OCR 504 – Essential Virtual Data Entities for Invoice Capture Configuration

Table of Contents

ToggleIntroduction

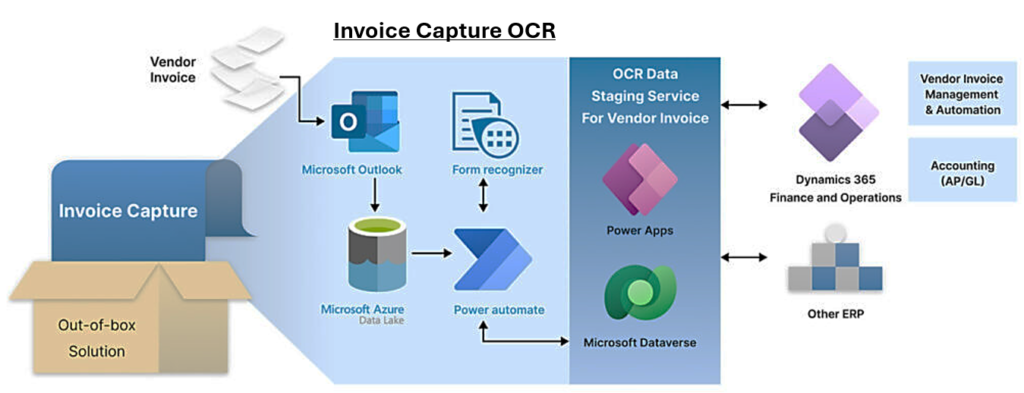

Configuring and enabling virtual entities is a crucial step in optimizing invoice capture processes within your financial systems. Virtual entities allow for seamless integration and data management, ensuring that all necessary information is accurately captured and utilized. Below is an overview of the required data entities for effective invoice capture.

Required Data Entities

| Sr. No. | Entity Name | Description |

|---|---|---|

| 1 | VendVendorEntity | Stores information about vendors, including names, contact details, and payment terms. |

| 2 | VendorInvoiceHeaderEntity | Contains overarching details of vendor invoices, such as invoice numbers, dates, and total amounts. |

| 3 | VendorInvoiceLineEntity | Captures individual line items from vendor invoices, including descriptions, quantities, and prices. |

| 4 | VendorInvoiceDocumentAttachmentV2Entity | Manages attachments related to vendor invoices, allowing for the inclusion of supporting documents. |

| 5 | PurchPurchaseOrderHeaderV2Entity | Holds header information for purchase orders, facilitating the link between purchase orders and invoices. |

| 6 | PurchPurchaseOrderLineV2Entity | Details individual line items within purchase orders, ensuring accurate matching with vendor invoices. |

| 7 | VendProductReceiptHeaderEntity | Contains header details of product receipts, linking received goods to vendor invoices. |

| 8 | VendProductReceiptLineEntity | Captures line items for product receipts, providing granular detail on received products. |

| 9 | VendInvoiceJournalHeaderEntity | Manages header information for invoice journals, consolidating invoice data for accounting purposes. |

| 10 | VendInvoiceJournalLineEntity | Details individual line items within invoice journals, supporting financial reporting and analysis. |

| 11 | CurrencyEntity | Stores currency information, enabling accurate financial transactions across different currencies. |

| 12 | TaxPurchaseTaxTransEntity | Captures tax-related information for purchase transactions, ensuring compliance with tax regulations. |

Conclusion

By configuring and enabling these essential data entities, organizations can streamline their invoice capture processes, enhance data accuracy, and improve overall financial management. Proper management of these entities not only facilitates smoother operations but also strengthens compliance and reporting capabilities. Embracing this structured approach will empower organizations to optimize their accounts payable workflows effectively.

Expand Your Knowledge: See More Invoice Catpure Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment