SB516 – Handling Short-Term and Long-Term Deferred Revenue in D365 Subscription Billing

Table of Contents

Toggle🌐 Introduction

Welcome to SB516 in our Revenue & Expense Deferrals series for Dynamics 365 Subscription Billing.

In earlier parts of this series (SB514 and SB515), we explored how to configure deferrals and automate monthly revenue recognition. Now we focus on a powerful, often underused capability: splitting deferred revenue into short-term and long-term balances.

This feature supports better financial reporting and transparency for:

- CFOs managing liabilities,

- Auditors validating compliance,

- FP&A teams forecasting revenue across fiscal years.

Let’s walk through what it is, how it works in D365, and how to demo it in your own system.

🧾 What Is Short-Term vs. Long-Term Deferral?

When you invoice a multi-year subscription, D365 allows you to split the deferred revenue into two categories:

| Category | Meaning |

| Short-Term | Will be recognized within 12 months |

| Long-Term | Will be recognized after 12 months |

This split directly impacts:

- Balance Sheet classification (current vs. non-current liabilities)

- Accurate financial ratios

- Audit readiness and statutory reporting

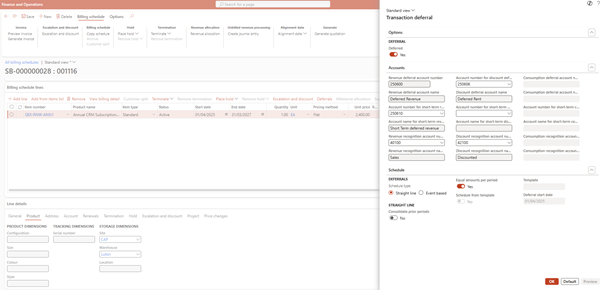

🎯 Example: 24-Month CRM Subscription

| Item | Description | Invoice Date | Amount | Template |

| SBX-RNW-ANN1 | CRM Renewal – 24 Months | 01-Apr-2025 | £2,400 | STRAIGHT24 |

- Revenue recognized: £100/month

- Year-end = 31-Mar-2026

🗓 As of Year-End:

- £1,200 already recognized

- £1,200 remains deferred → Short-Term

📌 But at the time of invoicing:

- £1,200 is due in next 12 months → Short-Term

- £1,200 is due after 12 months → Long-Term

This allows your balance sheet to show how much deferred revenue is “soon” vs. “later.”

🔧 How D365 Handles It

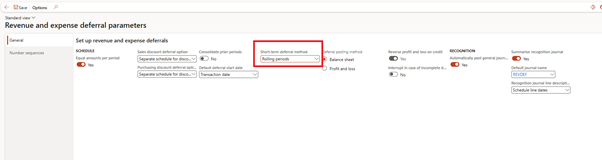

The key control is the Short-Term Deferral Method, found here:

📍 Path:

Revenue and expense deferrals > Setup > Revenue and expense deferral parameters

⚙️ Options for Short-Term Deferral Method

| Option | What It Does |

| None | No split — everything posts to one deferred revenue account |

| Rolling Period | Splits based on a rolling 12-month view from invoice/recognition date |

| Fixed Year | Uses fiscal year-end to determine 12-month cutoff (e.g., 31-Mar) |

🌟 Recommended: Use Rolling Period for dynamic and clean reporting across any period.

📤 How It Affects Journal Entries

When an invoice is posted using a deferral template (e.g., STRAIGHT24), and Rolling Period is active:

➕ At Invoice Time:

| Journal Date | Posting | Account Type | Amount | What’s Happening |

| 26-Apr-2025 | DR: 11100 – Customer Balance | Asset (Receivables) | £2,880.00 | Full invoice including VAT posted to receivables |

| 26-Apr-2025 | CR: 250600 – Deferred Revenue | Liability (Deferred Revenue) | £2,400.00 | Total deferred revenue for 24 months initially posted to main deferral account |

| 26-Apr-2025 | CR: 24100 – VAT | Liability (VAT Payable) | £480.00 | VAT portion of invoice posted separately |

| 26-Apr-2025 | DR: 250600 – Deferred Revenue | Liability (Deferred Revenue) | £1,200.00 | System moves 12-month short-term portion out of long-term deferred account |

| 26-Apr-2025 | CR: 250610 – Deferred Rev ST | Liability (Short-Term) | £1,200.00 | System posts 12-month portion to short-term deferred revenue |

🔁 Each Month After:

| Date | Posting | Amount |

| 01-May-2025 | DR: Deferred Revenue – ST | £100 |

| 01-May-2025 | CR: Revenue | £100 |

➡️ No reclassification needed — D365 tracks how much is “short-term” based on the recognition timeline.

📍 Where to View the Short-Term / Long-Term Split

📍 Path:

Revenue and expense deferrals > All deferral schedules

From there:

- Open your schedule → Go to Voucher or Journal entry

- You’ll see two credit lines:

- One to short-term deferred revenue

- One to long-term deferred revenue

✅ D365 automatically splits it based on the method you selected — no manual journal splitting needed.

🧠 Best Practices for Short-Term & Long-Term Deferrals

| Tip | Why It Helps |

| Use Rolling Period method | Automatically reflects true current/non-current |

| Assign separate GL accounts if needed | Improves visibility in balance sheet & reporting |

| Post recognitions monthly | Ensures balances reduce accurately over time |

| Review deferrals before fiscal close | Keeps ST/LT split clean for audit and compliance |

✅ Summary

Short-term vs. long-term deferral logic isn’t just about accounting—it’s about smarter financial storytelling.

| Metric | With Deferral Split | Without |

| Current Liabilities | Accurate | Overstated |

| Long-Term Liabilities | Accurate | Missing entirely |

| Revenue Planning | Predictable | Skewed |

| Audit Readiness | Strong | Limited insight |

🔜 Coming Up Next: SB517 – Enquiries and Reports for Revenue Deferrals in D365 Subscription Billing

In the next article, we’ll shift focus to monitoring, auditing, and reporting deferred revenue:

- How to view and track deferral schedules and balances

- How to validate monthly revenue recognition

- How to use audit trails to maintain compliance

- Best practices for period-end reviews and audit readiness

You’ll learn how to keep your deferred revenue transparent, accurate, and fully audit-ready!

Expand Your Knowledge: See More Subscription Billing Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment