EM505 – The Importance of OCR in Expense Management: Enhancing Efficiency with Mobile Technology

Table of Contents

ToggleIntroduction

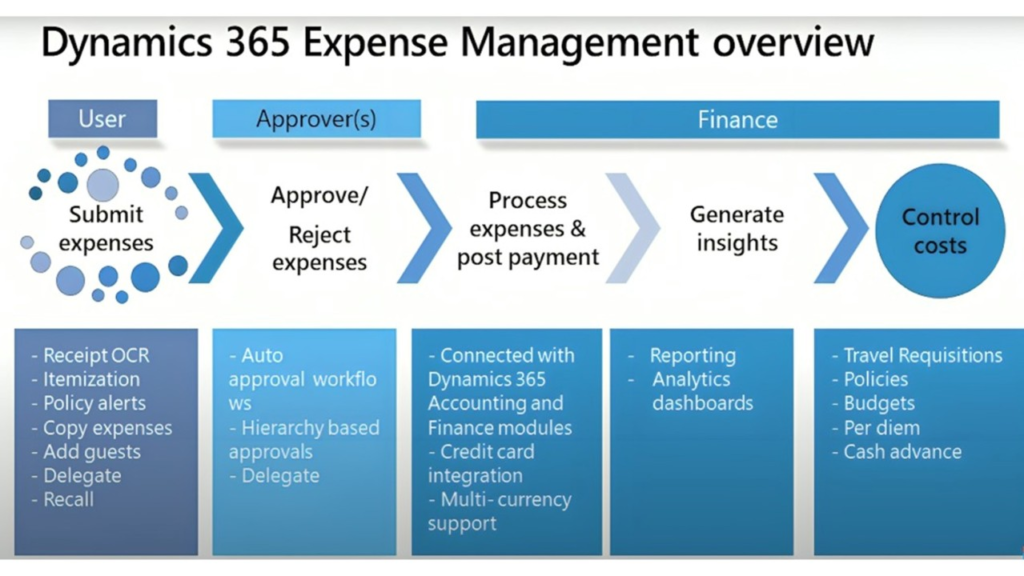

In today’s fast-paced business environment, organizations are constantly seeking ways to improve operational efficiency and reduce the burden of manual processes. One such innovation that has gained significant traction is Optical Character Recognition (OCR) technology. Particularly in the realm of expense management, OCR can play a crucial role in streamlining expense reporting, enhancing accuracy, and improving overall employee satisfaction. In this article, we will explore the importance of OCR in expense management and how it transforms the way businesses handle expense submissions.

The Role of OCR Technology in Expense Management

Streamlining Expense Reporting

OCR technology automates the process of extracting data from receipts and invoices. Instead of employees manually entering details such as amounts, dates, and merchant names, OCR software scans receipts and automatically populates the relevant fields in the expense report. This significantly speeds up the expense submission process, allowing employees to focus on their core responsibilities rather than tedious data entry tasks.

Reducing Manual Data Entry

Manual data entry is not only time-consuming but also prone to errors. Employees might miskey amounts or misinterpret handwriting on receipts, leading to inaccuracies in expense reporting. By leveraging OCR technology, organizations can reduce the reliance on manual entry, thereby minimizing human errors and ensuring that the data entered into the expense management system is accurate and reliable.

Improving Accuracy in Expense Submissions

The precision offered by OCR enhances the accuracy of expense submissions. With OCR, the likelihood of data entry errors is significantly reduced, which means that the financial records maintained by the organization are more precise. This accuracy is critical for compliance, budgeting, and financial reporting purposes, as it helps organizations maintain a clear and accurate view of their expenses.

Enhancing User Experience with Mobile Technology

Most modern OCR solutions are integrated into mobile applications, allowing employees to capture receipts on the go. With the ability to simply take a picture of a receipt using a smartphone, employees can quickly submit expenses as they incur them, rather than waiting until they return to the office. This convenience enhances the user experience, making expense reporting less burdensome and more intuitive.

Facilitating Real-Time Expense Tracking

With OCR technology integrated into mobile expense management solutions, organizations can facilitate real-time tracking of expenses. As employees submit their receipts and expenses through the mobile app, finance teams can access this data immediately. This real-time visibility allows for better budgeting, forecasting, and financial planning.

Reducing Paperwork and Streamlining Processes

OCR contributes to a more paperless environment by digitizing receipts and invoices. This not only reduces the physical storage space required for paperwork but also streamlines processes such as auditing and expense reconciliation. Digital records are easier to manage, retrieve, and analyze, leading to improved efficiency across the organization.

Conclusion

The integration of Optical Character Recognition (OCR) technology into expense management processes represents a significant leap forward in enhancing efficiency and accuracy. By streamlining expense reporting, reducing manual data entry, and improving user experience through mobile technology, organizations can transform the way they manage expenses.

Expand Your Knowledge: See More Expense Management Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment