SB521 – Advanced Deferral Adjustments and Corrections in D365 Subscription Billing

Table of Contents

Toggle🌐 Introduction

Welcome to SB521, the next article in our Advanced Revenue Deferrals series for Subscription Billing in D365 Finance!

Billing and recognition processes aren’t always static. In real-world subscription and project environments, you often need to:

- Correct errors

- Process early terminations

- Handle customer credits

- Update milestone or project delivery timelines

In this article, we’ll walk through how to adjust and correct deferral schedules after they have been created and how D365 helps maintain compliance and audit traceability.

🧾 Why Adjustments Matter

✅ Revenue obligations change (early cancellations, reduced scopes)

✅ Customers may receive partial or full credits mid-contract

✅ Delivery dates (and therefore revenue recognition timing) sometimes shift

✅ Audit compliance demands clean correction processes, not manual workarounds

🔍 Types of Deferral Adjustments

| Adjustment Scenario | Typical Business Event | Needed Action |

| Early Contract Termination | Customer cancels subscription mid-term | Adjust deferral to stop recognition |

| Credit Note Issued | Full or partial refund issued | Reverse recognized revenue |

| Milestone Date Changes | Project completion delayed or accelerated | Shift deferral schedule |

| Incorrect Template or Duration Used | Wrong deferral pattern applied during invoicing | Reassign correct template |

🔁 How to Adjust Deferral Schedules in D365

D365 Subscription Billing offers structured tools to adjust deferral schedules without manual journal entries.

📍 Main Adjustment Methods:

| Tool | Purpose |

| Schedule Line Adjustment | Manually change amounts, dates, proration, or recognition rules |

| Attach Deferrals | Link or relink deferral templates post-invoice |

| Recognition Reversal | Reversal of posted recognition via credit notes |

| Event-Based Mass Update | Adjust multiple milestone schedules when project delivery changes |

📦 Real-Life CRM SaaS Example: Early Termination

Scenario:

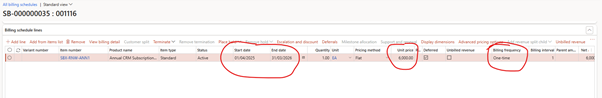

- Customer Contoso cancels CRM subscription after 6 months

- Originally billed £6,000 for 12 months (SBX-RNW-ANN1)

- Customer cancel contact from 25/9/25

Steps to Correct:

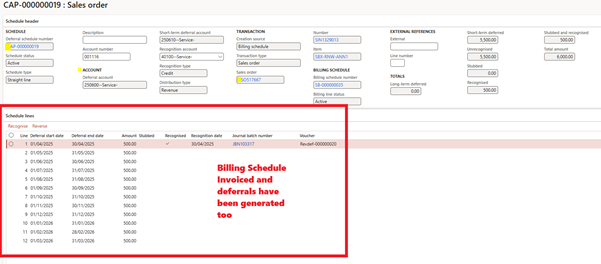

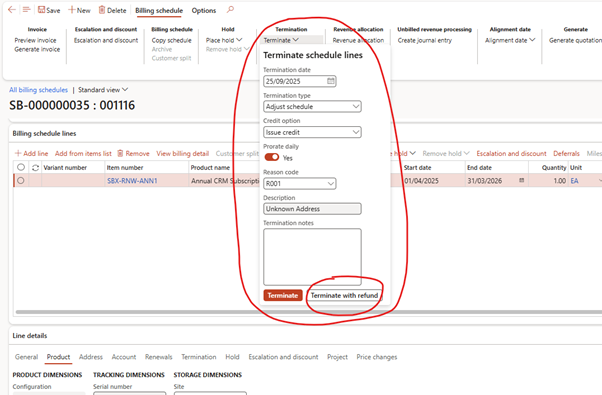

- Open Schedule Line ➔ Locate Contoso’s schedule

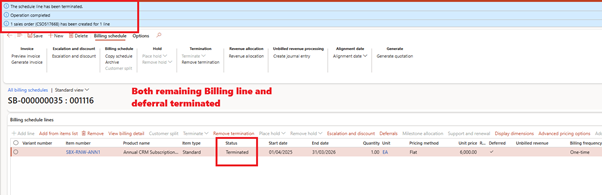

- Termination with refund ➔ Cut off at 25/9/25

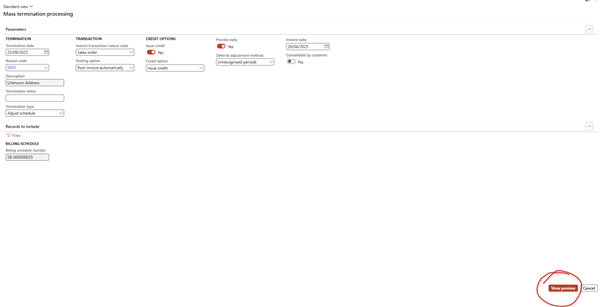

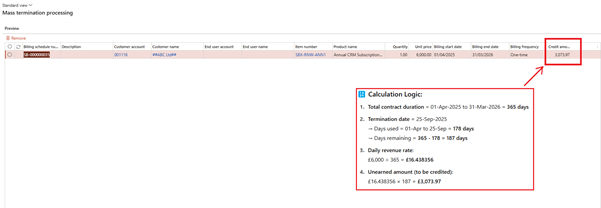

- Run Mass termination Processing ➔ Terminate with refund will take you to this screen automatically

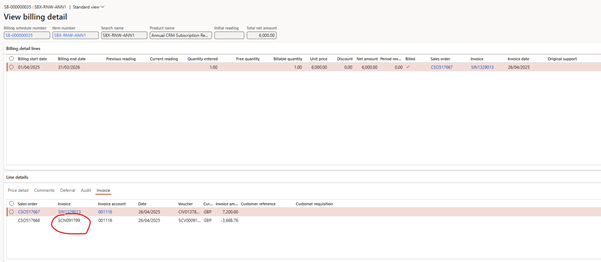

- Issue Credit Note for unearned portion (remaining £3,073.97)

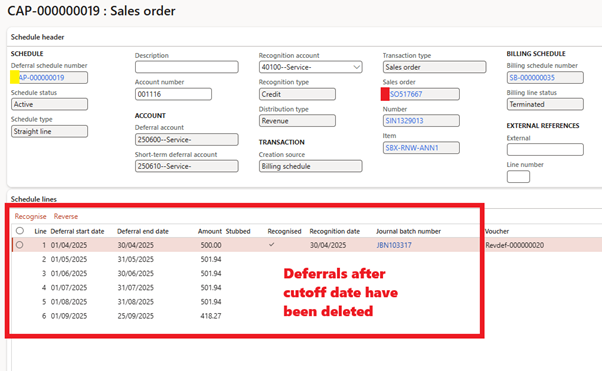

- D365 automatically adjusts future recognition postings and clears the deferred balance.

Credit note posted

📑 How Credit Notes Affect Deferrals

When a credit memo is posted against a deferrable invoice:

| Action | D365 Behavior |

| Full Credit (100% refund) | System cancels remaining deferral and reverses earned revenue |

| Partial Credit (e.g., 3 months) | Only the appropriate recognized revenue is reversed; schedule is reduced accordingly |

✅ Credit notes are fully audit-tracked through Schedule Adjustment History and Audit Trail.

🛠 Tools for Adjustment Management

| Tool/Page | Purpose |

| Schedule Line Maintenance | Manual changes to recognition timing and amounts |

| Attach Deferrals | Apply missing templates after invoice correction |

| Recognition Processing (Manual) | Post correction recognition manually |

| Audit Trail | Track and validate changes made to schedules |

| Credit Adjustments Enquiry | Monitor impact of credit notes on recognition balances |

🧠 Best Practices for Deferral Adjustments

| Best Practice | Why It Matters |

| Always use D365 adjustment tools, not manual GL entries | Maintains audit traceability and compliance |

| Document reason codes for adjustments | Improves audit explanations |

| Monitor Credit Adjustment Reports monthly | Ensure credits properly adjust deferred balances |

| Align milestone schedules with project team updates | Prevent early or incorrect revenue recognition |

| Revalidate deferral balances after large mass updates | Ensure financial statements reflect true revenue timing |

✅ Summary

Revenue deferral management doesn’t stop at posting — it must be continuously updated to reflect reality.

By using D365 Subscription Billing’s adjustment tools, you ensure:

- Accurate financial statements

- Transparent audit trails

- Full compliance with IFRS 15 and ASC 606

- Stronger alignment between billing, delivery, and revenue recognition

| Event | Correction Method |

| Early termination | Adjust schedule end date + credit |

| Milestone delay | Reschedule recognition start |

| Wrong template assigned | Attach new deferral template |

| Credit memo issued | Auto-reverse recognition |

🔜 Coming Up Next: SB522 – Troubleshooting Deferral Recognition Failures and Batch Job Errors

In SB522, we’ll cover:

- Why recognition batch jobs sometimes fail or skip schedules

- Troubleshooting recognition errors

- Handling issues with Waterfall or Declining Balance reports

- Best practices for batch job monitoring and reruns

You’ll gain the skills to keep your deferral system resilient, even when things don’t go as planned!

Expand Your Knowledge: See More Subscription Billing Blogs

I am Yogeshkumar Patel, a Microsoft Certified Solution Architect and Enterprise Systems Manager with deep expertise across Dynamics 365 Finance & Supply Chain, Power Platform, Azure, and AI engineering. With over six years of experience, I have led enterprise-scale ERP implementations, AI-driven and agent-enabled automation initiatives, and secure cloud transformations that optimise business operations and decision-making. Holding a Master’s degree from the University of Bedfordshire, I specialise in integrating AI and agentic systems into core business processes streamlining supply chains, automating complex workflows, and enhancing insight-driven decisions through Power BI, orchestration frameworks, and governed AI architectures. Passionate about practical innovation and knowledge sharing, I created AIpowered365 to help businesses and professionals move beyond experimentation and adopt real-world, enterprise-ready AI and agent-driven solutions as part of their digital transformation journey. 📩 Let’s Connect: LinkedIn | Email 🚀

Post Comment