GS524 – Embedding Business Rules and Exceptions in Globalization Studio

Compliance rules vary. Some customers want PDFs, others require XML. Some invoices must be signed, others not. Dynamics 365 Globalization Studio enables you to embed those differences as rules, not code.

In this article, you’ll learn how to:

- Embed business-specific logic and exceptions into your features

- Dynamically control steps in the processing pipeline using context-aware applicability rules

- Add validations directly in Format Designer

- Build localization logic that adapts to different business cases

🔗 Builds on: GS504 – Applicability Rules, GS514 – Output Routing, GS525 – Validation and Storage

Table of Contents

Toggle🧠 Why Add Business Logic?

Real-world compliance is not one-size-fits-all. You need to reflect:

| Type | Example |

| Country rules | Only Spain uses FACe |

| Customer exceptions | B2G needs digital signature, B2B does not |

| Invoice thresholds | Sign invoices only if > €500 |

| Delivery logic | Exports vs. domestic |

Hardcoding these rules in X++ creates rigidity. Using Globalization Studio + ER, they become configurable and transparent.

🪜 Step-by-Step: Add Pipeline Applicability Rules using Context

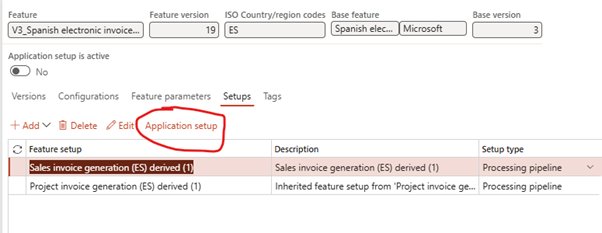

✅ Step 1: Find Context Configuration

- Go to Electronic Feature > Click Application Setup

Note – The Application setup is essential for:

- Automating electronic invoice creation and submission

- Ensuring regulatory compliance

- Supporting multiple document types and legal entities

- Driving dynamic behavior using context and validation rules

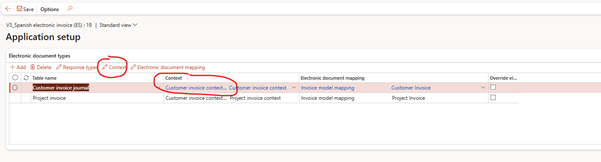

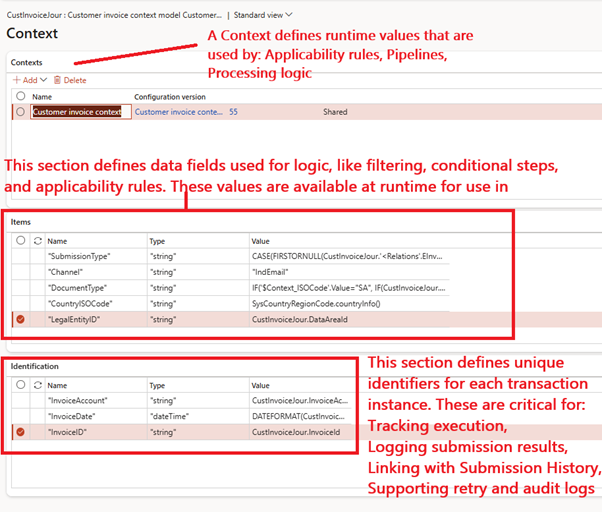

- Check Context name. Remember – this is by document type

- Context variables

👉 This defines dynamic runtime values available for rules.

As seen in your screenshot, these values are later used in applicability rules to filter steps by country, channel, or entity.

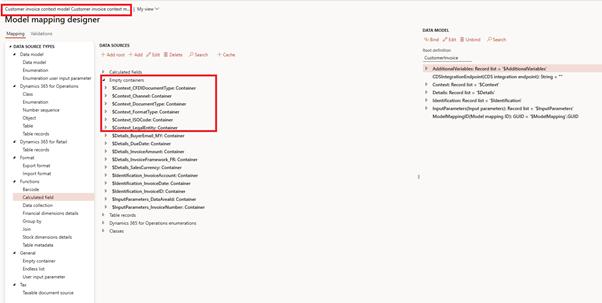

- Context variables are located under empty container in ER configuration

- You can extend these variables as per requirement or add new once.

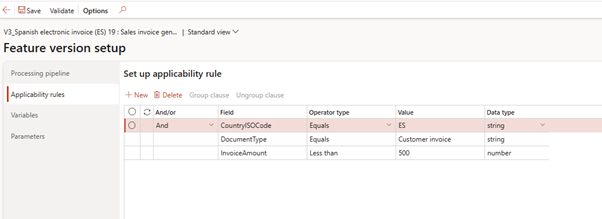

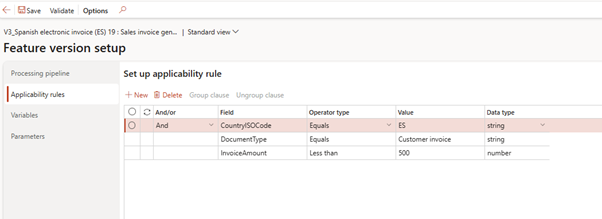

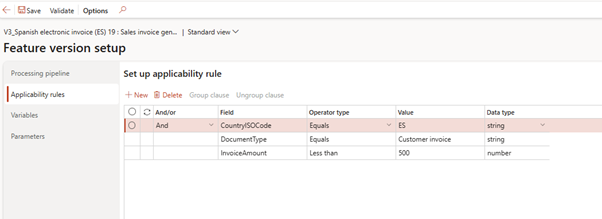

✅ Step 2: Use the Context in Applicability Rules

- Go to Globalization Studio > Feature > Applicability Rules

- Add a rule like:

- This restricts the entire feature to apply only for invoices in Spain

🧪 Step-by-Step: Add Validation in Format Designer

In Format Designer, validations are used to enforce business logic on the XML structure. For example, validating IBAN numbers or signer parameters.

✅ Step 1: Open Format Designer

- Go to Electronic Reporting > Configurations

- Select your format (e.g., Sales Invoice (ES))

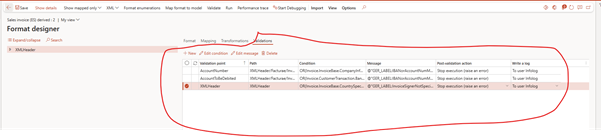

- Navigate to the Validations tab

✅ Step 2: Add Validation Conditions

Your screenshot includes the following conditions:

| Validation Point | Condition Sample | Function |

| AccountNumber | OR(Invoice.InvoiceBase.CompanyInfo.BankAccount.IBAN <> “”, Invoice.InvoiceBase.CompanyInfo.BankAccount.AccountNum <> “”) | This validation ensures that the company’s bank account details are present in the invoice , either: An IBAN, or A local bank account number 🔹 Why It’s Needed: For Spanish e-invoicing (e.g., submission to FACe), it is often mandatory to include payment account details of the issuer (supplier/company) in the XML. Missing this could result in: Submission rejection by government platforms Invalid invoice formats |

| AccountToBeDebited | OR(Invoice.CustomerTransaction.BankAccount.IBAN <> “”, Invoice.CustomerTransaction.BankAccount.AccountNum <> “”) | This validation ensures that the company’s bank account details are present in the invoice , either: An IBAN, or A local bank account number 🔹 Why It’s Needed: For Spanish e-invoicing (e.g., submission to FACe), it is often mandatory to include payment account details of the issuer (supplier/company) in the XML. Missing this could result in: Submission rejection by government platforms Invalid invoice formats |

| XMLHeader | OR(Invoice.InvoiceBase.CountrySpecificData.EInvoiceParameters_IT.EInvoiceSignerType_ES= Enums.ModelEInvoiceSignerType_ES.Issuer, Invoice.InvoiceBase.CountrySpecificData.EInvoiceParameters_IT.EInvoiceSignerType_ES= Enums.ModelEInvoiceSignerType_ES.Receiver, Invoice.InvoiceBase.CountrySpecificData.EInvoiceParameters_IT.EInvoiceSignerType_ES= Enums.ModelEInvoiceSignerType_ES.ThirdParty) | Validates that the invoice signer type (EInvoiceSignerType_ES) is one of the allowed values: Issuer Receiver ThirdParty 🔹 Why It’s Needed: The Spanish e-invoice model expects the invoice XML to include the correct signer classification, depending on: Whether the invoice is self-billed Who generated or signed the document Whether a third party is involved in the process This validation ensures that a valid enum value is selected , otherwise the XML may: Be structurally invalid Get rejected by the Spanish e-invoicing web service |

🛑 If these conditions fail, the export will be blocked and a validation error will appear.

📢 Tip: Use Edit Message to provide a clear business-friendly error message like:

“⚠️ IBAN or Account Number is required for customer payment details.”

💼 Advanced Use Case: Mixed B2B/B2G Customers in Spain

Contoso Spain sells to:

- Public sector (B2G) → requires Facturae XML + signature + FACe submission

- Private sector (B2B) → needs only PDF via email

How to handle both in one pipeline:

| Step | Applicability Condition |

| Sign | Context.CustomerGroup = “B2G” |

| Submit | Context.CustomerGroup = “B2G” |

| Store to Azure | Context.CustomerGroup = “B2G” |

| BDM PDF | Context.CustomerGroup = “B2B” |

| Context.CustomerGroup = “B2B” |

💡 Best Practices for Managing Rules

| Tip | Why It Helps |

| Name context variables clearly | IsExport, NeedsSignature, CustomerGroup |

| Keep validations user-readable | Auditors can understand failure reason |

| Separate logic cleanly | Don’t mix country + customer logic |

| Use comments in rules | Explain why the rule exists |

| Test edge cases | Ensure robustness (nulls, missing fields) |

📁 Where to Monitor Rule Outcomes

| Tool | View |

| Pipeline Execution Log | See if step was executed or skipped |

| ER Execution Log | See calculated values, e.g., IsB2G |

| Submission History | Result per document, incl. validation failures |

| Power BI Audit Report | End-to-end compliance view |

🧭 Related Articles

📘 Coming Up Next

In GS525 – Document Archival and Compliance Audits in Globalization Studio, we’ll explain how to securely store signed documents and submission logs for long-term audit compliance.

You’ll learn how to:

- Use Azure Key Vault and Blob Storage for secure retention

- Configure SharePoint for business-friendly document access

- Apply metadata and retention policies based on country rules

- Enable audit-ready traceability across all compliance features

📖 Continue reading: GS525 – Document Archival & Compliance Audits →

🔍 View Full Article in PDF

GS524I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment