SB515 – Deferral Schedule Generation and Journal Entry Posting in D365 Subscription Billing

Table of Contents

Toggle🌐 Introduction

Welcome to SB515, the next article in our Revenue & Expense Deferral series for Subscription Billing in D365 Finance.

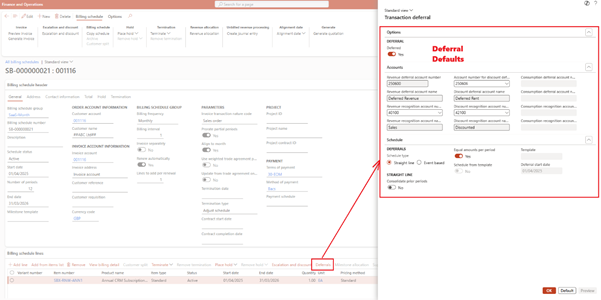

In SB514, we configured the system with templates, defaults, and setup rules for revenue deferral. Now, it’s time to walk through what happens next: how deferral schedules are generated, where they live, and how the system posts monthly revenue to the general ledger.

Whether you use straight-line recognition or milestone-based triggers, this post shows exactly how D365 turns configuration into compliant accounting automation.

🔁 What Triggers a Deferral Schedule?

A deferral schedule is automatically created in D365 when a transaction involving a deferrable item is invoiced.

| Triggered By | Example |

| Sales Order Invoice | SBX-RNW-ANN1 CRM Renewal – billed annually |

| Free Text Invoice | Onboarding Setup Fee with deferral enabled |

| Subscription Billing | Billing schedule line with deferral template assigned |

✅ D365 checks the item, template, and setup rules to create the schedule and defer the income.

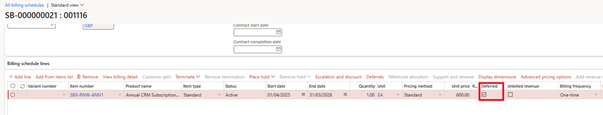

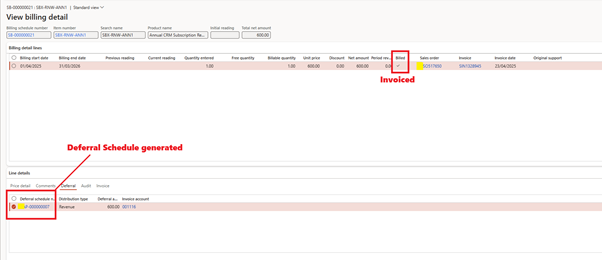

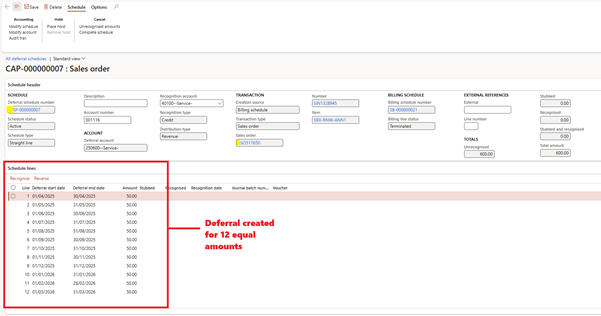

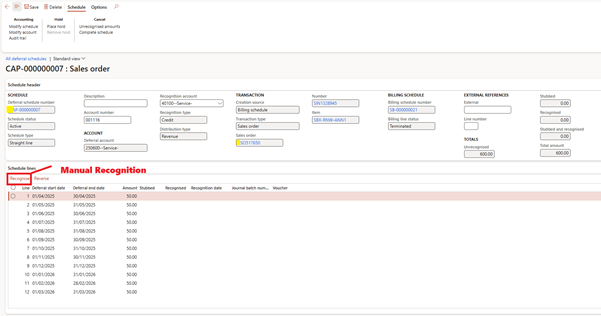

🧾 Example: Straight-Line Schedule Generation

Scenario:

- Item: SBX-RNW-ANN1

- Invoice Amount: £600

- Deferral Template: 12 periods (monthly)

- Start Date: 01-Apr-2025

System Creates:

| Period | Recognized Amount | Status |

| Apr 2025 | £50 | Not posted |

| May 2025 | £50 | Not posted |

| … | … | … |

| Mar 2026 | £50 | Not posted |

Total Deferred: £600

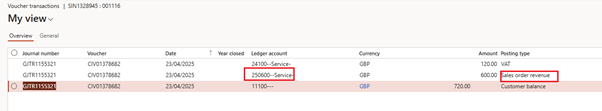

GL Posting (at invoice):

- DR: Accounts Receivable £600

- CR: Deferred Revenue £600

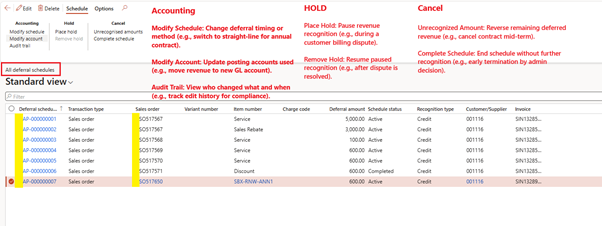

📍 Where to View Deferral Schedules

📍 Path: Revenue and expense deferrals > Deferral schedules > All deferral schedules

This page shows:

- Schedule line ID

- Total deferred amount

- Recognition frequency

- GL accounts

- Posting status by period

🔍 Filter by “Not posted” to review schedules before running recognition jobs.

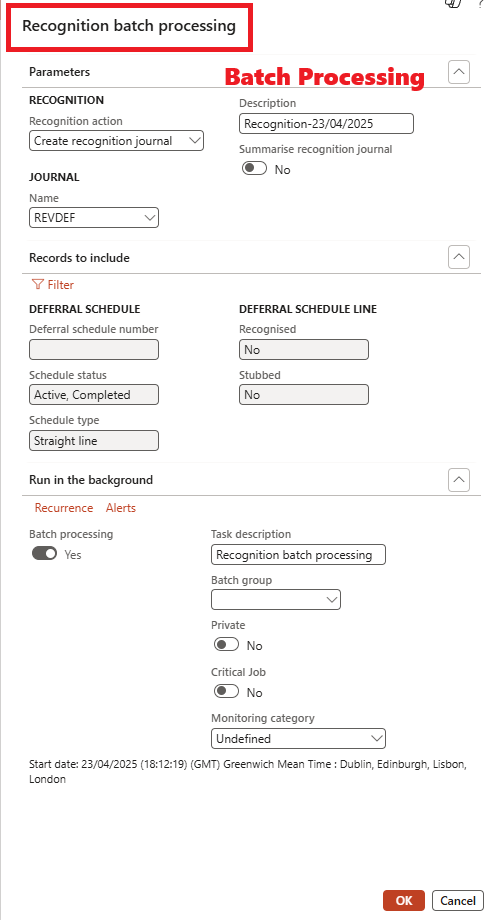

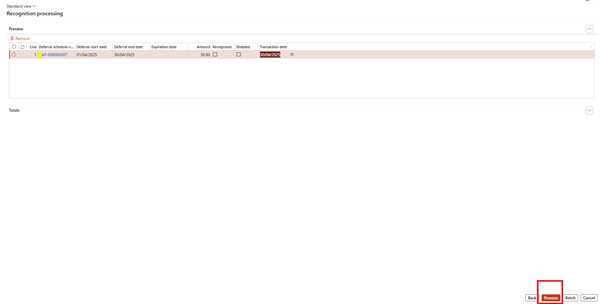

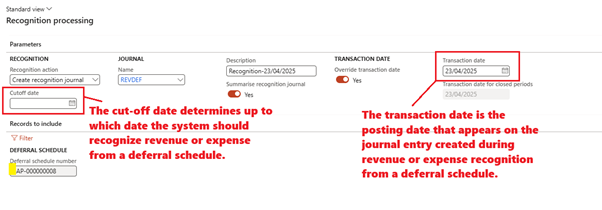

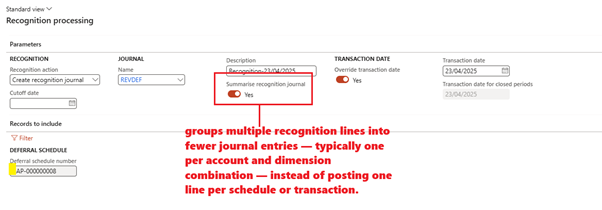

📤 Posting Revenue Recognition Journals

There are two ways to post journals:

| Method | When to Use | How to Access |

| Manual | For milestone or one-off schedules | Recognition processing screen |

| Batch job | For standard monthly straight-line deferrals | Recognition batch processing (automated run) |

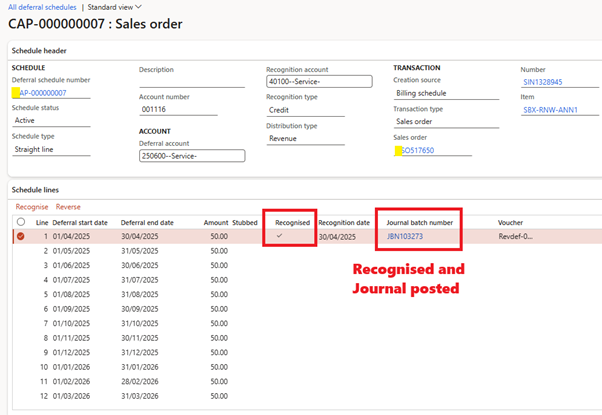

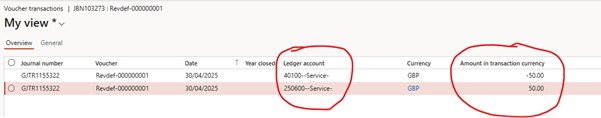

✅ Journal Posting Example (April Recognition)

For SBX-RNW-ANN1, if recognition is posted for April:

| Entry | Amount |

| DR: Deferred Revenue (250600) | £50 |

| CR: Subscription Revenue (40100) | £50 |

Posted to journal name: REVDEF

Posting date: Based on system date or cutoff override

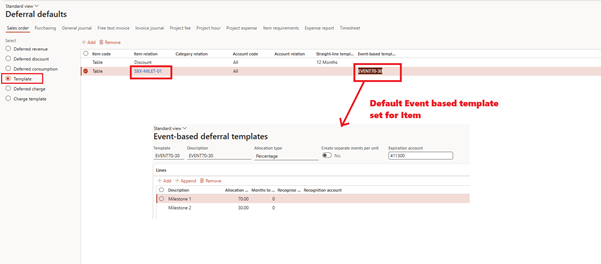

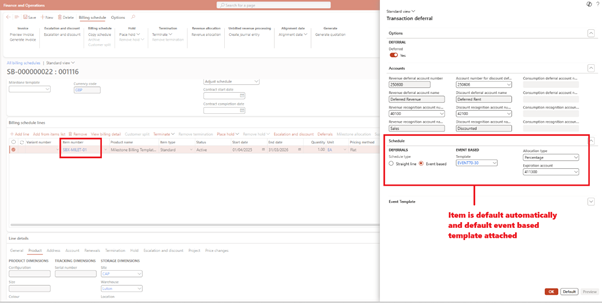

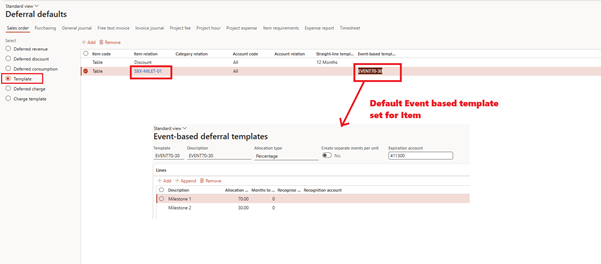

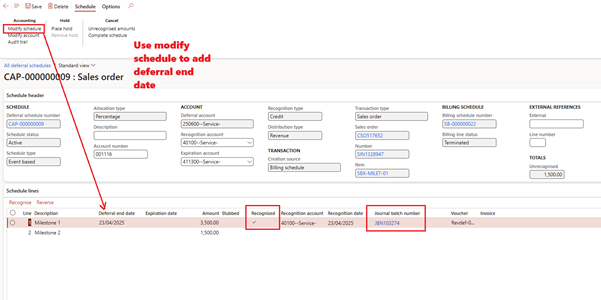

🔁 Event-Based Recognition Example

Scenario:

- Item: SBX-MILET-01

- Total Value: £5,000

- Event 1 = 70% | Event 2 = 30%

Workflow:

- Create Schedule > ensure event-based template attached > Generate invoice

- Deferral generates two deferrals for £3,500 and £1,500

- Recognise events once completed (Use Modio

- Deferral journal posted for earned revenue

🧠 Milestone schedules must be manually advanced based on project or delivery status.

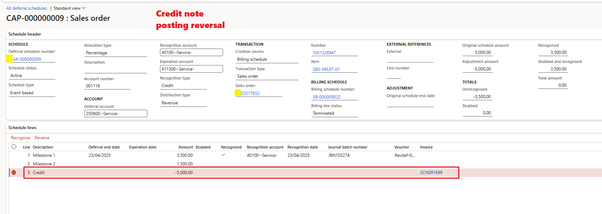

🔄 Reversals, Adjustments & Catch-Ups

| Action | Description |

| Reversal journal | System automatically reverses if you credit an already-recognized invoice |

| Adjust cutoff date | Manually update schedule to change start month or recognition window |

| Consolidate prior periods | System can post catch-up entries if schedule starts late |

✅ These features are controlled via deferral parameters (see SB514).

✅ Summary

Once a deferral-enabled invoice is posted, D365 handles everything else—from generating the recognition schedule to posting monthly journals. You get full traceability and financial compliance, with minimal manual effort.

| Step | Result |

| Invoice posted | Deferral schedule created |

| Recognition processing | Journals generated and posted |

| Monthly review | Audit-friendly trail of deferred revenue |

🔜 Coming Up Next: SB516 – Handling Short-Term and Long-Term Deferred Revenue

In SB516, we’ll explore how D365 separates short-term and long-term deferred balances using rolling periods or fixed year-end logic. We’ll also cover:

- Balance sheet impact

- Reclassification reporting

- Use case: Multi-year SaaS contracts

Expand Your Knowledge: See More Subscription Billing Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment