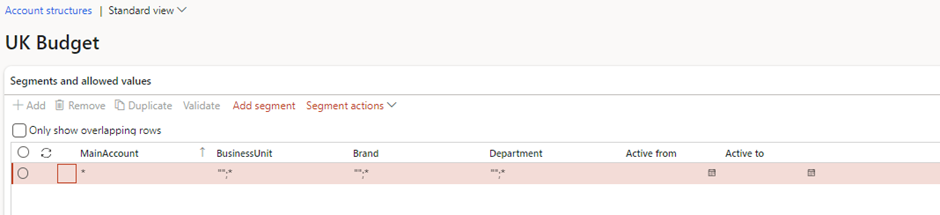

Setup Budget Account Structure

- Setup budget account structure: Setting up an account structure for helps organize and manage financial data effectively

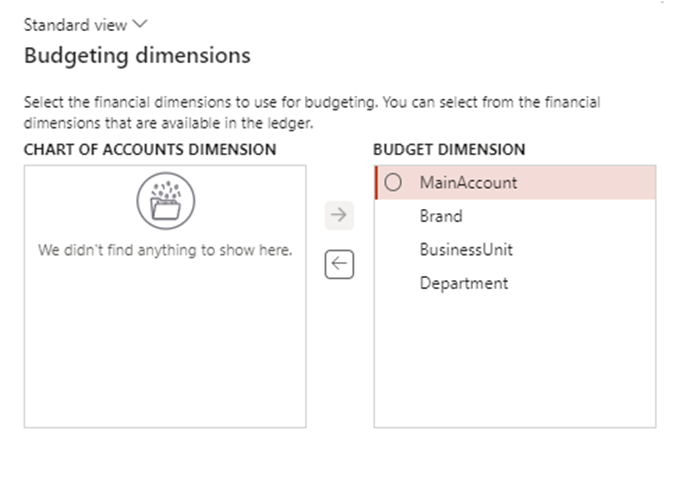

Activate Budgeting Dimensions

2. Activate Budgeting Dimensions: Choose dimensions require for your budget tracking and control.

Setup Budget Plan

3. Setup Budget Plan: Defines the structure and parameters for how budgets are created and managed.

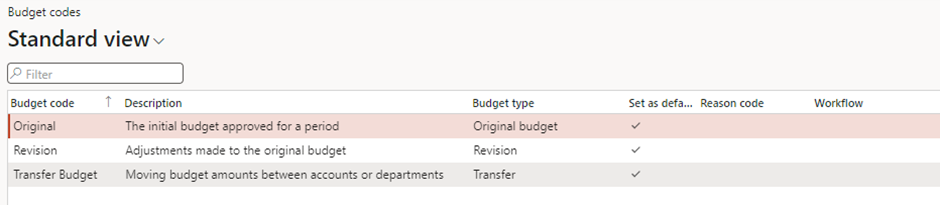

Setup Budget Code

4. Budget Code: Categorizes and identifies specific budget entries for tracking and reporting.

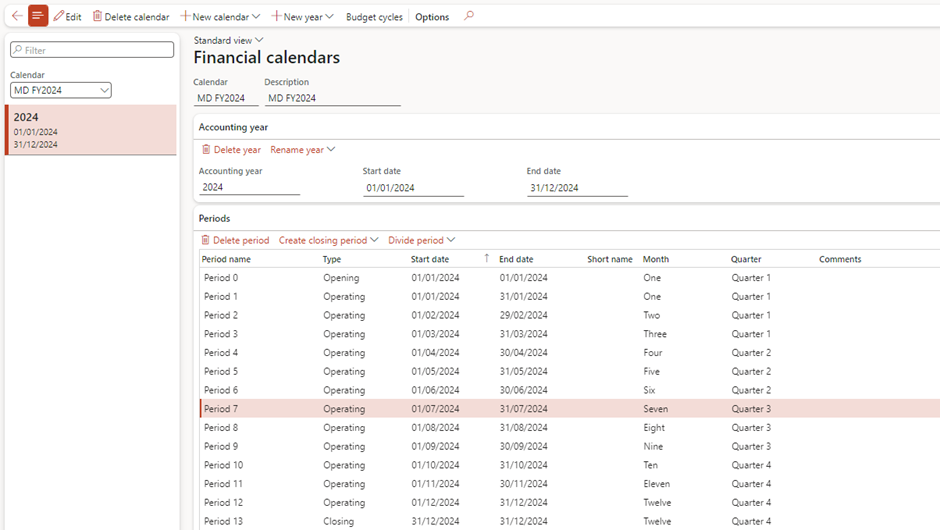

Setup Budget Calendar

5. Budget Calendar: Aligns budgeting activities with fiscal periods or custom-defined timelines.

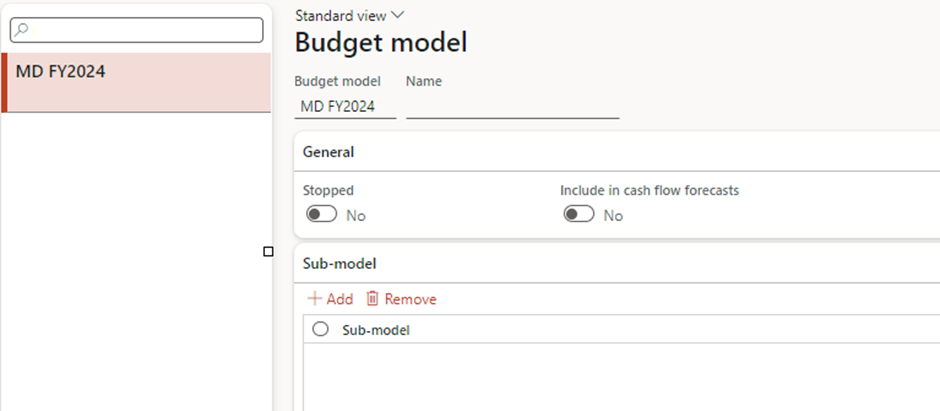

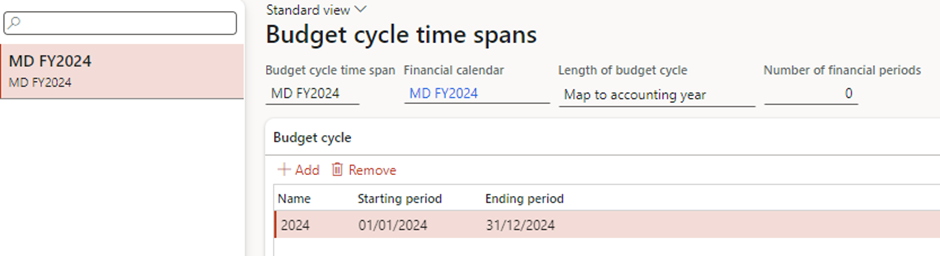

Setup Budget Cycle

6. Budget Cycle: Establishes the time frame for budget preparation, approval, and execution.

Setup Budget Hierarchy

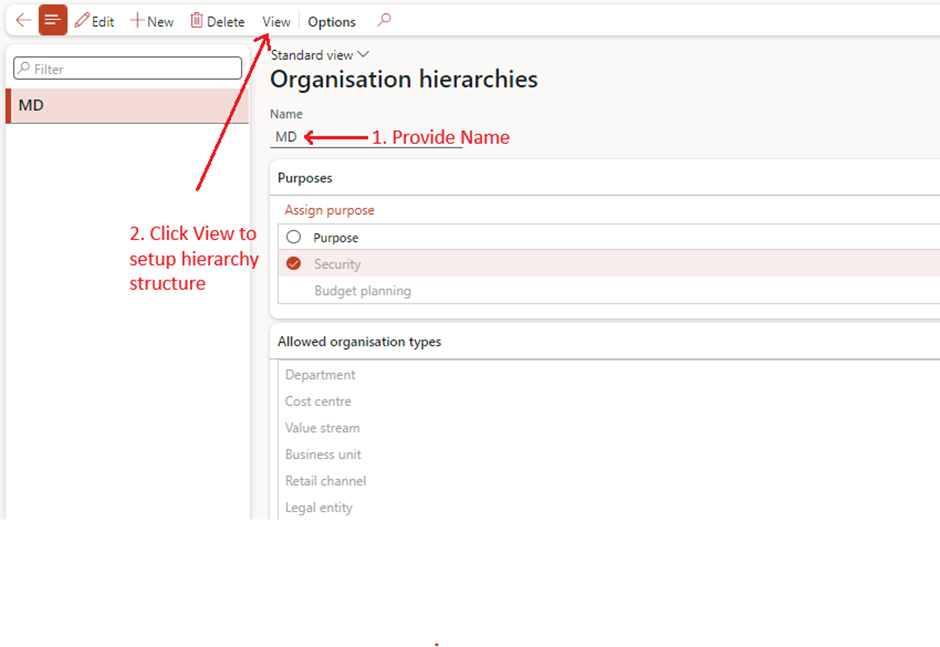

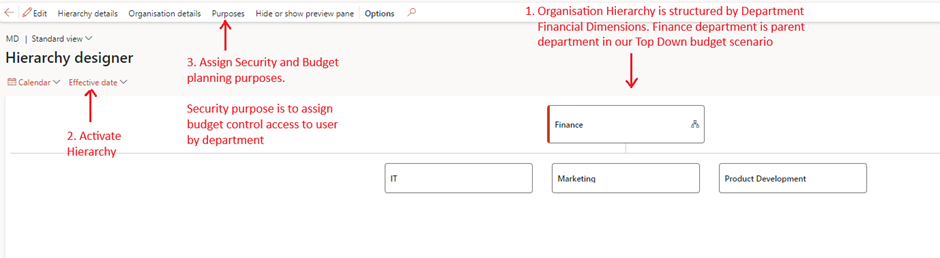

7. Budget Hierarchy: Sets up organizational relationships for budget distribution and approvals.

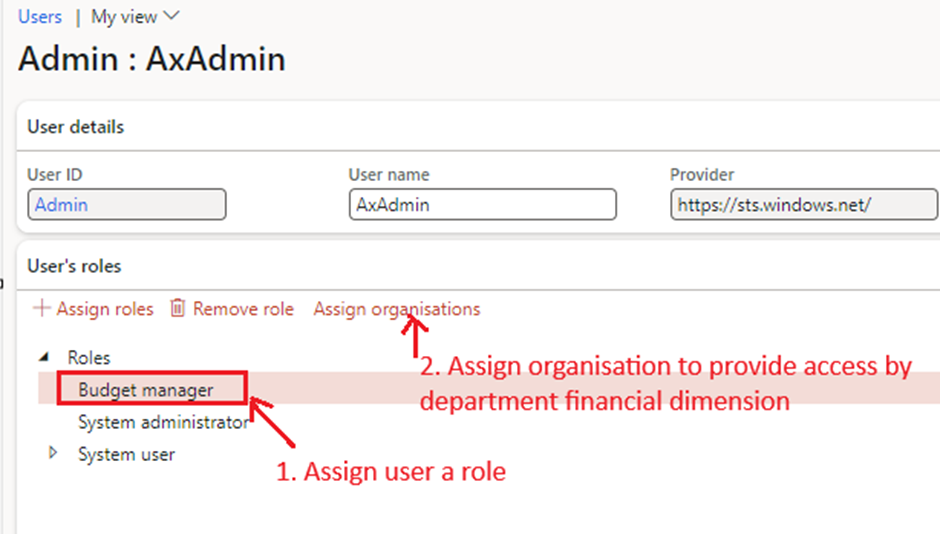

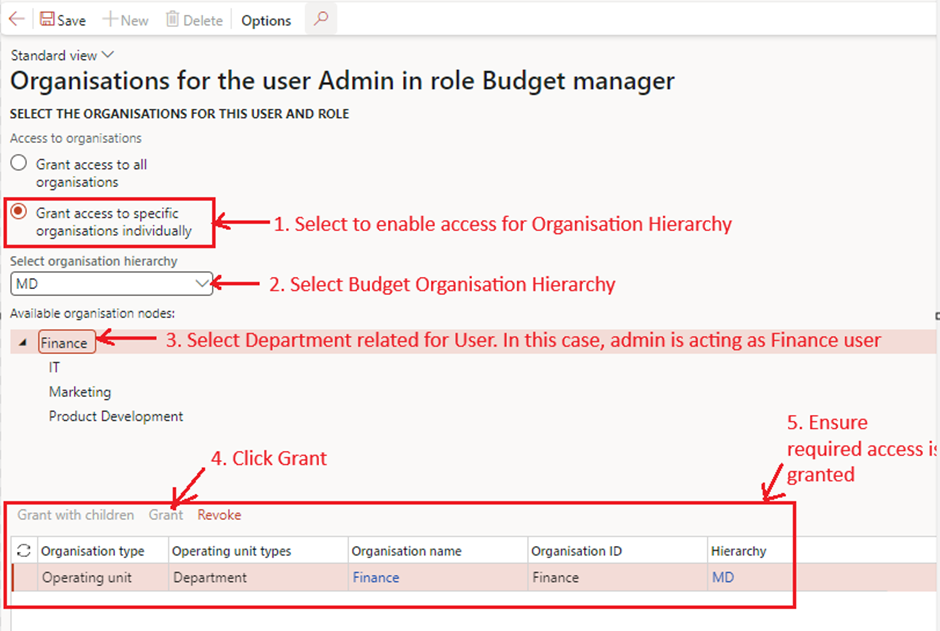

Provide Security Access

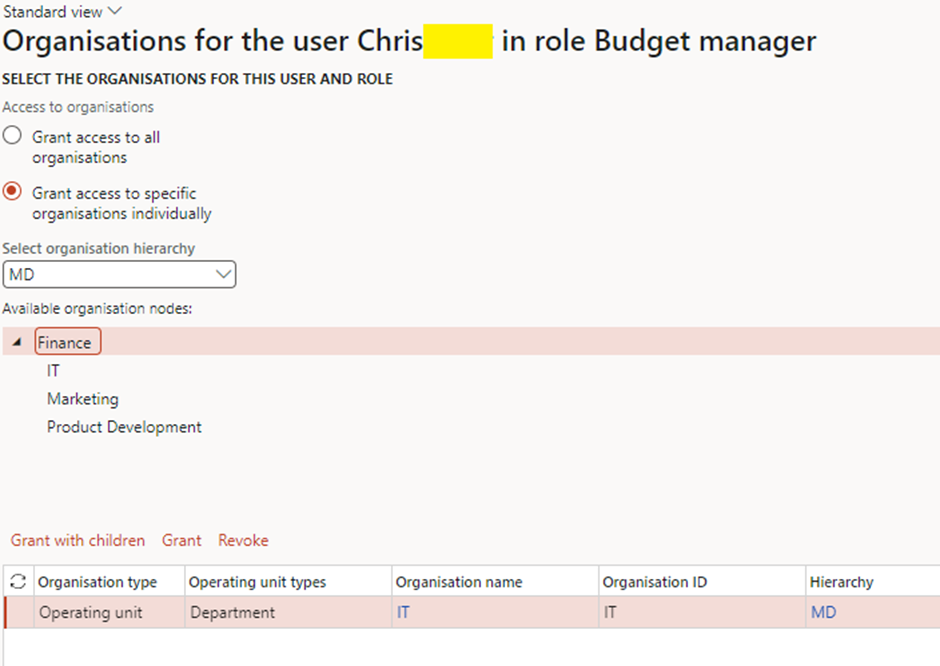

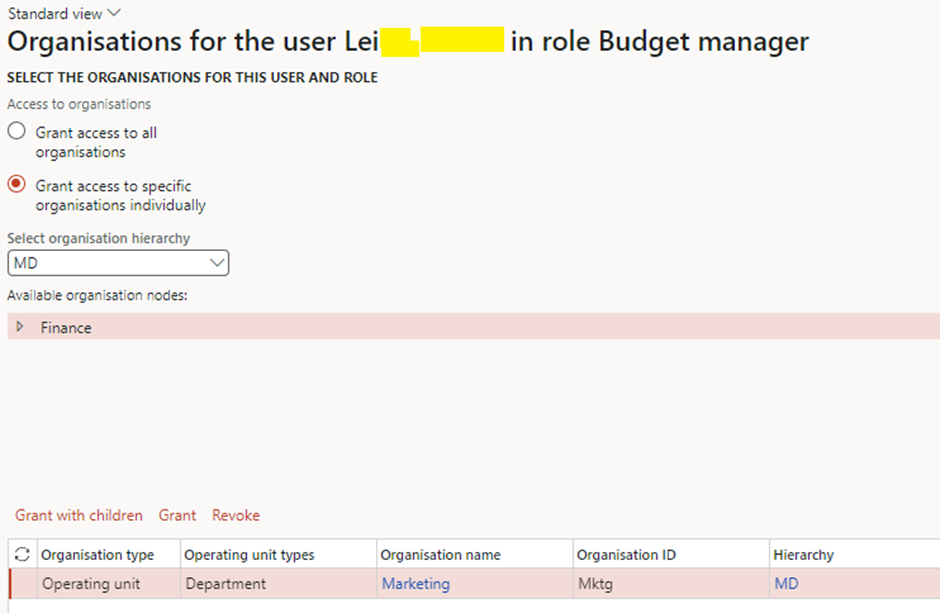

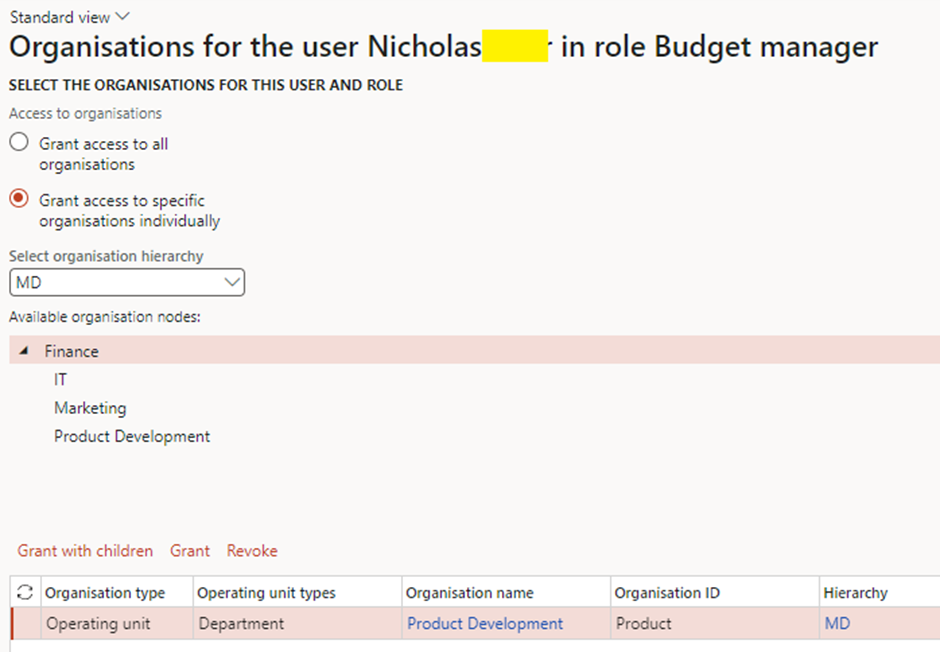

8. Security access to User: Grant departmental access to user.

- Provide access to other user for remaining departments attached in Hierarchy

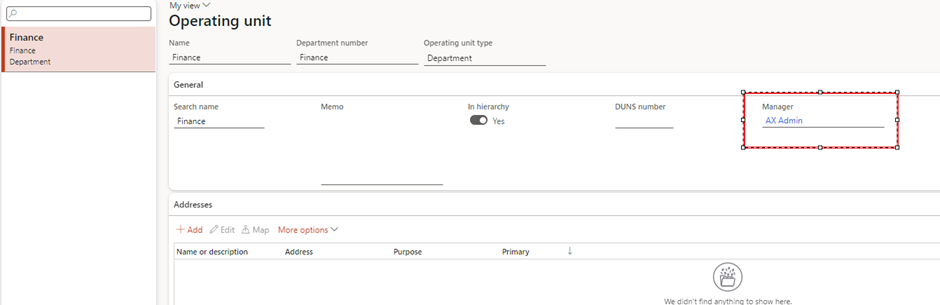

Assign Department Manager

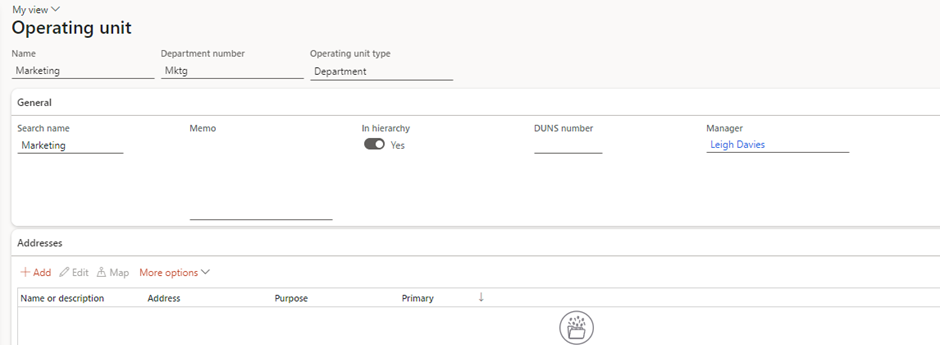

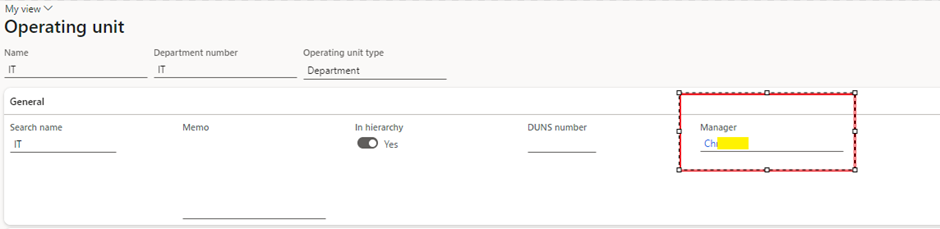

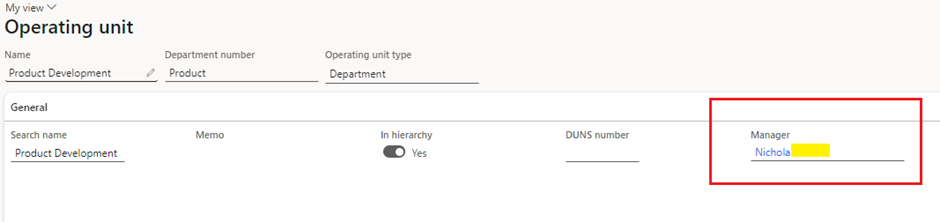

9. Assign manager to Department manager: For workflow to know who to assign workflow for approval upon budget plan distribution

Setup Budget Plan workflows

10. Budget Plan Workflow: Automates the review, approval, and submission process for budget plans.

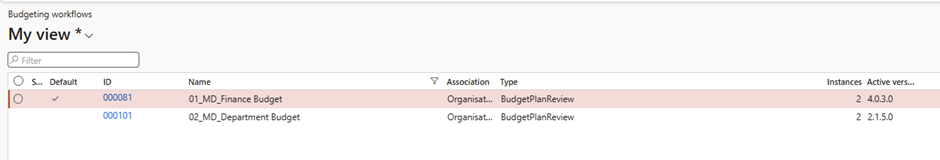

We need two workflows for budget plan.

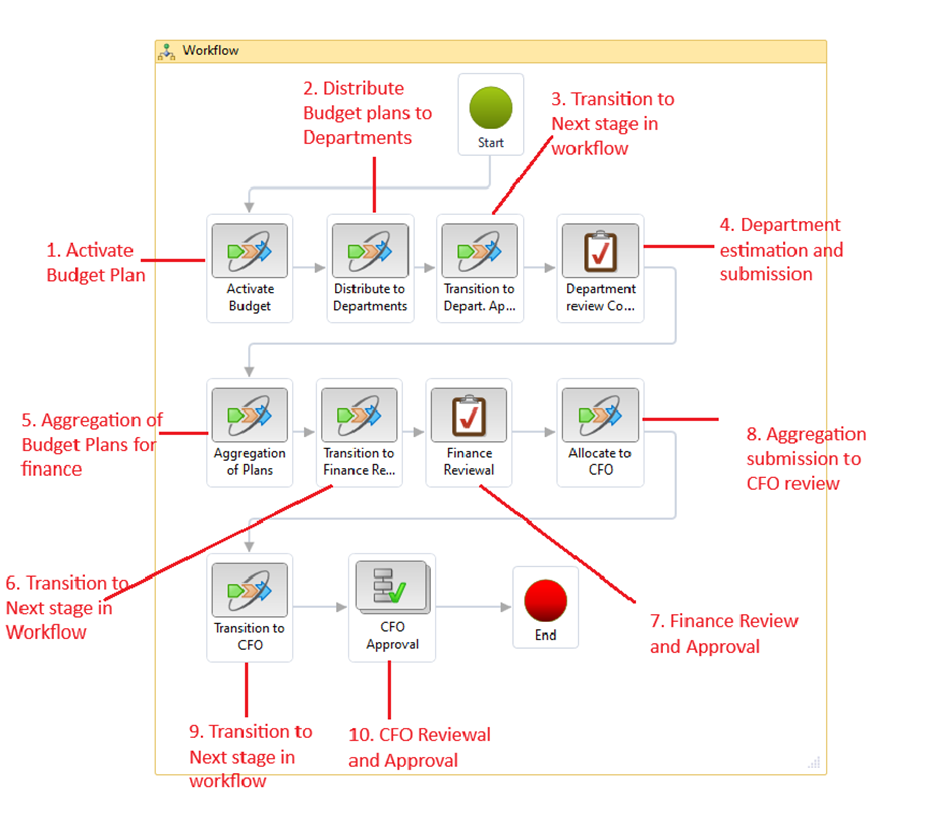

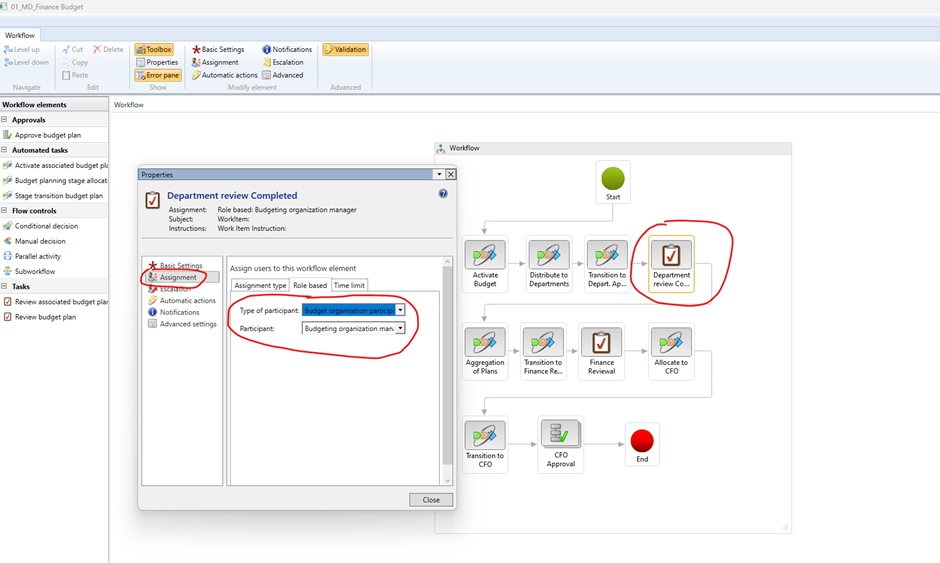

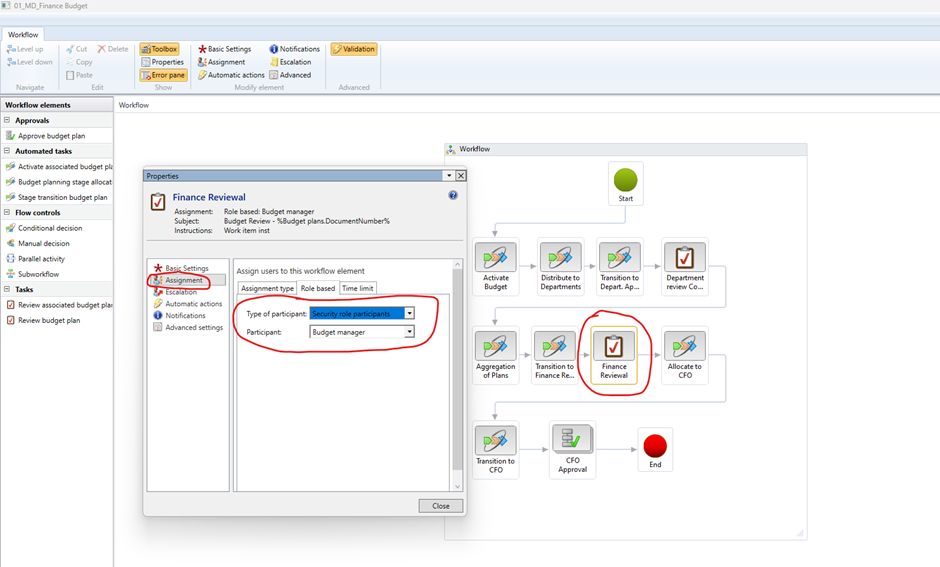

Parent workflow

Workflow 1:

- 01_MD_Finance Budget – This is Parent workflow for Finance and CFO approval, distribution and aggregation of departmental approved budget

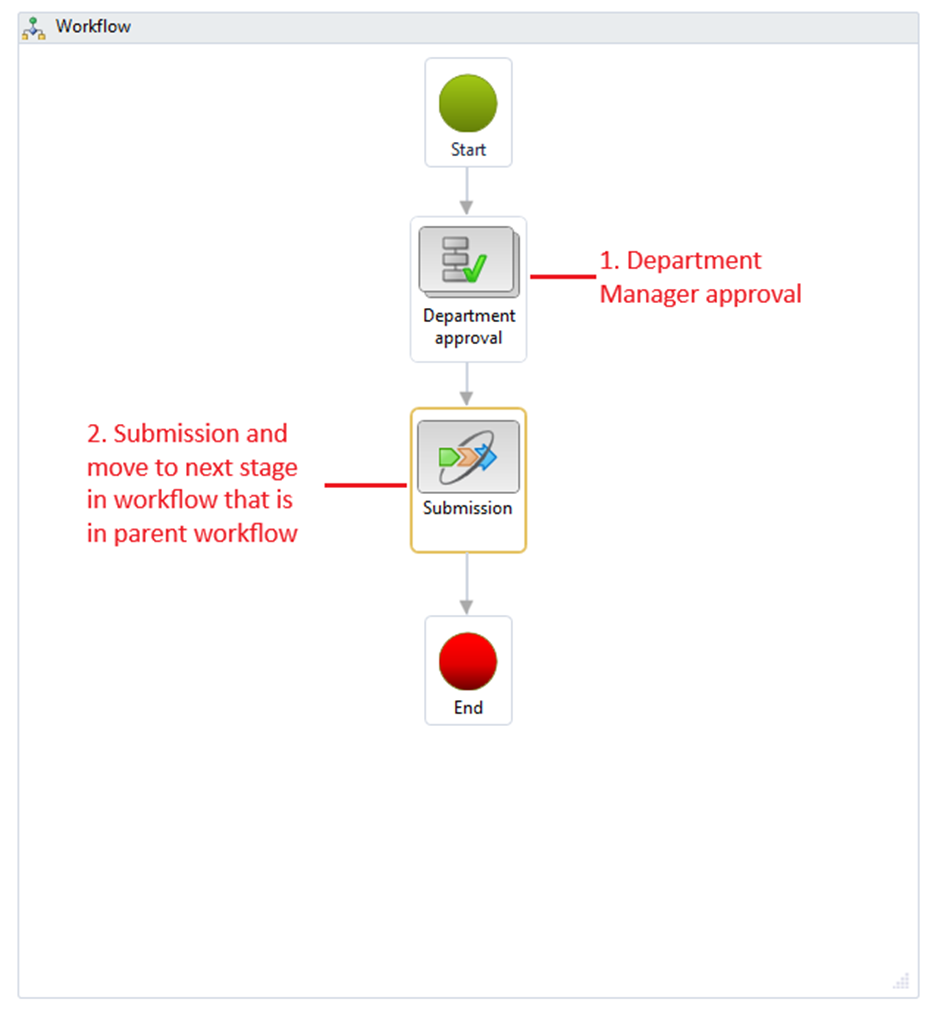

Child Workflow 1

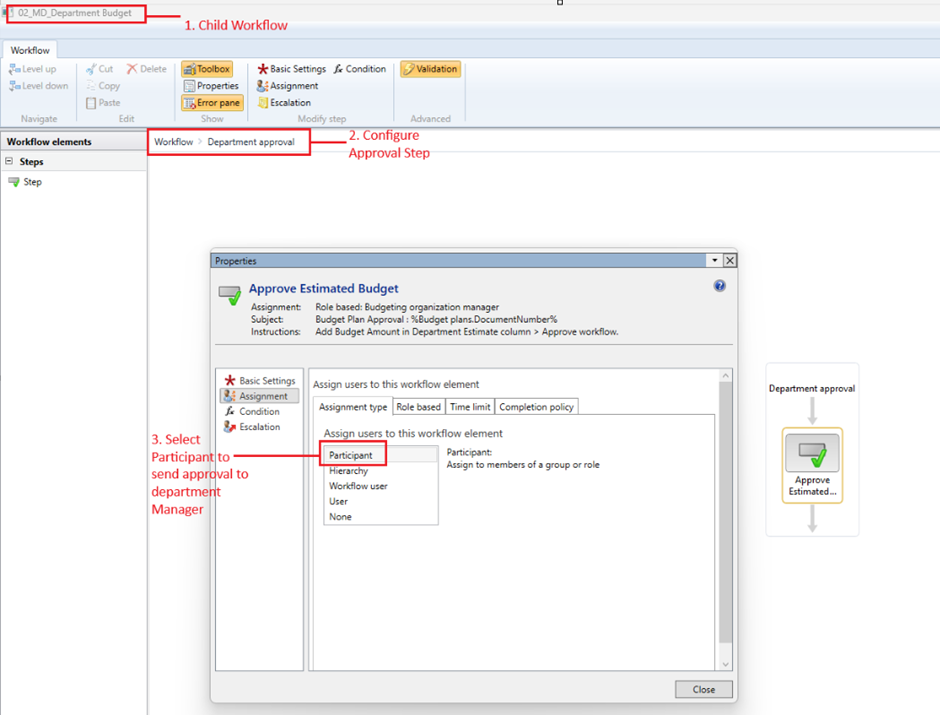

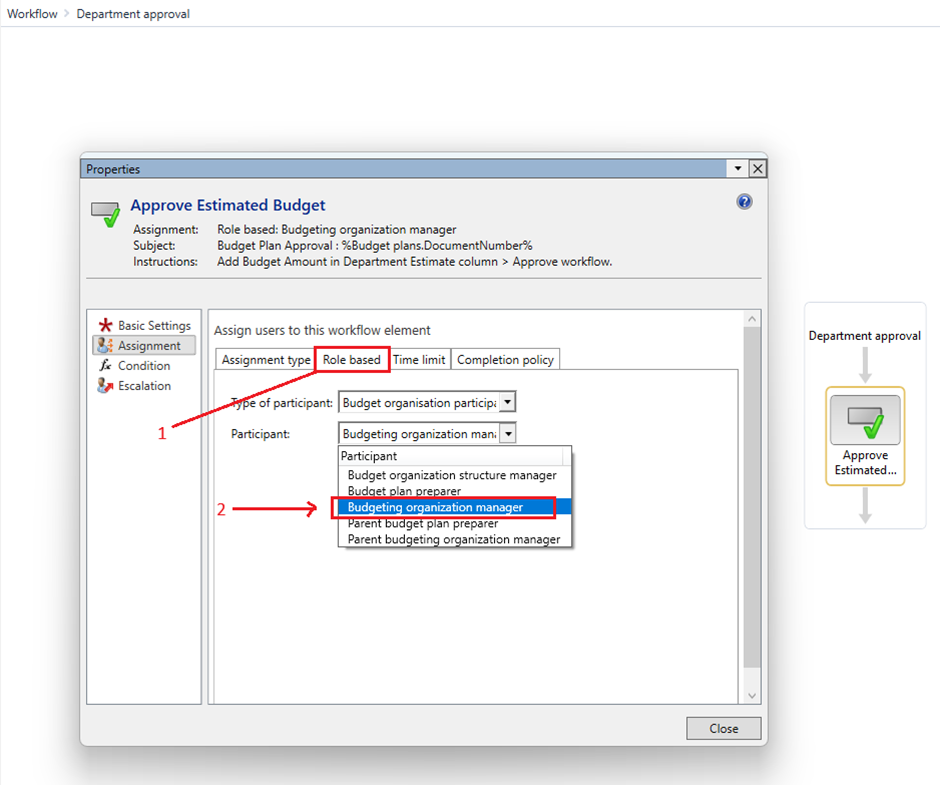

Workflow 2:

- 02_MD_ Department Budget – This is child workflow for distributed budget plan approval by each Department

Child Workflow 2

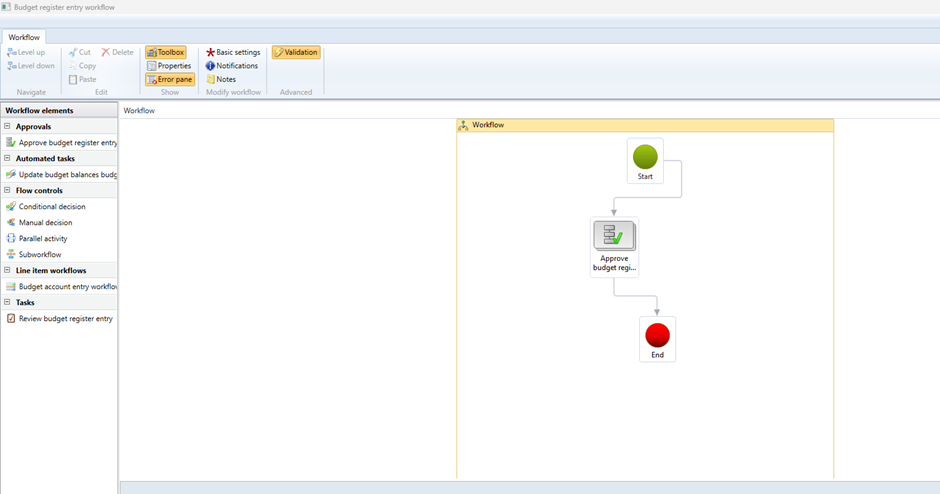

11. Budget Register Entry Workflow: Manages approvals for budget adjustments, transfers, and updates.

- I kept workflow on my approval for this demo.

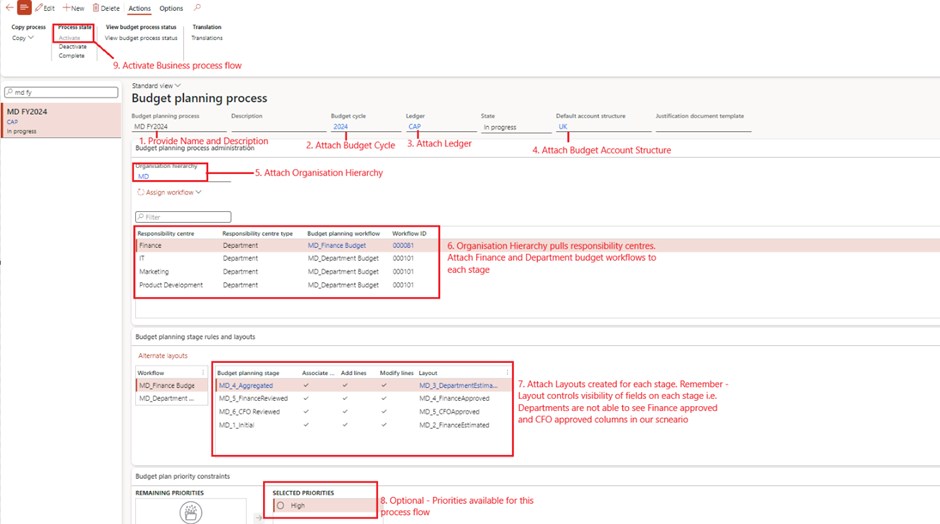

Setup Budget Planning Process

12. Budget planning Process:

Conclusion

In conclusion, understanding and configuring basic budgeting in Dynamics 365 Finance is the foundation for a streamlined and effective budgeting process. By setting up essential components such as budget models, codes, cycles, and calendars, organizations can establish a robust framework that supports strategic financial planning.

This groundwork ensures that all subsequent processes—like budget planning, register entries, and control—operate seamlessly within a structured and efficient system. With these basics in place, businesses can empower their teams to collaborate, allocate resources wisely, and maintain financial accountability, setting the stage for successful budget management and execution.

This foundational setup is critical for the next stages, where we’ll explore Budget Planning Configuration and take a deep dive into collaborative workflows, end-to-end scenario testing, and approval processes. As we progress through this series, you’ll gain a step-by-step understanding of how to implement and manage a seamless budgeting process that aligns with organizational goals and promotes financial discipline. Stay tuned as we build upon this foundation to achieve a fully integrated and effective budgeting strategy.

Expand Your Knowledge: See More Budgeting Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment