GS501 – Why Globalization Studio Matters in Dynamics 365 Finance & Supply Chain

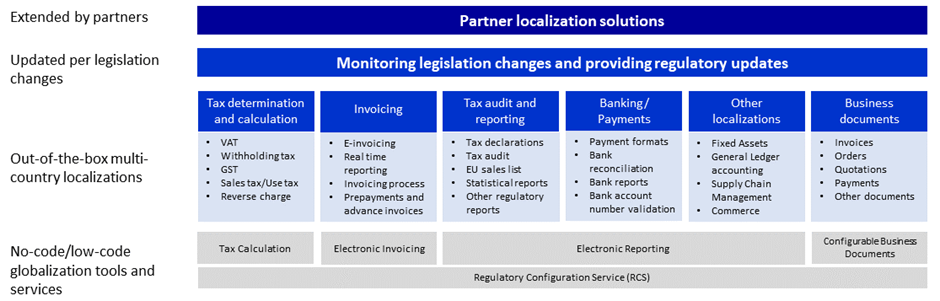

Image: Source Microsoft – Globalization Studio overview – Finance | Dynamics 365 | Microsoft Learn

When your business operates in multiple countries, keeping up with each country’s tax rules, document formats, and compliance obligations is no small task. Many companies rely on local customizations, partner solutions, or even spreadsheets, making it hard to scale or remain audit-ready.

Globalization Studio in Dynamics 365 Finance & Supply Chain was created to change that. It offers a configuration-first approach to manage global compliance, without code.

In this first article of my 25-part series, I’ll explain what Globalization Studio is, why it exists, and how it can help you transform your global rollout strategy. You’ll also find references to other articles in this series for deeper learning.

Table of Contents

Toggle🌍 What Is Globalization Studio?

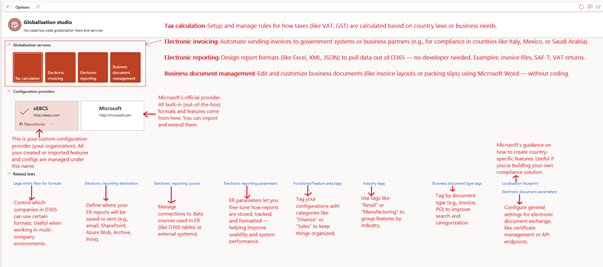

Globalization Studio is a built-in workspace in Dynamics 365 (starting version 10.0.39+) that helps businesses manage country-specific compliance features using tools like:

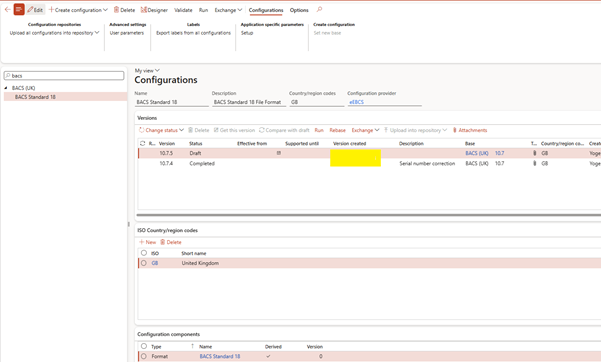

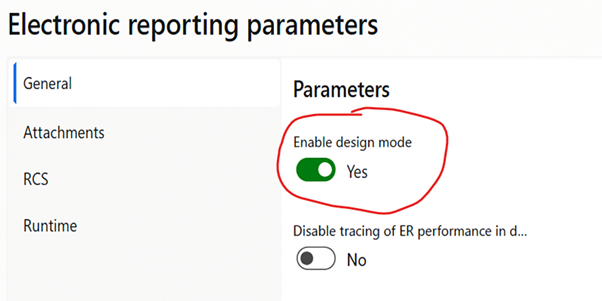

Electronic Reporting (ER)

- A no-code/low-code tool to define how data is exported from or imported into Dynamics 365 in formats like Excel, XML, JSON, and PDF. Purpose: Enables country-specific regulatory reporting, file exchange, and structured data transformation. Use when: You need to generate legally required exports (e.g., SAF-T, eInvoices) or import external data (e.g., tax portal responses).

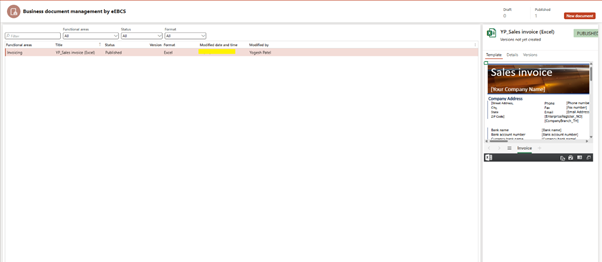

Business Document Management (BDM)

- A user-friendly, Office-integrated designer built on top of Electronic Reporting that allows business users to customize document templates in Word, Excel, and other supported ER formats. Purpose: Enables format editing for printed documents like invoices, orders, or checks without developer support. Use when: You want business users to safely update document layouts (e.g., invoice headers, logos, translations) using familiar Microsoft Office tools, without code changes or deployments.

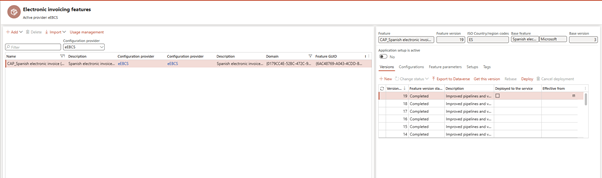

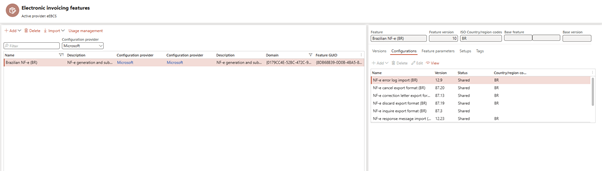

Electronic Invoicing

- A cloud-based configurable service for generating, signing, submitting, and receiving e-invoices in government-mandated formats. Purpose: Handles end-to-end e-invoice lifecycle including digital signing, web service communication, and receiving validation responses. Use when: You need to send invoices to tax authorities (e.g., FACe in Spain, MyDATA in Greece) or comply with country-specific e-invoice mandates.

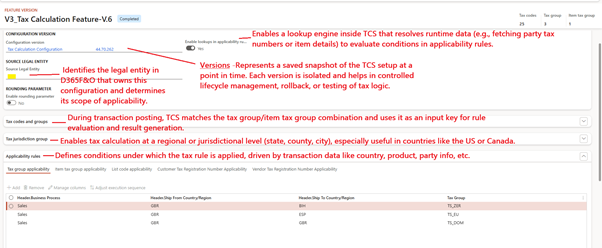

Tax Calculation Service

- An external tax engine offering flexible, rule-based logic beyond the standard D365 sales tax framework. Purpose: Supports complex tax rules, jurisdiction-level overrides, and integration with external services. Use when: You need advanced tax handling, including multi-country logic, custom tax formulas, or real-time integration.

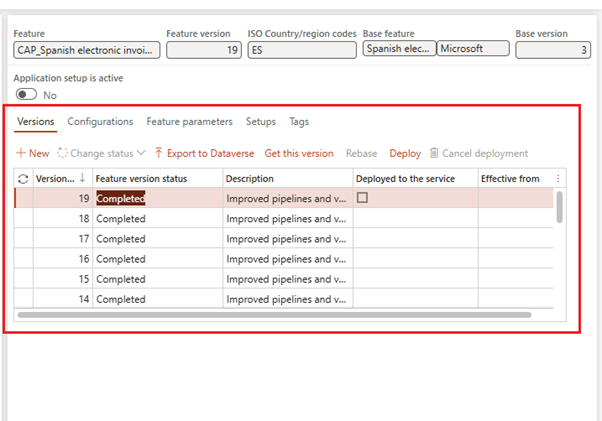

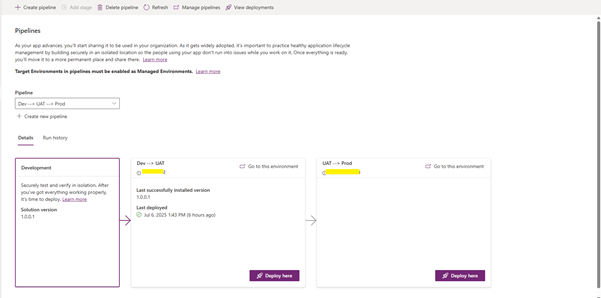

Lifecycle and version control

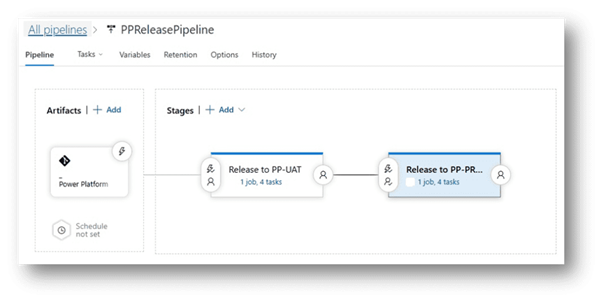

Dataverse integration for Application Lifecycle Management (ALM)

Devops Pipeline

Power Platform

It replaces the separate Regulatory Configuration Service (RCS) and brings everything into one unified place within the ERP system.

👉 Learn more about this transition in GS502 – From RCS to Globalization Studio.

💡 Why Does It Matter?

Let’s say your company operates in the UK, Italy, and India. Each has different legal formats and submission rules. Without a structured toolset, compliance becomes costly and error-prone.

Here’s how Globalization Studio helps:

| Benefit | What It Means for You |

| Stay compliant faster | Easily apply regulatory changes without needing developers |

| One setup for many countries | Reuse logic across legal entities and countries |

| Easy to manage | Track versions, errors, and audit logs |

| Lower costs | Replace code and customizations with reusable features |

🧰 What’s Included?

| Tool / Module | What It Does |

| Electronic Reporting (ER) | Generates outputs in XML, Excel, JSON, TXT, or PDF formats |

| Business Document Management (BDM) | Lets business users modify invoice or order templates using Word, no technical skills needed |

| Tax Calculation Service | Enables flexible tax rules and logic per country, customer, or document type |

| Electronic Invoicing Service | Handles secure submission and receipt of e-invoices, often with digital signatures |

| Processing Pipelines | Automates steps like file generation → signing → sending → receiving |

| Feature Lifecycle Workspace | Manages versioning, applicability rules, and deployment status for features |

| Dataverse Repository | Stores and shares features using Power Platform ALM capabilities |

Each of these components will be explored in-depth throughout this series:

- GS503 – Getting Started with the Globalization Studio Workspace

- GS504 – Feature Lifecycle and Applicability Rules

- GS513 – Configurable Business Documents Using BDM

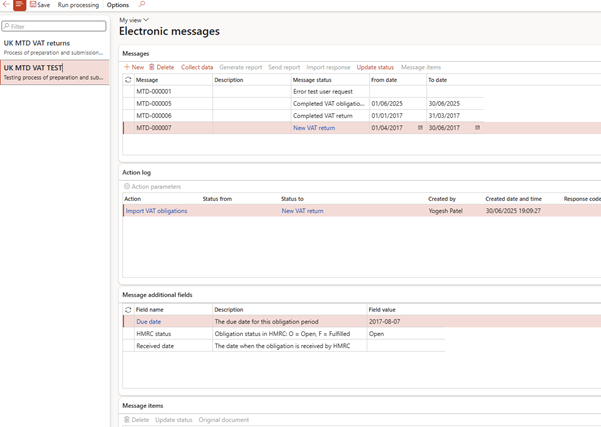

🧾 Real-Life Example 1: United Kingdom – Digital VAT Submissions

If you operate in the UK, you’re required to submit VAT returns digitally to HMRC under Making Tax Digital (MTD).

Using Globalization Studio:

- Import the UK VAT feature from Microsoft’s repository

- Use Electronic Reporting to generate MTD-compliant XML

- Submit data through Azure Logic Apps or web service integration

- Monitor submission status in the logs

This setup eliminates manual exports and ensures compliance with UK law.

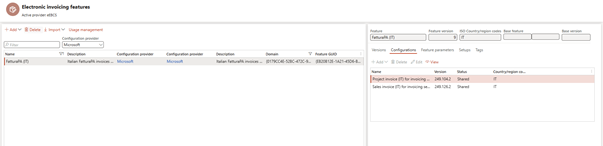

🧾 Real-Life Example 2: Italy – FatturaPA Electronic Invoicing

In Italy, all B2B and B2G invoices must be submitted to the government platform (SDI) in a format called FatturaPA.

With Globalization Studio:

- Import the Italy FatturaPA feature

- Use BDM to customize the invoice layout (header, footers, QR codes) directly in Word

- The ER format generates compliant XML

- The invoice is signed, submitted, and logged, all automatically

👉 A full walkthrough of this is covered in GS507 – Electronic Invoicing Overview and GS513 – Configurable Business Documents Using BDM

🧾 Real-Life Example 3: Brazil NFe (Nota Fiscal Eletrônica)

Let’s say your company is expanding into Brazil. To operate legally, you must issue government-approved invoices (NFe) using XML files signed with digital certificates and submitted via a secure web service.

Using Globalization Studio:

- You download a ready-made Brazil NFe feature from the global repository.

- You deploy it to your environment, assign a certificate from your Azure Key Vault, and activate the processing pipeline.

- Once a sales order is posted in D365, the electronic invoice is automatically created, signed, submitted, and confirmed, fully compliant and auditable

🔄 What’s Different from Before?

Previously, companies used RCS or code-heavy setups to manage local requirements. With Globalization Studio, things are far more efficient:

| Old Way | New Way (Globalization Studio) |

| Disconnected tool (RCS) | Built directly into D365 |

| Hard to track document formats | BDM manages versions in Word |

| Complex tax logic | No-code Tax Calculation features |

| Manual email submission | Electronic Invoicing Service automates this |

| Custom X++ reports | Use ER and BDM with reusable templates |

⚠️ Things to Know Before You Start

| Consideration | What to Keep in Mind |

| Cloud-only | Not available for on-premises deployments |

| Initial learning curve | Best to start with out-of-box features and tweak |

| Migration from RCS | Learn how to reuse and adapt Microsoft ER features in GS510 – Reusing and Adapting ER Features |

| Requires Feature Management | Must be enabled in environment first (see GS503) |

📘 Coming Up Next

In GS502 – From RCS to Globalization Studio, we’ll explore:

- Why Microsoft is retiring RCS

- What architecture has changed

- How to start planning your move from legacy setups

📖 [Continue reading: GS502 – From RCS to Globalization Studio →]

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment